Ride-hailing company Uber has evolved to become one of the world’s most innovative companies, but will it ever become profitable?

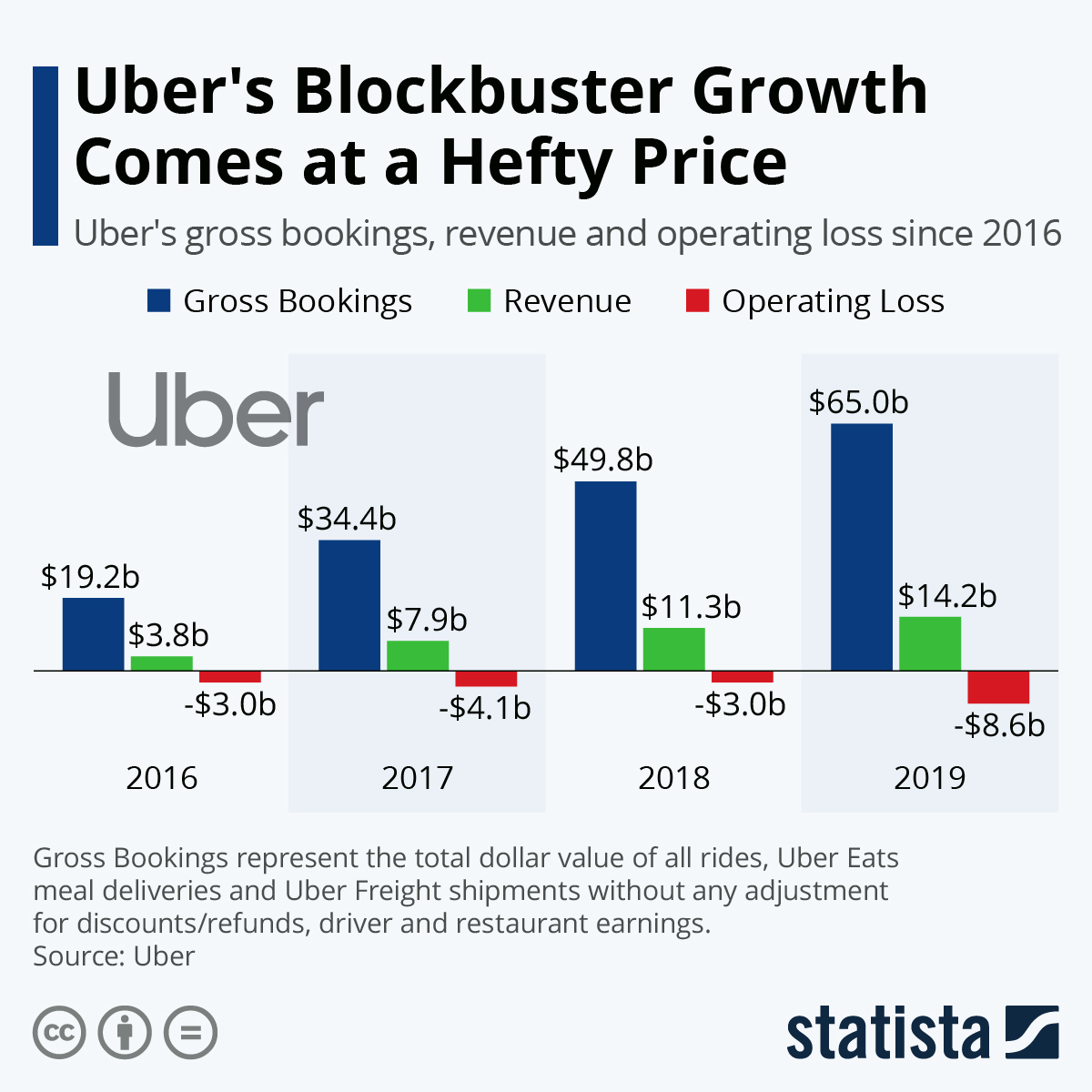

In 2019, Uber recorded losses of $8.5 billion but CEO, Dara Khosrowshahi had been optimistic that the company would begin to turn profits by the end of 2020 prior to the emergence of the devastating Covid-19 pandemic.

The pandemic saw significant drops in Uber bookings throughout 2020, falling by as much as 73% when compared to 2019, but the company managed to beat analyst expectations, posting $2.18 billion in revenue for Q2 of 2020 – however, this represents a 29% decline on the year prior.

As a company that places itself at the forefront of innovation, Uber’s development of its UberEats platform helped to drive a better degree of earnings, with food orders on the app skyrocketing by 113% since 2019.

(Image: Statista)

There’s little doubting that Uber has some lofty aspirations. The company aims to champion driverless cars and shift all vehicles to electric by 2030, all while delivering food via flying drone in the near future, but its frailties were exposed during a disastrous IPO launch in 2019 – which unravelled to become the largest first-day IPO loss for early investors since 1975.

So, what will it take for Uber to become profitable? And will there be a light at the end of the tunnel sooner rather than later for the pioneering ride-hailing business?

Uber’s Bruising Price Wars

As an emerging technology, Uber engaged in price wars to challenge the status quo of traditional taxiing setups in cities and towns around the world. As the company expanded, this contributed to flattening its revenue growth and increased losses across the board.

With over 110 million active users worldwide, Uber’s mounting losses have drawn questions from critics. Matt Kennedy, a market strategist at Renaissance Capital, labelled Uber “an $80bn company that’s unproven.”

“They still need to improve the model because it’s losing $2bn annually. There’s still a lot of uncertainty about the ride-sharing industry that’s reflected in the stock price,” Kennedy explained.

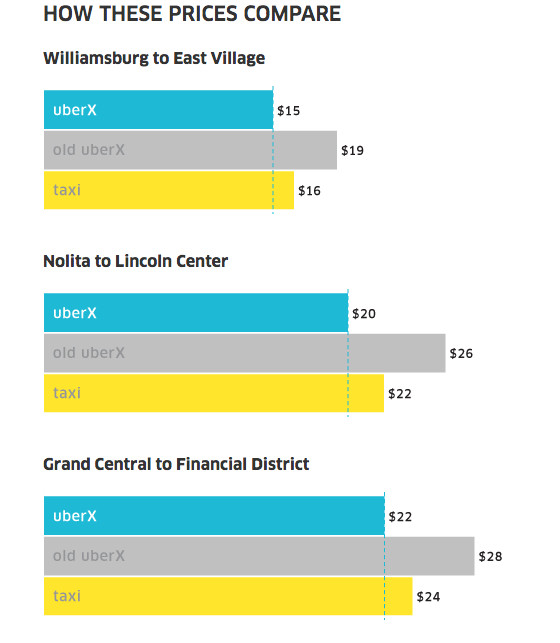

(Image: CB Insights)

Evidence of Uber’s price wars in cities around the world can be seen in the figures above. The ride-hailing company slashed its prices to undercut the famous yellow taxis of New York in a bid to accelerate adoption.

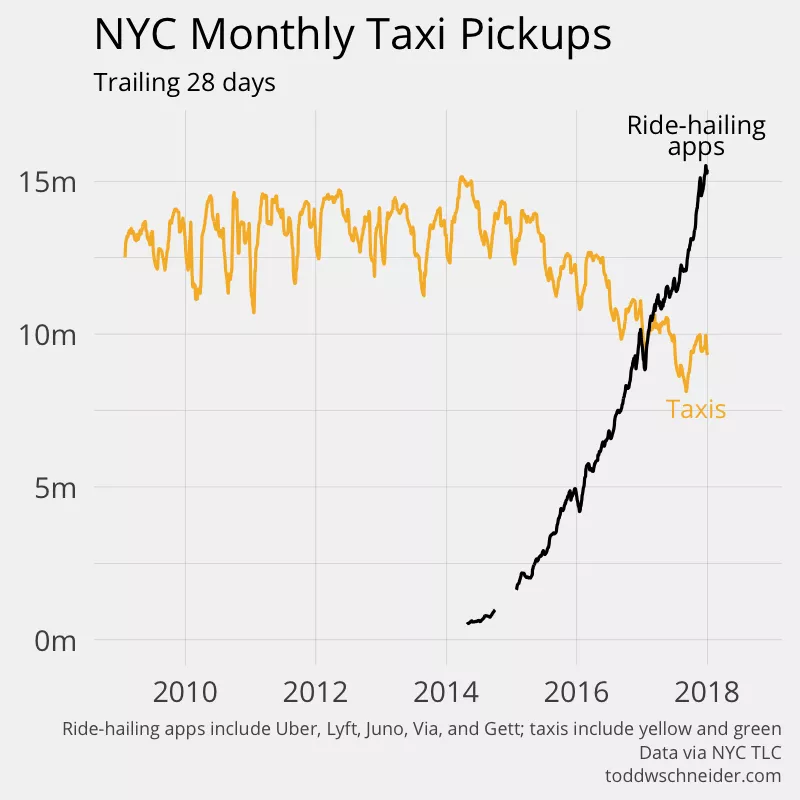

According to the chart below, the tactics were successful in the sense that it accelerated adoption in the city, but with such fine margins between profitability and loss, Uber’s newfound popularity in major cities isn’t enough to instantly turn losses into revenue.

(Image: Vox)

One confounding problem for Uber is that it isn’t simply facing battles from traditional taxi services around the world. The rise of rival ride-hailing apps like Lyft has pushed the company into a new battle against a more technologically resourceful adversary.

However, there are questions as to whether the prices that Uber advertises in order to win their battles against competitors are in any way sustainable.

The Fallacy of Subsidised Journeys

Back in 2017, Reuters reported that Uber passengers pay just 41% of the full cost of their trips. The news agency warned that this could send an “artificial signal about the size of the market” after Uber released data showing the company had made losses of around $708 million per quarter at the time.

Currently, the price of taking a ride in an Uber taxi isn’t enough to cover the cost of the ride itself. This means that as adoption rises and the company grows, so too does its losses.

This places ride-hailing companies like Lyft as well as Uber into a difficult conundrum. They can either create more sustainable pricing plans and inevitably experience slower growth, or continue making operational losses in order to bolster demand.

The markets saw straight through Uber’s push for more demand at the cost of its bottom line, punishing the company by giving it the title of the biggest IPO loss in history.

However, Uber is already looking at ways to push back on its losses by accepting lower levels of demand and revenue at around 20%. However, this could be seen as evidence of slowing growth by the markets which is already having to come to terms with trips on the apps growing at a rate of 32% year-on-year as opposed to the 100% growth shown September 2018 over the same period in 2017.

Adopting a Fresh Business Model

Despite a significant issue with pricing, Uber can commit to becoming a profitable company provided that it effectively leverages its position at the top of the ride-hailing food chain.

David Wessels, adjunct professor of finance at Wharton, believes that Uber’s status means that it can afford to reign in its losses without facing a significant drop in demand: “It’s not like there are 40 competitors out there; it has one or two competitors nipping at their heels, who have their own problems to deal with,” Wessels explained. “So, this could be a successful business, but at some point, they’re going to have to get serious.”

However, Leonard Sherman disagrees that Uber has the capacity to stop and take care of its bottom line. “The company continues to promote this idea that it is growth at all costs, which is, of course, what Travis (Kalanick, Uber founder) did. Travis did an amazing job scaling this company. Unfortunately, he was replicating a fairly broken business model around the world rather than taking the steps necessary to strengthen the foundation of the business.”

The Importance of Acting Fast

Ride-hailing technology is still developing, and while Uber may be setting its sights on a future of autonomous vehicles taxiing customers around the world, it’s vital that the company spends time looking for more short term fixes for their mounting losses.

Growth may be slowing for Uber, but they’re still more popular than Lyft, and more advanced than traditional taxi services. Making more sustainable movements in the market and tightening the purse strings is more likely to be beneficial in the short term than in the coming years when a new competitor may develop a cheaper, sustainable service.

The arrival of Covid-19 – while financially terrible for Uber in the short term – may offer new hope for the company as more remote work could lead to lower levels of car ownership.

Although Uber CEO, Dara Khosrowshahi, had been optimistic about the company’s profitability before Covid-19, with the right level of responsible spending and better-managed growth, there’s no reason why the world’s favourite ride-hailing app can’t look ahead to a brighter and more sustainable future.