Business intelligence (BI) continues to become more important for many segments of industry, including banking, retail, and automotive manufacturing. Many large corporations depend on the quality of data and the completeness of the data analysis to formulate goals and strategies. For this reason, they want to validate their business intelligence system. One of the validation providers is Gartner Inc., an advisory firm based in the United States. They rate BI systems according to their position in the market and the direction of their acceptance. They also analyze the maturity of the providers as well as the experience and expertise of the participants. Gartner presents this information with a unique visualization tool called the Gartner Magic Quadrant. Here are some considerations for companies using the Gartner rating system.

Business intelligence (BI) continues to become more important for many segments of industry, including banking, retail, and automotive manufacturing. Many large corporations depend on the quality of data and the completeness of the data analysis to formulate goals and strategies. For this reason, they want to validate their business intelligence system. One of the validation providers is Gartner Inc., an advisory firm based in the United States. They rate BI systems according to their position in the market and the direction of their acceptance. They also analyze the maturity of the providers as well as the experience and expertise of the participants. Gartner presents this information with a unique visualization tool called the Gartner Magic Quadrant. Here are some considerations for companies using the Gartner rating system.

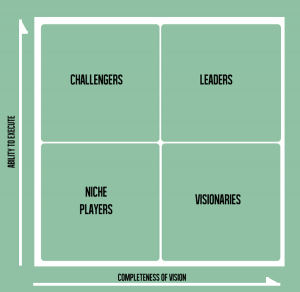

The Quadrant Components

Gartner publishes a Magic Quadrant (MQ) approximately every one to two years for each industry. The most recent MQ for Business Intelligence was released in February of 1013. The quadrant displays two axes representing the completeness of the company position and the ability to execute. Those companies with the best ratings for both qualities get a marker in the upper-right of the quadrant. These companies include Microsoft, IBM, and Oracle.

Companies with a rating that places them in the upper right quadrant are labeled “Leaders”. These are typically larger, more mature businesses that have both the vision and the ability to execute the vision. Those companies with the ability to execute, but lack completeness of vision are labeled “Challengers”. Those with vision but without a lesser ability to execute are called “Visionaries”. Those companies that fall short in both categories are labeled “Niche Players”.

How to Use the Magic Quadrant

The short answer is that BI clients can choose the best providers from the “Leader” quadrant. However, the implications of challengers implies that a “Challenger” company still has the ability to execute, and may be a better match for a startup company. This means, that both the “Challenger” provider and the startup client may be maturing their visions and strategies, and that the provider may offer a lower price during the maturation period.

Challenges to the Magic Quadrant

The MQ has many challengers, as does any rating system. A company rated as a “Challenger” may consider itself a “Leader”, and may take exception to the MQ rating. The software vendor ZL Technologies challenged the legitimacy of Gartner outcomes in May 2009. Gartner successfully defended its position by reiterating that it publishes pure opinion. Gartner clients must understand that the reports are opinion, although a very informed opinion. Gartner offers expertise to analyze the big data available to any buyer, who could otherwise analyze the data on his or her own. Gartner allows buyers without the resources or expertise to do their own analysis a way to get an informed conclusion.

Recommendations for Use

Although a buyer can simply observe the position of companies within the quadrant, a better way to use the MQ is to read the justifications. In this way, BI clients can draw their own conclusions when necessary, and adjust specific companies on the quadrant according to their own judgments. The IIAR analyst Ludovic Leforeslier offers additional insights.

- A company rated as a “Niche Player” has better credentials than one not listed at all.

- The MQ is superior to a linear rating like MarketScope, which implies that the best company is simply the one that appears rightmost on the chart. The MQ allows viewers to make their own priority of vision versus ability to execute.

- The MQ is still limited to two dimensions. Some clients may be interested in a third parameter, which must be analyzed separately from the quadrant.

- Vendors should allocate 100-120 person hours for MQ submission

BI clients should consider a Gartner Magic Quadrant Business Intelligence platform as part of their goal-setting strategy, keeping in mind the strengths and limitations of such a system.