Hershey (NYSE: HSY) is having a troublesome year amid tepid sales and high cocoa prices. The pessimism is well reflected in its share price which is languishing near 52-week lows even as the US stock markets are hitting new records following Donald Trump’s election as the 47th President.

In the most recent jolt to Hershey, Grizzly Research – a prominent short seller activist firm – has insinuated that the company deliberately used PFAS (Per- and poly-fluoroalkyl substances), also known as “forever chemicals”, in packaging. PFAS banned in several US states for food packaging because they are health hazards that increase the risk of cancer. What makes the allegations even more worrying is the fact that Hershey’s products are quite popular among children and if the charges are correct, it could mean that millions of children were put at risk.

Here’s everything we know about the case and what impact it could potentially have on Hershey.

We are short $HSY . High Levels of Banned PFAS Detected in Hershey's (NYSE: $HSY ) Packaging. Independent Tests Reveal Widespread Presence of Cancer-Linked “Forever Chemicals” in its Biggest Brands. Read our new report here: https://t.co/P3gC4Tkvyt

— Grizzly Research (@ResearchGrizzly) October 23, 2024

Grizzly’s Research Shows High PFAS in Hershey Products

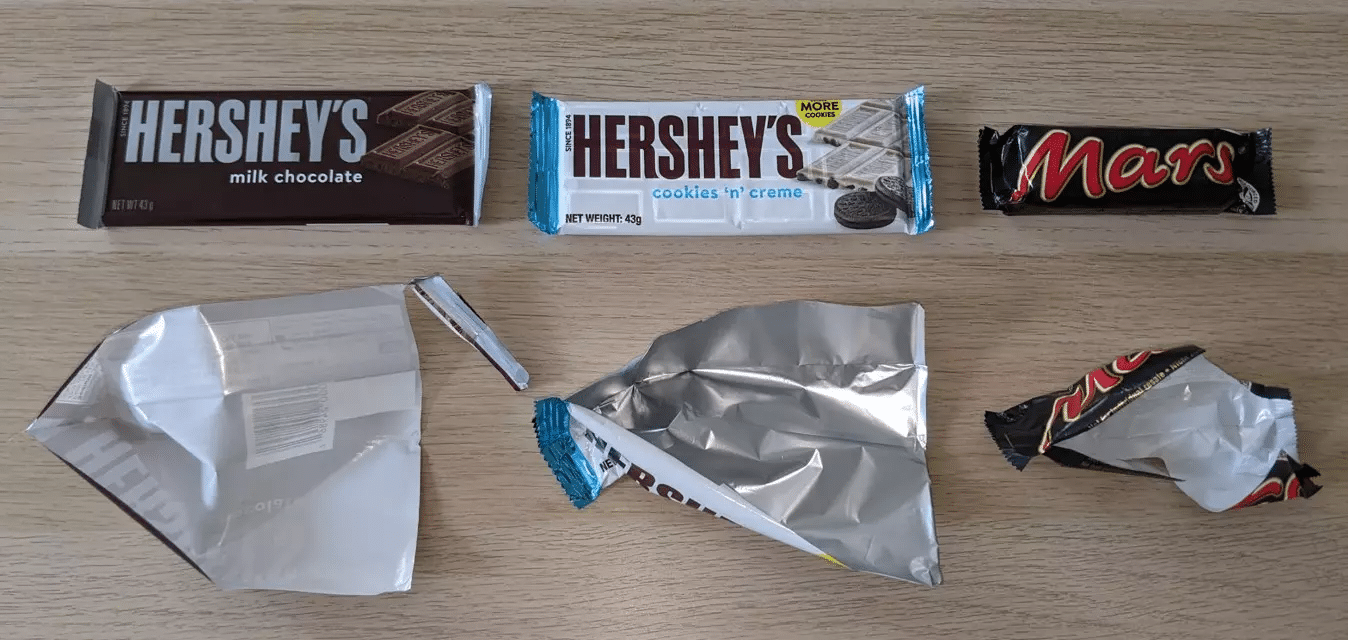

Grizzly tested 40 different products in labs in the US, China, and Germany using four different methods which show heightened traces of PFAS in many Hershey products. Notably, the tests showed nil or negligible presence of PFAS in Mars and Nestle products.

“Experts we talked to were very surprised about the high levels of PFAS we found in HSY candy wrappers because plastic wrappers do not need anti-stick or anti-grease treatment. Experts suggested the data might be explained by foil dusting with PFAS for easier production processes, unclean production processes or aesthetic concerns,” says Grizzly in its report.

It insinuates that Hershey uses PFAS deliberately to make the packaging look shiny and attaches images to show how the company’s packaging appears premium as compared to competing brands – which helps the company charge a premium price for its products.

Short Seller Reports Should be Taken with a Pinch of Salt

Here it is worth noting that Grizzly’s research should be taken with a pinch of salt as it is short on Hershey stock and stands to benefit if the shares fall after its report. That said, in the past short sellers have helped uncover many cases of real mismanagement (and sometimes crimes) by companies.

Hindenburg Research, for instance, exposed how Nikola faked an ad by simply rolling down a non-functioning truck down a hill while implying that it was running on its own on a level road. It also accused Lordstown Motors of misleading investors with its EV pickup truck.

Cut to 2024, and Nikola trades at a fraction of its 2020 highs (when Hindenburg released its report) while Lordstown Motors has filed for bankruptcy. However, its report on Indian conglomerate Adani created a lot of controversy and while the shares fell initially they subsequently recovered and the company also managed to raise capital from foreign investors.

Grizzly too raised an alarm over Chinese EV company NIO’s accounting policies. While NIO refuted the allegations, its share has crashed since then. However, it is more of an industry-wide sell-off than anything peculiar to the company.

Last year, Grizzly issued a short seller report in Chinese online retailer PDD Holdings which owns Temu. While there are several issues with Temu and rival SHEIN, most analysts refuted Grizzly’s pessimistic view of the company.

Why Are PFAS Dangerous?

PFAS are known as “forever chemicals” as they can take hundreds of years to break down. Since they take so long to break down, they can be hazardous for the environment as well as the human body. These manmade chemicals have been around since the 1940s but over the last few years, many regulators have taken note of their harmful impact.

Eric D. Olson director of health and food at NDRC (Natural Resources Defense Council) lists the multiple reasons for PFAS being dangerous. “First, the structure of PFAS means they resist breakdown in the environment and in our bodies. Second, they move relatively quickly through the environment, making their contamination hard to contain. Third, for some PFAS, even extremely low levels of exposure can negatively impact our health,” said Olson.

According to the European Environment Agency, PFAS “can lead to health problems such as liver damage, thyroid disease, obesity, fertility issues and cancer.” It however adds, “At this time, scientists are still learning about the health effects of exposures to mixtures of different PFAS. Additional research may change our understanding of the relationship between exposure to PFAS and human health effects.”

The US Environmental Protection Agency (EPA) also echoes similar views. “Current scientific research suggests that exposure to certain PFAS may lead to adverse health outcomes,” says EPA.

It adds, “However, research is still ongoing to determine how different levels of exposure to different PFAS can lead to a variety of health effects. Research is also underway to better understand the health effects associated with low levels of exposure to PFAS over long periods of time, especially in children.”

PFAS Are Becoming Omnipresent

While research on the harmful impact of PFAS is still underway, there is no denying that it is an environmental hazard. A global study published by Nature Geoscience showed how pervasive PFAS are in water supplies.

“Overall, this study suggests that a large fraction of surface and groundwaters globally exceed PFAS international advisories and regulations and that future PFAS environmental burden is likely underestimated,” said the report.

Notably, while several regulators have instated PFAS reporting regulations for companies and many countries have set a PFAS limit in water, these measures don’t seem to be helping much considering the growing presence of PFAS in the environment. Many companies continue to use PFAS despite concerns over their impact on human health and the environment. Even Costco is facing a lawsuit alleging its Kirkland Signature Baby Wipes, Costco’s in-house brand, contain dangerous levels of PFAS.

Hershey Stock Is Underperforming

Meanwhile, Hershey’s woes extend beyond allegations of PFAS in its packaging. The company missed earnings estimates for the third quarter of 2024 with sales and adjusted EPS respectively falling by 1.4% and 10%. It also lowered its full-year forecast and sees sales as flat compared to the last year versus the previous forecast of around 2% growth. Similarly, it now expects its adjusted EPS to fall in “mid-single digits” while previously it had said that the metric would “fall slightly.”

$HSY Hershey CEO: "…year-to-date results have been affected by historically high cocoa prices and a challenging consumer environment…" pic.twitter.com/CEag4X1WnI

— The Transcript (@TheTranscript_) November 7, 2024

Iconic brands like Hershey’s have the ability to charge a premium price to consumers and leverage their strong brand. However, if allegations of the company deliberately using PFAS in packaging turn out to be true, it could be a total disaster for the brand.

“Revelations about PFA contamination in HSY’s product could lower consumer trust in the brand and leave a long-lasting dent in the brand,” says Grizzly in its report.

It would not only hamper the company’s sales and profits but also its valuation multiples – not to mention the immediate financial cost in terms of the damages that the company would need to pay.

Meanwhile, Hershey has denied allegations and told Bloomberg that it stopped using PFAS “well over a decade” and its suppliers also don’t use it. Obviously, someone is wrong here, whether its HSY or Grizzly, and the issue needs to be investigated further.

Hershey’s stock hasn’t reacted much to Grizzly’s short-sell report, in part due to its already dismal price action this year. As for PFAS, while we still don’t know for sure whether Hershey deliberately uses it for packaging (or at all), there is no denying that its increased presence in the environment and human body risks becoming a major health hazard.