President-elect Donald Trump revealed this week his intention to impose massive widespread tariffs on the US’ three largest trade partners: China, Mexico, and Canada.

The announcement comes roughly two months before his inauguration speech, which is scheduled to take place on January 20, 2025. The plan could dramatically reshape the relationship with these three important commercial allies to the country and may be interpreted as a signal of what Trump’s stance is when it comes to foreign policy.

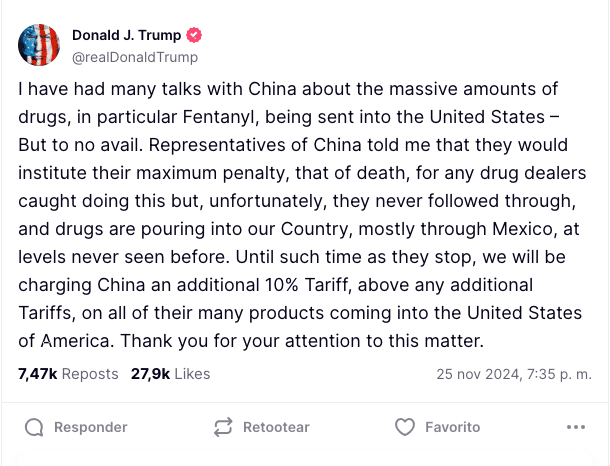

The soon-to-be leader of the free world cited economic and national security concerns to justify these measures. He intends to leverage the US massive demand for foreign goods from these three countries to enforce and gain ground on important issues that are affecting America like border security, drug trafficking, and unfair competition.

“Both Mexico and Canada have the absolute right and power to easily solve this long simmering problem,” Trump posted on his right-leaning social media platform Truth Social.

“We hereby demand that they use this power, and until such time that they do, it is time for them to pay a very big price!”

Mexico and Canada Would Face Sweeping 25% Tariff Increase

Trump’s strategy would involve a sweeping 25% increase on all goods coming from Mexico and Canada while Chinese goods could see a 10% customs tax increase as well. These higher levies will be in place until they demonstrate their commitment to solving these issues.

Illegal immigration and drug trafficking are the two most pressing matters affecting the relationship with Mexico and Canada while matters of corporate espionage, counterfeit items, and subsidized imports have plagued the US’s trade relations with China for decades.

Also read: Trump Promises Huge Corporate Tax Cut: Here’s What It Means for Businesses

The scale of these proposed tariffs is unprecedented. During his previous administration, Trump implemented tariffs on approximately $380 billion worth of goods. However, these new proposals will have a much more disruptive impact on the economy of the four countries and could have massive macroeconomic consequences on all of them.

Higher Tariffs Across the Board Could Lead to Higher Inflation for the US

Economists warn that an increase in import costs for a consumer economy like the US could be immediately passed on to consumers in the form of higher prices on everyday goods.

This would include price hikes on groceries, household essentials, school materials, spare parts, office supplies, and many other similar categories that would have an immediate impact on both personal and corporate budgets.

Gary Ng, senior economist for Asia Pacific at Natixis, warns that these tariffs could lead to higher inflation in the United States and may complicate things for the Federal Reserve in terms of monetary policy decisions.

In this context, a strong dollar would exacerbate the issue as it could slow down economic growth if these countries decide to retaliate by increasing tariffs on US goods as well.

Meanwhile, certain sectors will face the most severe consequences of this sweeping increase.

Also read: Biden Kicks Out Chinese Crypto Firm as Spy Threat: What’s the Risk?

For Mexico, the automotive industry could be the most critically exposed as it relies heavily on exports to the United States. Brands like Honda, Toyota, and Nissan have manufacturing plants in the Central American country that produce thousands of vehicles that are commercialized in the US.

Meanwhile, China’s consumer electronics manufacturing sector would be heavily impacted as well as companies like Foxconn, Lenovo, and Nvidia have manufacturing facilities in the Asian country that export key components and finished goods to America.

“What the rest of the world should take from this is that Trump views relationships on a bilateral perspective and Trump views relationships based on whether the US has a trade deficit or a trade surplus with a given country,” commented Steve Okun, the head of the Singapore-based consultancy firm APAC Advisors.

He added: “Trump has made very clear that USMCA is something that needs to be relooked at and renegotiated when he becomes president. You could look at these tariffs on Mexico and Canada as a precursor to a renegotiation.”

China and Canada React Have Reacted Moderately… For Now

Canada and China addressed the reports with a moderate tone. In the case of Canada, they allege that they have a “mutually beneficial” relationship with the US and stressed that they have always been fully committed to secure the border and cooperating on facilitating trade between the two countries.

“We will of course continue to discuss these issues with the incoming administration,” Deputy Prime Minister Chrystia Freeland said about these proposed measures.

Meanwhile, the Chinese embassy in Washington responded with a warning about the zero-sum game that a full-scale “tariff war” is in practice. The government maintains that any accusations concerning the government’s support of illegal exports of fentanyl-like drugs to America are entirely false.

Also read: Temu and Shein’s Battle in US Courts and App Stores Heats Up as They Fight Over Suppliers in China

“The idea of China knowingly allowing fentanyl precursors to flow into the United States runs completely counter to facts and reality,” the embassy said in a statement to the BBC.

The markets have already started to react to the news. The Canadian Dollar is advancing 1% against the US dollar while the Mexican peso is up by 1.6% as a tariff increase would hurt their economic growth badly.

Meanwhile, the Chinese yuan barely moved despite Trump’s heated rhetoric, possibly because the proposed tariff increase was slightly lower for the Asian country.

A higher price for the Canadian dollar and the Mexican peso reflects the market’s growing uncertainty about how the economy of these two countries – which are heavily dependent on US exports – will fare if Trump goes through with his plans.

Trump’s approach challenges the existing free trade framework, signaling a potential shift towards a relationship that benefits all parties. The President-elect appears focused on reducing trade deficits and using economic leverage as a diplomatic tool.

The tariffs represent a significant departure from traditional trade diplomacy and could market the beginning of a new era of more aggressive policies.