US banks made a killing in the past two and a half years as higher interest rates resulted in estimated profits of $1.1 trillion.

According to researchers, American paid an average of $3,000 than they should have to banks – a figure that questions the economic implications and ethical concerns associated with interest rate hikes.

The Chairman of the Federal Reserve, Jerome Powell, opted to keep interest rates at a historically high level for a long time as efforts to control inflation proved elusive after the first few increases.

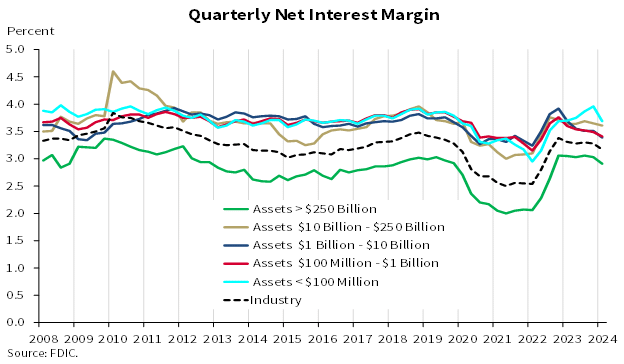

As a result, banks were able to ask for higher rates for their loans while the spread between the average savings rate and the annual percentage rate (APR) charged to consumer and commercial loans was significantly wide.

This research has sparked critics like Matt Stoller, the author of a highly lauded antitrust book called Goliath, to call for major changes at the Fed.

Banks Did Not Increase Their Savings Rates Alongside the Fed

According to the Financial Times, at the end of the second quarter, the average US bank paid depositors an annual interest rate of just 2.2%, significantly lower than the Fed’s 5.5% overnight rate.

This discrepancy between what banks earn from the Fed and what they pay to depositors has resulted in the reported $1.1 trillion in excess interest revenue for banks.

Large institutions like JPMorgan Chase and Bank of America have been particularly advantaged as they paid just 1.5% and 1.7% to savers respectively. Naturally, seeing that the biggest banks were able to get such low rates is frustrating, especially for those of us with mortgages, auto loans, student loans, or nearly any other kind of debt.

The job of the Federal Reserve is to determine the best course of action in terms of monetary policy to achieve its dual mandate of keeping inflation low while, at the same time, generating adequate economic growth.

When it comes to banks, they are able to influence the cost of financing for individuals and businesses. If rates are high, banks are usually able to charge higher APRs to customers, which translates into higher income.

However, the Fed has harnessed significant power to influence the US economy and they are able to tilt the balance in favor of banks by maintaining interest rates at a high level for longer than necessary.

They justify this cautious approach amid the complexity that an economy as diversified as that of the United States can process interest rates cuts and hikes much differently than theoretical models may indicate.

However, the longer they keep interest rates high, the more consumers suffer from higher financing costs and the more money banks made.

Head of CFPB Opposes Relaxation of Basel III Rules

This massive transfer of wealth from consumers and companies to banks interesting ethical questions about the role of central banks and capitalism in shaping society.

On the one hand, individuals are facing significant grocery and rent inflation while, at the same time, bank executives like JP Morgan’s CEO Jamie Dimon are absolutely raking it in. Dimon and other bank execs and shareholders have reached billionaire status through stock grants of a bank that is fully supported by the Federal government amid its systemic importance.

Meanwhile, the issue of profits and capital requirements for banks in the US has been a topic of heated debate and some have even attempted to reform the system. Shortly after the financial crisis, new banking rules called Basel III were introduced to reduce the risk that these institutions carried on their balance sheet by demanding higher capital buffers.

However, the implementation of Basel III has faced significant challenges. Powell held private meetings with large banks earlier this year that resulted in a relaxation of these rules – a controversial move. This is just one of many examples of the Fed’s dovish behavior when it comes to massive corporations, even at the expense of the general public.

In this landscape of suspect regulatory compromises, the Director of the Consumer Financial Protection Bureau (CFPB), Rohit Chopra, has emerged as a relevant figure.

Chopra is known for coining the term “junk fee” and has taken several measures that have helped consumers. He is typically viewed as a good regulator who advocates for what is best for the public and not just big corporations.

In the case of banks, he refused to support Powell’s agenda of relaxing bank’s capital requirements and said that this would give them too much leniency and would open up the door for extra risk-taking.

Chopra has leveraged his seat at the Federal Deposit Insurance Corporation (FDIC) to intervene during the Basel III negotiations. Some of his most notable pro-consumer achievements include banning Navient from servicing student loans and forcing credit bureaus to remove health care bills from credit reports.

The Fed’s Rate Cut Could Prompt Investors to Move Money to High-Yield Instruments

A few weeks ago, the Fed opted to cut rates by 50 basis points. This was the the first cut since 2020. Their decision lowered the target range to 4.75% – 5% and defied economists’ expectations as most analysts were expecting a milder 25 bps reduction.

Powell emphasized the importance of taking advantage of the good moment that the economy is experiencing to make these changes. A few banks have already stated that they plan to make changes to their savings rates after the Fed’s cut.

Although the approach and extent of the changes may vary from one institution to the other, most banks will likely take advantage of the move to slash their interest expenditures.

This means that bank may continue to benefit from the wide spread between savings and lending rates despite the Fed’s decision to start easing their monetary policy.

Meanwhile, the rate cut could also pull investors away from money market funds and into longer-duration bonds.

Total money market fund assets decreased by $20.02 billion to $6.30 trillion for the week ending on September 18 while government funds and prime funds decreased by over $20 billion combined as well.

Americans Let Banks Make Billions Off Higher Rates, Europeans Make Them Pay Taxes

The situation in the United States contrasts sharply with the approach taken in some European countries. The Financial Times noted that in Europe, some governments imposed windfall taxes on banks benefiting from higher rates.

This divergence in how regulators treat seasonal and opportunistic bank profits highlights how extreme, poorly regulated capitalism can affect bank profitability along with the limitations of self-regulation when it comes to protecting the interests of consumers.

Critics like Stoller argue that the current system, which has helped drive the largest wealth transfer of all time to the top 1%, needs a reform desperately.

Suggestions include smashing the independence of the Fed, which some argue is actually a variant of the monopoly-friendly consumer welfare standard, increased oversight and transparency of the Fed’s decision-making processes, strengthening smaller banks through policies that encourage the distribution of capital to more specialized institutions, and revisiting executive compensation rules for large banks.

As the Fed begins to cut rates, the banking industry’s ability to maintain these levels of profitability may be threatened to some extent.

The ongoing debates associated with the implementation of Basel III, the role of regulators like Rohit Chopra, and future monetary policy decisions from the Fed will likely determine the course of bank profits and financing costs for consumers and companies.