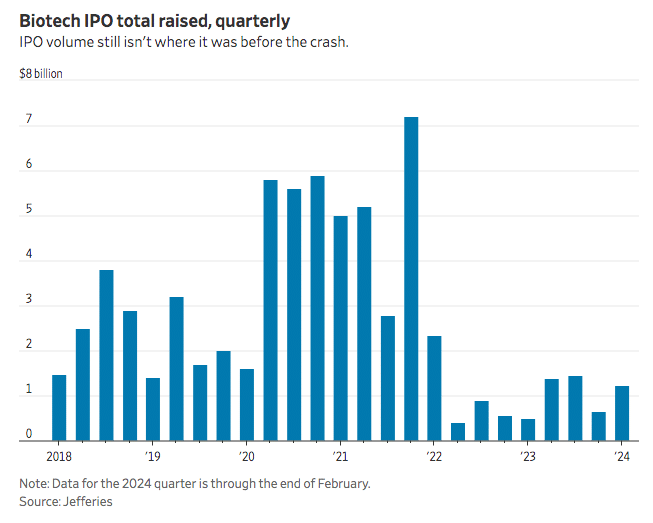

After over two years of an inhospitable market for biotech initial public offerings, the gates have started to crack open in 2024 as investor optimism returns and companies line up to capitalize on newfound fundraising opportunities.

A string of initial public offerings (IPOs) in the first three months of 2024 has put the biotech sector on its strongest pace for stock market debutantes since the boom year of 2021. During this opening quarter, eight drug developers have offered their shares in the public markets, raising a combined $1.2 billion according to data from Jefferies and BioPharma Dive.

Leading the charge were CG Oncology, Kyverna Therapeutics, and ArriVent Biopharma, all three of which upsized their IPOs and saw their stock prices climb above listing levels in the first few days of trading. Notably, CG’s shares nearly doubled on its first trading day.

“It’s a positive sign, unlocking a market that’s been pretty much closed for the last couple years” said Stacie Aarestad, co-chair of the capital markets practice Foley Hoag. “There’s some light coming through… but not enough to give you comfort that the window is wide open.”

Getting Better but Nothing Quite Like 2020 Yet

The green shoots are finally springing up after biotech IPOs withered in 2022 and 2023 amid economic uncertainty, rising interest rates, and a shift in investors’ tolerance for risk due to these two and other pressing factors.

Just 41 biotechs pulled off IPOs during these two years compared to nearly 100 companies that went public at the height of the pandemic bull market in 2020.

Now, with inflation seemingly under control and the Federal Reserve signaling an end to its aggressive rate hikes campaign, investors’ appetite for risk may be returning and that is a tailwind for the high-risk-high-reward biotech industry and for companies seeking to raise money to pursue multiple endeavors.

The industry’s two biggest stock funds have rebounded over 35% since bottoming out last year.

“We are definitely on pace to eclipse the volume of the last two years, but with no sign of excessive investor enthusiasm”, said Jay Ritter, a finance professor at the University of Florida who studies IPO cycles and who was interviewed by the Wall Street Journal.

According to Ritter’s data, stretches of moderate, not over-exuberant IPO interest have historically been followed by better long-term stock performance than periods when debutantes are greeted by a frenzy of insatiable risk-tolerant investors.

“When public-market investors are enthusiastic, as reflected in big first-day jumps, the long-run results have been very poor”, Ritter emphasized.

According to Ritter’s analysis, relatively muted early performance in biotech IPOs, as it happened in 2004, have led to above-average returns of 48% in the three years that followed compared to the closing price of the shares after their first day of trading.

In line with Ritter’s thoughts and considering early 2024 IPOs like CG Oncology logging solid but not stratospheric first-day pops, Yaron Werber, the managing director of T.D. Cowen’s biotech division, views the current conditions as reflective of a “recovery phase.” She thinks that it could create an advantageous environment for new entrants to join the chorus.

Werber emphasized that there have been 18 years during which biotech stocks have had a positive performance in the first innings of the year. “… in 14 out of those 18 years—or 78% of cases—the sector ends up up for the year.”, the securities analyst highlighted.

Industry insiders see the demand dynamics playing out similarly this time, with biotech-focused investors taking the lead for now.

“I think that investors are very discerning. They’re going to be able to figure out which are the higher quality names, and which are the lower quality names”, predicted Eric Schmidt, a biotech analyst at the investment bank Cantor Fitzgerald.

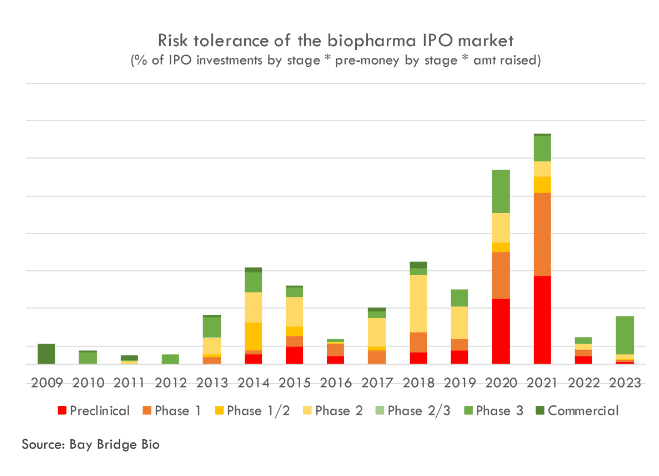

He went on to comment that companies whose products are already at the clinical stage have been the most welcomed by investors during this type of market cycle. “[the] later stage the better”, Schmidt told Fierce Magazine, a web publication specialized in the life sciences industry.

What Types of Biotech Companies Are Performing Best?

Separating high from low quality is easier said than done in drug development. Most of the companies that have gone public so far have cleared that hurdle by having programs that have reached clinical testing and begun generating data.

Peter Maag, CEO of Kyverna, highlighted that the market “is skewed towards late-stage, de-risked types of assets”. His company raised $319 million in one of 2024’s largest IPOs to fund its experimental cell therapies for autoimmune diseases.

It is worth noting that nine of the ten biggest IPOs priced since early 2023 involved programs that had reached at least Phase 2 clinical trials, according to BioPharma Dive’s analysis.

The relative maturity of the assets going public contrasts with 2020 and 2021, when the majority of new issuers were still in preclinical development or just beginning human testing.

“People with a platform that is five years away from the clinic, that’s just not going to fly in this environment whatsoever”, said Christiana Bardon, co-managing director at MPM Capital, in an interview with BioPharma Dive.

The difficulties facing Metagenomi, whose IPO raised $118 million, underscore that point. As a gene editing biotech firm that has yet to nominate a lead candidate, the deal was viewed by analysts as a key test to evaluate if the IPO window had reopened for earlier-stage companies as well.

“To really see momentum, we need to see an expansion of the opportunity for companies,” emphasized Tim Ehrlich, partner at Gunderson Dettmer who works with young biotechs.

In the case of Metagenomi, the stock has gone down by more than 20% since the company went public and its IPO was priced at the bottom of the initial range due to this reigning skepticism.

Investors are More Eager to See Results in This Cycle

Rather than testing the boundaries of the IPO market, some biotechs may adjust their business models to meet the prevailing standards.

“The patience for investors in some of these bigger stories that are going to take longer just isn’t there in the way it was a few years ago”, said Kale Frank, managing director at Silicon Valley Bank’s life sciences practice.

Frank noted that a number of preclinical companies have been working with their boards to identify drug candidates further along that can get them on a “real viable path to the patient” more quickly.

Also read: Reddit Files for Highly Anticipated IPO With Plans to Offer Loyal Users Stock Early

However, some venture investors are taking a different route by incubating a higher percentage of assets entirely in-house before bringing in outside funding.

“The reality is, the public markets are not qualified to judge a lot of the early science that’s going on”, Kale further commented. “It’s a very difficult place to extract value.”

Keeping drug programs private could help biotechs better prepare for prime time and achieve the level of validation that public investors now appear to be demanding.

Positive Results Will Likely Attract New Fishes to the Sea in 2024-2025

If the IPO window stays open through at least the first half of 2024 as investment bankers predict, capital could begin flowing more freely across the drug development ecosystem.

Biotechs struggling with cash crunches and layoffs following two years of fundraising headwinds may find it easier to raise fresh private funding as IPO prospects improve across the industry.

After a sharp drop over the last two years, venture capital investing has already started to pick back up, with insiders like Michael Cohen from Brown Rudnick, having already reported “a significant uptick” in new seed and Series A rounds for first-time founders.

Others have noted that newly funded companies will likely be raising money at valuations at parity or above previous rounds, avoiding the painful down rounds that have plagued startups and early-stage biotech firms in the past couple of years.

The promising early returns could inspire still more biotechs to find the courage to test the IPO waters, even before the market fully resets to prior highs.

“More people will go IPO now because there’s now money, and they don’t want to be the last guy when there’s no money”, predicts analyst Kazi Helal of PitchBook.

However, a full-blown resurrection isn’t forecasted to occur until the back half of 2024 or 2025. After surviving a downturn more extreme than the historical norm, a partial revival may be what the capital-hungry biotech industry needs to get back on track.