GameStop published its financial results covering the second quarter of the 2024 fiscal year, ending on 3 August, sparking heated discussions as investors and analysts dove into the numbers.

During these past three months, the company generated net sales of $798 million resulting in a substantial 31% reduction compared to the same period a year ago. The figure was also worse than the consensus estimate from analysts of $896 million for this period.

However, although sales disappointed, the battered videogame retailer managed to turn a profit of $14.8 million or $0.04 per share, substantially better than what analysts had predicted, which was a net loss of $27 million for the second quarter.

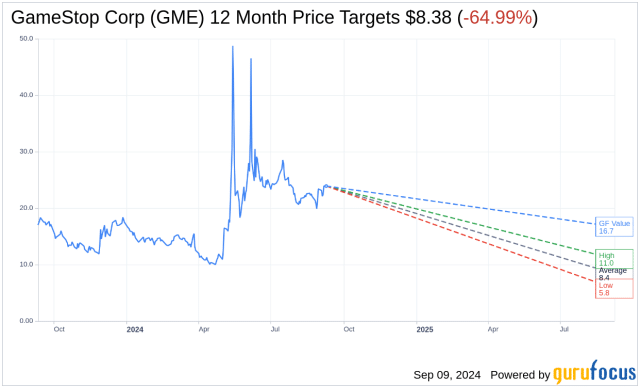

The report was not welcomed by market participants as the stock fell sharply shortly after it was released. Although a handful of buyers stepped in to mitigate the initial drop, GME shares ended up shedding nearly 12% of their value on 10 September and closed the session at $20.6 per share.

Despite this loss, the stock still accumulates an 18% gain since the year started as the Roaring Kitty saga from earlier this year pushed the value above its previous minimums.

Meanwhile, by the end of this quarter, GameStop (GME) reported a strong cash position with cash, cash equivalents, and marketable securities totaling $4.204 billion. The management team managed to take advantage of Kitty’s comeback to sell shares in the open market at a favorable price to shore up the firm’s finances.

This gave GameStop more economic flexibility as it continues with its ongoing transformation efforts but it also angered its many retail holders by diluting their holdings.

No Guidance, No Earnings Call, and No Plans Aside from Closing More Stores

Changing consumer behavior has negatively impacted GameStop’s business model for the past few years as customers prefer digital video game purchases over visiting one of the company’s stores.

GameStop’s management said that they are planning to close more stores but did not provide specifics on the number of locations. They just said that the number of store closures will exceed that of previous years, causing investors to worry that a reckoning is coming.

In their 10-Q filing with the Securities and Exchange Commission (SEC), the management team said that they began a “comprehensive store portfolio optimization review which involves identifying stores for closure based on many factors, including an evaluation of current market conditions and individual store performance.”

“While this review is ongoing and a specific set of stores has not been identified for closure, we anticipate that it may result in the closure of a larger number of stores than we have closed in the past few years,” the statement reads.

“GameStop announced accelerated store closures with its earnings, but with no replacement strategy in sight, management indirectly indicates that it is no longer beholden to shareholder interests,” Michael Pachter from Wedbush Securities commented about this brief announcement.

GameStop Plans to Sell More Shares

GameStop (GME) also disclosed plans for a potential offering of up to 20 million shares of Class A common stock. The sale, which accounts for approximately 4.7% of the company’s total outstanding shares could provide additional capital for its ongoing transformation efforts but may also depress stock price pressure in the short term.

Notably, the firm chose not to provide forward-looking guidance or host an earnings conference with analysts for this quarter.

This lack of transparency regarding future expectations has left some investors and analysts seeking more clarity on the company’s strategic direction.

The company’s approach to investor communications may be aimed at focusing on long-term execution rather than fostering volatile short-term market reactions based on comments and remarks from the leadership team. That said, it also leaves investors seeking more detailed insights into GameStop’s plans for the future, which are crucial at the moment.

With over $4 billion in cash and marketable securities, GameStop has significant resources to invest in its transformation. The effective deployment of this capital into growth initiatives and strategic pivots will be crucial for the company’s future success.

The company’s leadership team faces the challenging task of identifying what the next steps are for GameStop to turn the business around. The decision to close additional stores and potentially offer new shares reflects the management’s efforts to adapt to changing market conditions but can’t be considered a step forward in its efforts to reimagine the business.

Wedbush analysts also claim that, although profit margins for used hardware and software are significantly better than for new products, the company still faces unfavorable “secular trends” that are “unlikely to shift in the near-term.”

“As a result, we expect ongoing revenue declines in the coming years to result in decreasing profitability,” Wedbush analysts concluded.

The “Meme Stock” Factor and Investor Sentiment

— Roaring Kitty (@TheRoaringKitty) May 13, 2024

The influence of Keith Gill – a.k.a. Roaring Kitty – on GameStop’s stock performance was once again a notable catalyst that propelled the value of this “meme stock” earlier this year.

His return to social media in June 2024 prompted a spike in the stock’s price and volatility as market participants believed that this would be a doover of the frenzy that took place in 2021 when an army of retail traders led by Gill made the headlines and managed to put out of business a handful of short sellers.

During one of Gill’s popular YouTube livestreams, GameStop shares experienced significant turbulence and closed that day’s trading session down by 39% – the worst decline since February 2021.

Despite the volatility and speculation, Gill confirmed that he had not sold any of his substantial GameStop holdings and diamond-handed a stake worth over $300 million.

GameStop’s Q2 2024 earnings report portrays the struggles faced by a company that is transitioning to a new era – although nobody knows what era that may be. Although its surprising net profit was seen as a glimpse of hope, the significant revenue decline and ongoing store closures highlight the challenges that the business still faces to stay competitive in a rapidly changing landscape.

As GameStop continues its efforts to adapt to the digital age of gaming, investors, analysts, and industry experts will be observing every step the management takes and the chances that these actions may have to successfully transform its business model and recapture the growth that once made it a dominant force in the video game retail space.