As turbulence hits both small and large banks from Morgan Stanley to New York Community Bank (NYCB), market participants are worrying that the US banking system is nearing total collapse. The banks are currently grappling with unexpected trading patterns and the challenges of commercial real estate loans, which could turn into a serious contagion if it gets out of hand. Amid rumors of concealed losses and risky strategies, the financial world is watching closely.

Can these disturbances unsettle our entire economic framework, or might thoughtful regulation and planning ward off a major crisis? Explore the unfolding story set to potentially transform the banking landscape.

The Precursors of Panic

In the midst of economic uncertainty, the banking sector is again under close watch and speculation. Recent issues have highlighted important institutions like Morgan Stanley and NYCB, starting discussions on potential financial instability. These concerns are justified as the condition of these banks reflects wider economic trends and their impact on markets around the world.

Morgan Stanley has a massive presence in investment banking, wealth management, and securities, making it an essential piece of the US (and global) economy. Recent reports have bred concerning rumors about hidden losses and unusual trading activity, putting the bank’s stability into question.

NYCB is significantly smaller than Morgan Stanley but it’s still a key player in regional banking. It is currently encountering tremendous hurdles, especially from its deep involvement in commercial real estate loans, a sector facing recent challenges. Investors quickly took notice and sold off large amounts of NYCB shares, pushing its stock price down 68% in just over a month.

The road to recovery for NYCB seems tough, stressed by its commercial real estate holdings, highlighted by a $1.05 billion capital boost aimed at stabilizing its shares. Its significant exposure to rent-controlled properties and a recent 7% drop in deposits add to its difficulties, showcasing the wider intricacies facing the banking industry.

The role of these banks goes beyond their immediate stakeholders; they are crucial to the financial system, facilitating the flow of money and contributing to economic growth. It’s vital for everyone, not just financial industry insiders, to understand the early signs of financial distress. Furthermore, modern banks are highly interconnected which is great for economic growth in strong markets but it also makes the entire system more vulnerable to financial contagion.

History has shown that the health of our banks is closely tied to the overall economy’s health, making this a critical issue.

Morgan Stanley – A Closer Look

Morgan Stanley, a leading entity in the finance sector, has recently attracted attention due to unusual trading activities and concerning information in its financial reports. These issues have sparked speculation, leading investors and analysts to question the firm’s stability and reliability.

https://twitter.com/DarioCpx/status/1765560703434498464?s=20

Alarming Trading Patterns and Share Dumping

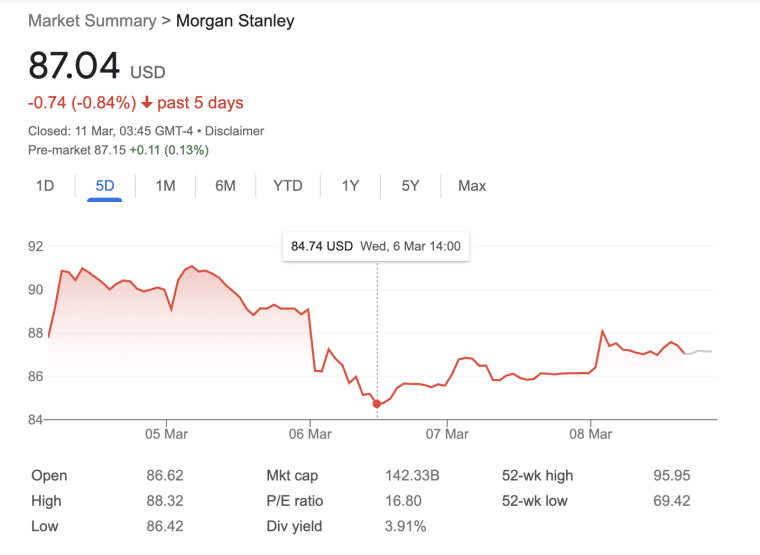

Alarms were raised on March 6th when Morgan Stanley’s stock dramatically dropped on unusually high volume, a move not typical for the market. On the day, an impressive 23.2 million shares were traded, almost three times the average of the last three months. This surge began with a sudden sale of 4.3 million shares, dropping the stock price to $85.

This sharp sell-off, without any prior public news or company announcements, raised doubts about potential undisclosed problems. These unusual trading patterns are similar to those seen before financial crises, indicating potential underlying issues within financial institutions. Naturally, it could be a normal sale from a large investor irrespective of Morgan Stanley’s position but it is still worth looking into.

The Warning Signs in Financial Statements

Further examination of Morgan Stanley’s financial statements uncovers additional concerns. A notable line in its latest 10-K report admits the possibility of liabilities surpassing reserves for commercial and residential real estate loans. The exact quote is as follows:

We may be responsible for representations and warranties associated with commercial and residential real estate loans and may incur losses in excess of our reserves.

This unusual acknowledgment points to significant, yet unmeasured, risks in its loan portfolio.

Also, there’s been a significant drop in cash equivalents, down by $38.9 billion from the previous year, despite an increase in total assets. This reduction in liquidity, alongside asset growth, sparks worries about the bank’s ability to manage its finances and stay resilient in tough times.

Moreover, Morgan Stanley’s increase in trading assets, offset by liabilities, diverges from the cautious asset management approach of its competitors. This aggressive strategy increases exposure to market risks, reminiscent of the conditions leading to the 2008 financial crisis. The similar rise in assets used as collateral, reflecting the decrease in cash, suggests a risky leverage that could threaten the bank’s stability during economic downturns.

These indicators, from unexpected share sales to alarming financial statements, depict a bank possibly facing difficulties. Given their similarity to past crisis precursors, these signs demand careful monitoring and analysis by all involved in the financial sector, underlining the critical role of Morgan Stanley in the global financial system.

The Domino Effect – Could This Trigger a Recession?

Morgan Stanley’s current challenges have raised concerns about the wider banking sector and the possibility of a recession. The bank’s involvement in trading derivatives and its practices around using collateral are central to these worries because they can significantly increase financial instability.

- Derivative Trading: Derivatives, which are financial instruments priced based on other assets, can be used to manage risk. However, if they are not handled properly or if there is too much borrowing involved, they can cause major losses and destabilize the institution.

- Use of Collateral: Morgan Stanley’s approach to using a lot of its assets as collateral is particularly risky. This can cause problems with liquidity, making the bank more vulnerable to changes in the market and possibly affecting its stability during tough times.

The consequences of Morgan Stanley’s issues could be widespread, potentially affecting:

- Other Banks and Financial Institutions: Banks linked through the financial markets and derivatives may encounter similar problems, such as difficulties with liquidity and higher risk.

- The Broader Financial System: Stricter lending conditions might arise, affecting loans and investments essential for economic expansion.

This situation underscores the complex nature of modern banking and finance, highlighting how problems faced by a significant player like Morgan Stanley could impact the broader economic and financial environment.

The Fed’s Stance and Regulatory Measures

Federal Reserve Chair Jerome Powell recently spoke about the risk of bank failures and the challenges in the commercial real estate sector. Powell’s comments reveal the Federal Reserve’s active approach to safeguard financial stability, especially given the issues banks face due to falling real estate prices.

Powell’s Insights

- He recognized the possibility of bank failures, particularly highlighting the negative effects of the downturn in the commercial real estate market.

- He pointed out that these problems are more significant for small to medium-sized banks than for the larger, crucial banks.

Regulatory Oversight and Measures

- The Federal Reserve and other regulatory bodies are increasing their focus on banks’ involvement in high-risk areas.

- Steps being taken include thorough stress tests to ensure banks have enough capital to cover potential losses.

- There’s ongoing communication with banks to review their risk management strategies, making sure they can deal with financial pressures.

These actions by the Federal Reserve and regulatory agencies are designed to strengthen the banking sector amidst economic uncertainties. They aim to make sure banks can handle possible difficulties without leading to a wider banking crisis.

The Bottom Line

The recent issues surrounding Morgan Stanley and NYCB reveal deep-seated vulnerabilities within the banking sector, spotlighted by complex derivative dealings and the strategic use of collateral. These challenges put the spotlight on potential systemic risks, hinting at the possibility of wider economic impacts.

Against this backdrop, the Federal Reserve’s vigilant approach and regulatory efforts stand as crucial defenses against a potential banking crisis. However, the effectiveness of these measures in averting a financial disaster remains to be seen.

As we watch these events unfold, the implications for the banking sector and the broader economy loom large, signaling a critical juncture in the ongoing narrative of modern banking and financial stability.