The average US consumer, especially in lower income brackets, is slowly being buried under financial stress.

This is a problem in its own right but it also threatens the entire US banking system if regular people can no longer pay their debts. Unrecoverable loans at US banks swelled in the first quarter as many consumers find it tough to pay their dues.

But does a rise in these bad loans suggest a crisis for the US banking system and economy?

Painfully high inflation (which continues to be stubbornly sit above the Fed’s 2% target) coupled with wage growth sagging below the rise in cost of living have taken a toll on the finances of low-income households that earn below $45,000 annually.

There has been a rise in consumer delinquencies, making economists worried about the health of the world’s largest economy – whose strength has been the American consumer’s consumption propensity (mainly powered through credit).

Austan Goolsbee, the president of the Chicago Federal Reserve Bank, called rising delinquencies a concerning data point and said, “If the delinquency rate of consumer loans starts rising, that is often a leading indicator things are about to get worse.”

Credit card delinquencies surged more than 50% in 2023 as total consumer debt swelled to $17.5 trillion, per the New York Federal Reserve

— unusual_whales (@unusual_whales) February 8, 2024

More often than not, a rise in delinquencies signals trouble ahead and leads to a domino effect, impacting other sectors of the economy.

Key Highlights: US Banks’ Rising Bad Loans

- Major US banks like JPMorgan and Bank of America have reported significant increases in unrecoverable loans, particularly in credit cards and commercial real estate.

- Delinquencies in consumer loans are a growing concern, especially as inflation remains high and wages lag behind rising living costs.

- Banks have started offloading bad debt to manage risks, with a surge in net charge-offs indicating pressure on the financial system (

- Latest Update: JPMorgan, Wells Fargo, and Bank of America reported a combined $5 billion in loan charge-offs in Q2 2024, marking the highest charge-off rates since 2013. This comes amid rising interest rates and growing consumer delinquencies.

US Banks See a Rise in ‘Unrecoverable Loans’

Most leading financial companies have reported their Q1 earnings and have seen a rise in charge-offs.

For instance, JPMorgan Chase – the largest US bank – reported a net charge-off of $2 billion which was up $116 million from the previous quarter. The rise was predominantly due to a rise in credit card delinquencies.

During JPMorgan’s Q1 earnings call earlier this month, responding to an analyst question on the consumers’ financial health, CEO Jamie Dimon said: “I would say consumer customers are fine.”

He, however, added, “But the extra money of the lower-income folks is running out — not running out, but normalizing.” Dimon cautioned, that while “everything is OK today, but you’ve got to be prepared for a range of outcomes.” Naturally, Dimon might not want to spook investors even if there is a growing problem, but that doesn’t mean he’s wrong this time.

Notably, Dimon has for long been predicting economic turmoil and even predicted a severe US recession in 2023 – which in hindsight we know did not materialize.

Bank of America, which counts Warren Buffett as its biggest shareholder, also saw an increase in unrecoverable loans and its net charge-offs almost doubled YoY to $1.5 billion. The net consumer charge-off rose $115 million from the fourth quarter.

Are Bad Loans Threatening the Banking System Yet?

While top banks like JPMorgan and Bank of America see “cracks” in the finances of borrowers having a below-prime credit score, it is not overly worried.

Bank of America’s CFO, Alastair Borthwick, said during the Q1 earnings call, “we’re encouraged by the trend of delinquencies because the late-stage increases slowed and early-stage delinquencies improved as well. And that leads us to believe we should begin to see consumer net charge-offs start to level out over the next quarter or so.”

Both banks and fintechs are trying their hardest to adapt to the current environment and so far they have been rather successful. According to Tom Dent, senior vice president at an industry group Consumer Bankers Association, “Banks are trying to come up with early-warning signals for customers about their bill payments, offering debt counseling and educating the customers more so that they can stay on track.”

Also, banks are starting to raise interest rates on consumer loans and pulling back on lending to people with poor credit. Fintech giant SoFi, for instance, expects its lending volumes to fall this year as it has prudently cut its exposure to the business.

Do Rising Wave of Unrecoverable Loans Signals Trouble for Banks?

There are bound to be concerns over the health of US banks, especially as one more lender, Philadelphia-based Republic First, was recently shut by regulators. The bank was acquired by Fulton Financial but has ignited fears of more bank failures. It is reminiscent of last year’s banking crisis where names like SVB and Signature Bank collapsed.

Last year’s bank failures were sparked by a range of factors including the implosion of the top crypto exchange FTX, the following crash in the crypto market, lending to risky tech startups, and poor corporate governance. The Fed provided a backstop to failed banks last year which helped prevent a major crisis. The US Central Bank had to step in as letting banks collapse could jeopardize the US economy, especially as most economists were predicting a recession for the year.

Multiple bank failures in a short span of time could be detrimental for the banking sector as it leads to a “run on banks” and a flight of deposits. Looking at the current scenario, things don’t seem that bleak – at least for now – and banks have taken cognizance of the increase in unrecoverable loans by cutting down on lending and increasing the pricing for such loans.

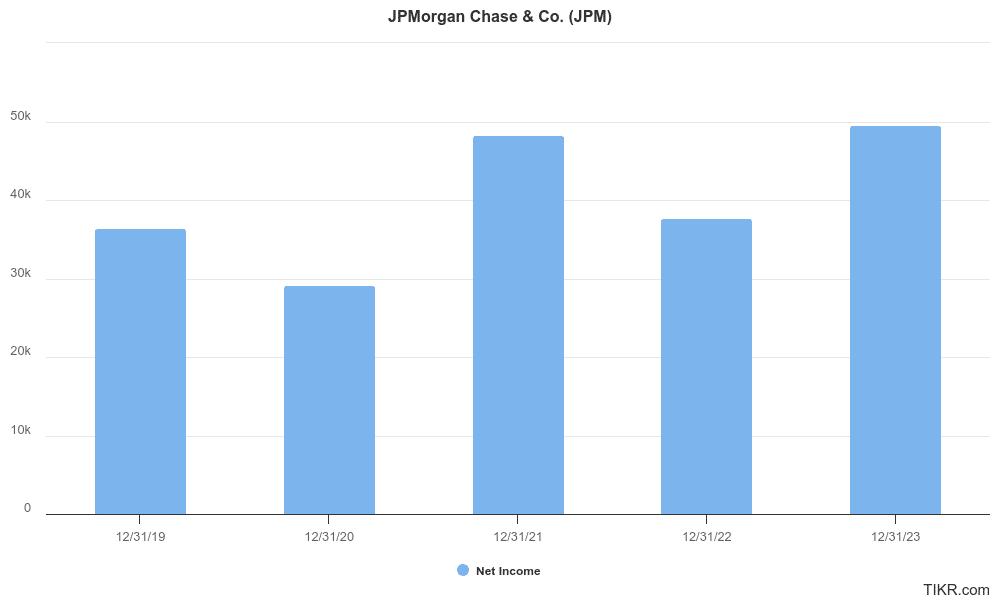

Also, the banking sector is currently posting healthy profits. For instance, JPMorgan Chase posted a net profit of $49.6 billion last year while Bank of America earned $26.5 billion. Healthy profitability, coupled with strong balance sheets, should help banks absorb losses from these unrecoverable loans.

However, there is always a chance of things getting out of control, especially with a shaky economy, geopolitical tensions, and high interest rates.