Elon Musk’s net worth is about to tank after his massive $56 billion compensation plan for his role at Tesla was struck down yesterday by a Delaware judge who argued that it he had too much control over the company and its board.

Specifically, she ruled that the company’s board failed to prove “that the compensation plan was fair.” In this article we break down the details of the plan, why it was struck down, and the path forward for the company. We’ll also see how Musk’s humongous compensation plan compares to other tech CEOs to see if it really is fair or not.

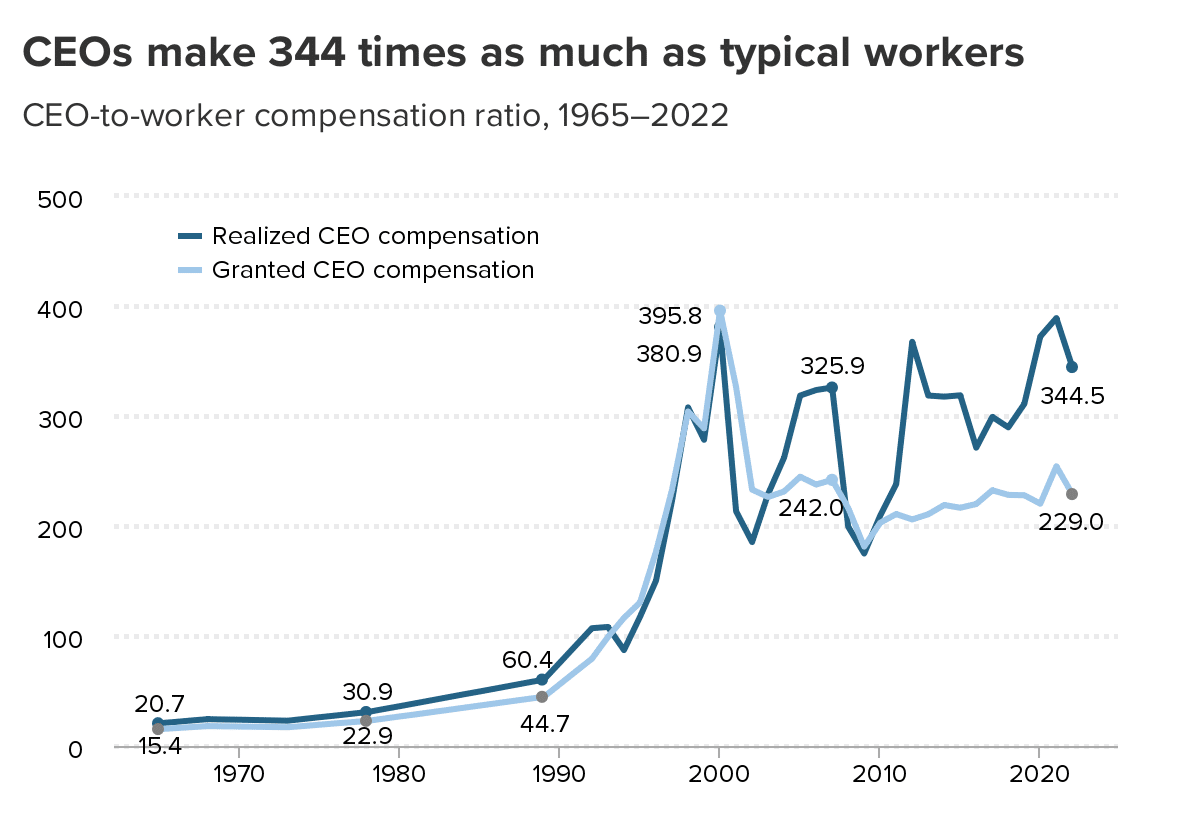

Executive compensation has been a burning issue and the gap between CEO and average worker pay has widened tremendously over the years. According to the Economic Policy Institute, in 2022, CEOs were paid 344 times the average worker pay which is a sharp increase from 1965 when the average CEO pay was 21 times the average worker pay.

Because Musk is so heavily intertwined with Tesla, it makes sense that he is paid more than many other CEOs. But $56 billion is still an absurd amount of money for one man’s pay.

This Isn’t the First Time Musk’s Pay Has Been Challenged

This gargantuan pay package isn’t the first of Musk’s to be challenged. Musk’s contentious 2018 made him the highest-paid CEO in the world but was challenged by a Tesla shareholder Richard Tornetta. Musk does not get any fixed salary, bonus, or incentive from Tesla – unlike most other companies where the CEO pay is a combination of fixed pay and variable bonus.

Musk’s compensation had milestones linked to metrics like Tesla’s market cap and he was entitled to a maximum pay of $55.8 billion through 12 tranches in the latest agreement.

In its proxy filing, Tesla said, “Elon’s only compensation will be a 100% at-risk performance award, which ensures that he will be compensated only if Tesla and all of our stockholders do extraordinarily well.” The filing added,

“The award consists of stock options that vest only if Tesla achieves specific milestones, which if fully achieved would make Tesla one of the most valuable companies in the world with a market capitalization of at least $650 billion — more than 10x today’s value.”

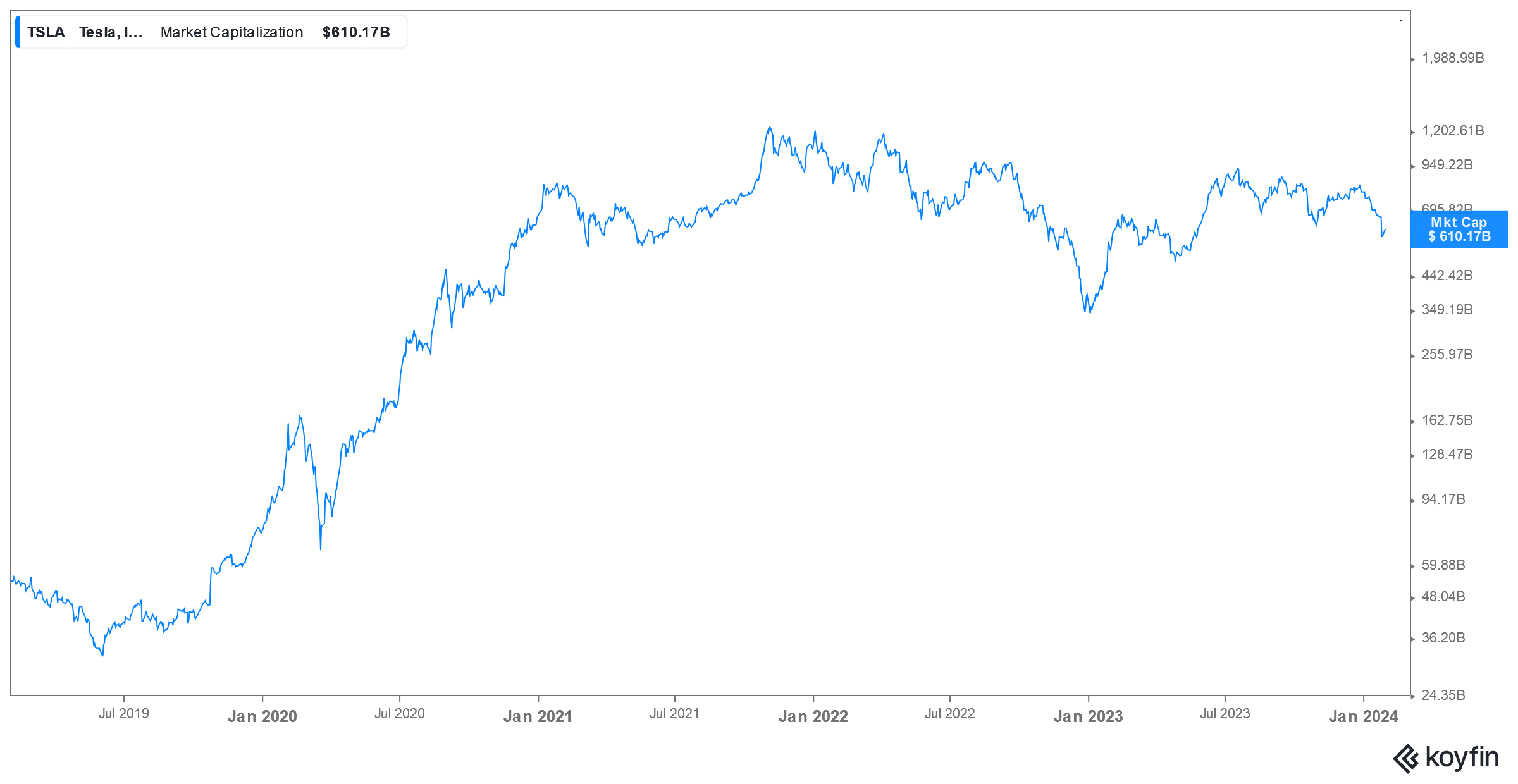

To be sure, Tesla stock did remarkably well over the course of the outlined 2018 compensation structure and is now the world’s most valuable automaker with a market cap of around $600 billion. For context, Toyota Motors, the world’s largest automaker in terms of total deliveries, has a market cap of around $325 billion.

At its peak in 2021, Tesla’s market cap was over $1.2 trillion as it became the first-ever automaker to have a market cap over $1 trillion. Thanks to the spike in Tesla’s market cap, Musk was able to vest all the tranches which made him the highest-paid CEO in the world by a large margin. The next highest-paid CEO is Jeff Green of the advertising company TradeDesk with $835 million (mostly in equity), a massive sum but only a fraction of Musk’s pay.

It wasn’t exactly surprising when Musk went on to become the world’s richest person and the first ever to have a net worth of over $300 billion.

The Case Against Musk’s Payout

In his appeal, Tornetta argued that shareholders were not told how easily the goals under the 2018 compensation plan would be achieved. Also, despite the pay structure offering him an extremely generous 1% of Tesla’s equity whenever the company achieved one of the 12 tranches, the board did not seek more time commitment from Musk.

Notably, since 2018, Musk’s commitment to his other business ventures has increased, especially after he bought Twitter in 2022. Musk also launched his artificial intelligence (AI) company xAI as the billionaire CEO tries to capitalize on the generative AI wave.

In her 200-page ruling, Chancery Court Judge Kathaleen McCormick said that Musk “controlled Tesla” at the time when the compensation structure was approved while terming the board’s approval of the pay as “deeply flawed.” The judge argued that he had massive influence over Tesla and its board, saying in her ruling that:

“In addition to his 21.9% equity stake, Musk was the paradigmatic “Superstar CEO,” who held some of the most influential corporate positions (CEO, Chair, and founder), enjoyed thick ties with the directors tasked with negotiating on behalf of Tesla, and dominated the process that led to board approval of his compensation plan. At least as to this transaction, Musk controlled Tesla,”

Notably, apart from Musk, the Tesla board then consisted of his brother Kimbal Musk as well as James Murdoch and Antonio Gracia – both of which are Musk’s friends and the former has also partied with Musk at various locations.

The judge further noted, “The board never asked the $55.8 billion question: Was the plan even necessary for Tesla to retain Musk and achieve its goals?”

How Does Musk’s Compensation Compare with Other Tech CEOs?

While CEOs get a lot of hate for their sky-high pay, every single one pales in comparison to Musk’s massive compensation. For instance, according to the New York Times, Jeff Green was the 2nd highest paid with a package worth roughly $835 million. Zig Serafin of software titan Qualtrics came in 3rd with a whopping $541 million package. All of the highest paid CEOs made most of their money in equity, often when the price of their stocks skyrocketed following the negotiations.

Is Musk Really Necessary for Tesla and What Would Be His Next Steps?

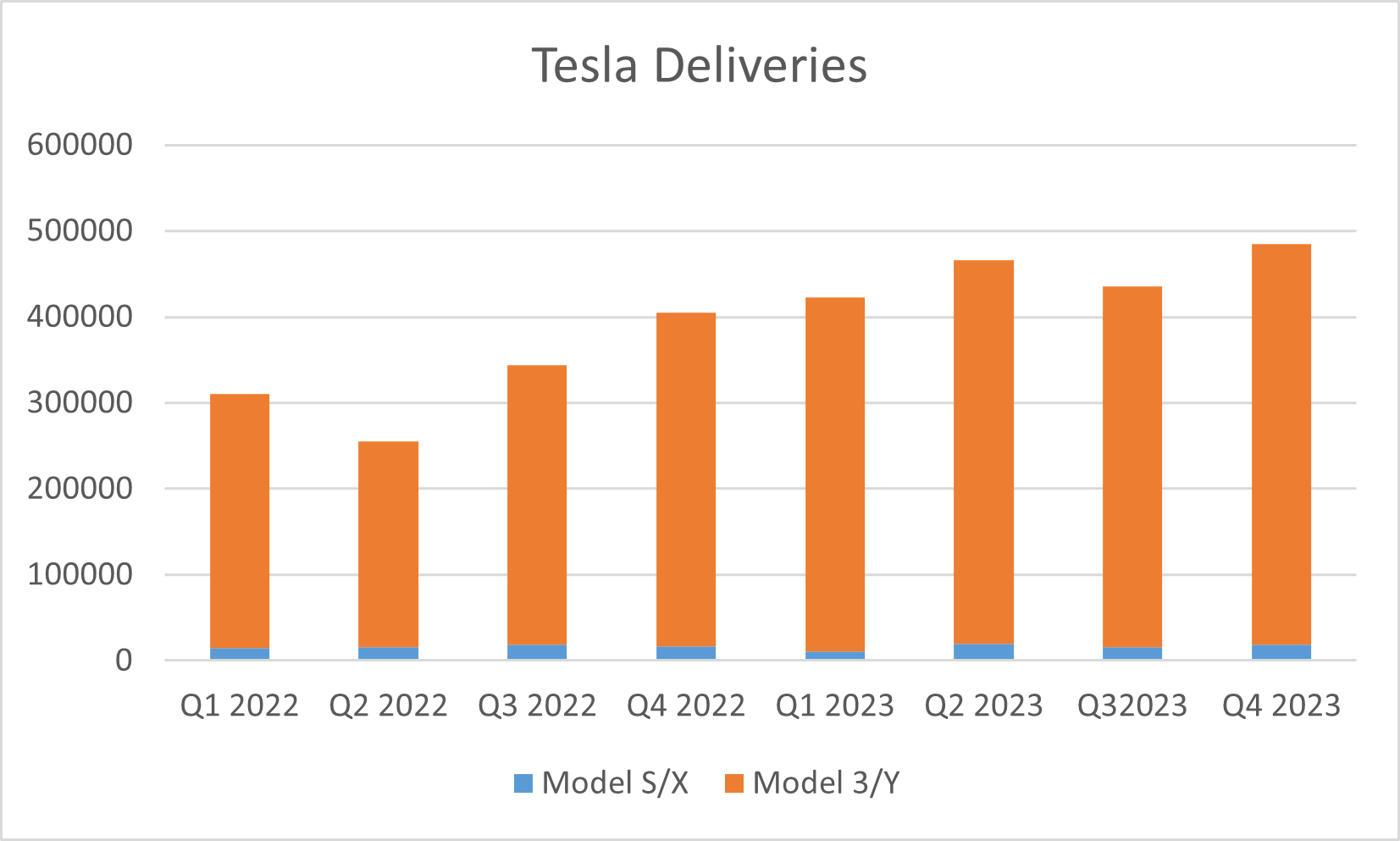

While some shareholders might agree with the judge and find Musk’s 2018 pay structure as flawed and too high, others believe that it’s fair because Musk has been instrumental in growing Tesla to become the tech titan it is today. Last year, the company sold over 1.8 million vehicles as compared to a mere 245,240 deliveries in 2018.

Furthermore, Musk has helped develop Tesla into a technology and AI powerhouse and the company’s next leg of growth could come from products like the Dojo supercomputer and Optimus humanoid. The company’s autonomous driving could also drive long-term value.

Notably, days before the court ruling, Musk warned in a tweet that unless he has a controlling stake in Tesla, he won’t be comfortable building AI products at the company. His tweet sent shockwaves and the stock fell on his de facto warning to the board.

I am uncomfortable growing Tesla to be a leader in AI & robotics without having ~25% voting control. Enough to be influential, but not so much that I can’t be overturned.

Unless that is the case, I would prefer to build products outside of Tesla. You don’t seem to understand…

— Elon Musk (@elonmusk) January 15, 2024

After the judge voided his 2018 compensation, Musk tweeted “Never incorporate your company in the state of Delaware.” So far, Tesla as well as Musk haven’t said much else officially.

Tesla Stock Falls on Court Ruling

The judge’s decision is already having a major impact on Musk and Tesla alike.

The court voiding Musk’s previous compensation is a major blow to the new compensation structure that he has been pushing the board for as well as every future package he negotiates. While analysts expected the TSLA stock to rise today after the judge struck down the previous massive pay package, the reverse is happening. Tesla shares are lower on fears that the lack of a new compensation structure could push Musk to build AI products at one of his other companies instead of Tesla.

The price action is a testament to the perceived value of Musk and his leadership, despite the infinite controversies he seems to stumble his way into. Whether you like him or not it’s hard to argue that Musk hasn’t been absolutely instrumental in Tesla’s incredible growth over the past few years, pushing it to mammoth valuations that no other automaker has ever neared.