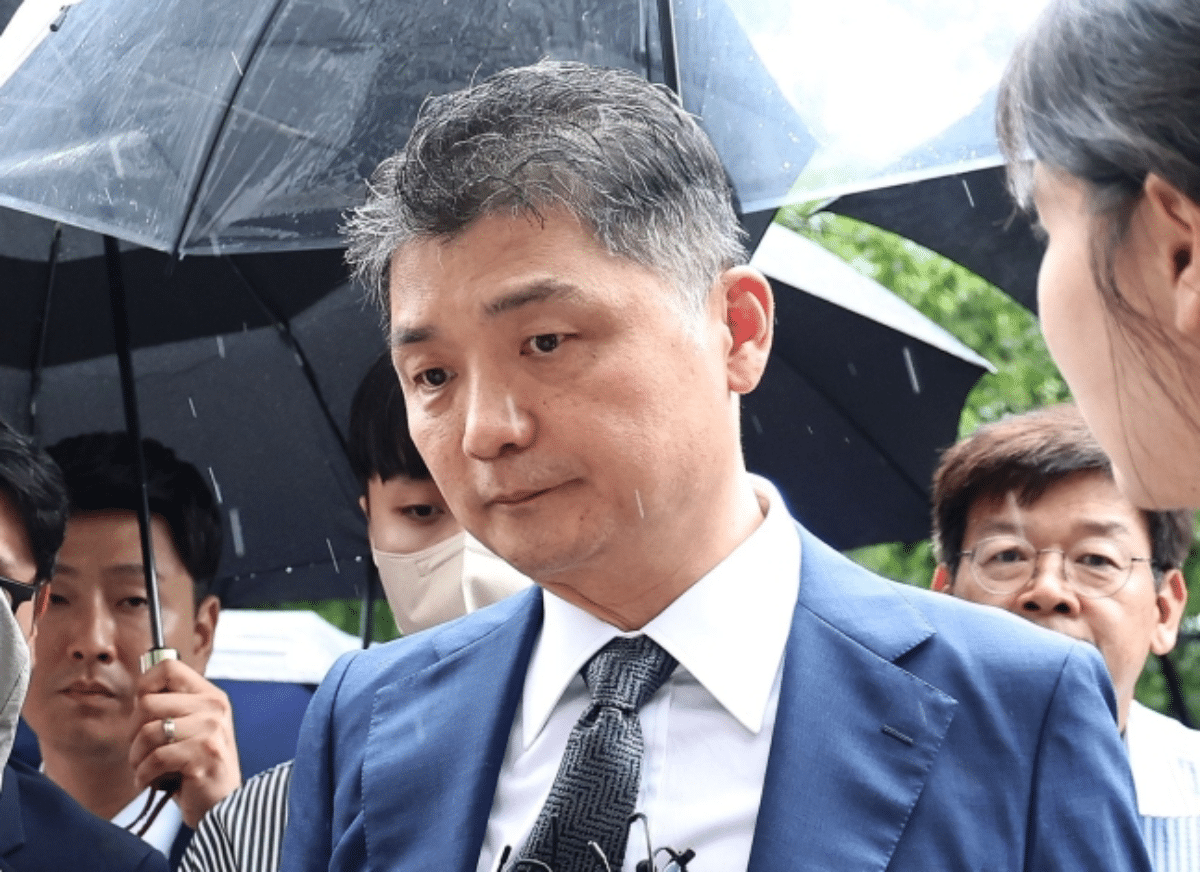

Kim Beom-Su, the founder of South Korean superapp Kakao, has been arrested after a local court approved the prosecution’s request for a warrant to arrest him over allegations of stock price manipulation during the 2023 acquisition of SM Entertainment.

6 Key Facts about Kim Beom-Su’s Arrest

- Arrest: Detained over allegations of stock price manipulation during Kakao’s acquisition of SM Entertainment in 2023.

- Potential Consequences: A conviction could lead to significant repercussions for Kakao, especially concerning its banking operations under South Korean financial regulations.

- Controversial Acquisition: Kakao won a heated bidding war against Hybe for SM Entertainment, despite allegations of manipulating SM’s share price.

- Regulatory Conditions: The Korean Fair Trade Commission approved Kakao’s acquisition of SM Entertainment with specific conditions, including fair music distribution practices.

- Legal Issues: Following the arrest of Kakao’s Chief Investment Officer for market manipulation, Kim is under investigation, though he denies any illegal activity.

- Impact on Kakao: Kim’s arrest could strain Kakao’s banking arm and affect its international expansion and AI investments.

What is the BTS Parent Acquisition Controversy All About?

For context, a bidding war broke out between Kakao and Hybe (which is the company behind the famous K-pop group BTS) over the agency, SM Entertainment. However, allegedly Kakao bought Korean won (KRW) 240 billion (~ $174 million) worth of SM Entertainment’s shares in February 2023 to drive up its share price.

Because of Kim’s purchases which were spread across 553 trades, SM Entertainment’s share price spiked above Hybe’s tender offer price of 120,000 KRW per share. Hybe had to withdraw its offer for SM Entertainment which paved the way for Kakao to acquire the company.

South Korean authorities have issued an arrest warrant for Kakao founder Brian Kim over allegations of market manipulation, setting the stage for him to become the most prominent business figure in the country to wind up in jail in years. https://t.co/R6b2xFZTWb

— The Japan Times (@japantimes) July 23, 2024

Kakao Acquired SM Entertainment in 2023

The acquisition was embroiled in controversies from the beginning and was accompanied by a heated battle between Kakao and Hybe over the control of SM Entertainment.

SM Entertainment was founded by Lee Soo-man, who is widely referred to as “the godfather of K-pop” in South Korea. It represented famous artists including Girls’ Generation, NCT 127, and EXO, which made it a lucrative acquisition target for both Kakao and Hybe.

SM Entertainment management preferred to align with Kakao as it believed the two companies were on the same page on how SM Entertainment should operate.

The two even signed a share sale deal which was voided by a South Korean court.

However, Lee favored a deal with Hybe and sold his 14.8% stake to the company for 422.8 billion KRW ($334.5 million). Hybe became SM Entertainment’s biggest shareholder after the deal even as the company’s top executives opposed the deal terming it a “hostile takeover from outsiders.”

South Korean tech firm #Kakao's entertainment arm said Monday its business agreement with #SMEntertainment is aimed at creating synergy between the companies and it will take action against #HYBE's alleged attempt to threaten the strategic partnership.https://t.co/oN5lim0IBt pic.twitter.com/KxVFKR9nNw

— K-VIBE (@kvibe_yonhap) February 27, 2023

After its shareholder meeting, Hybe decided to increase the stake in SM Entertainment to 40% but its plans were foiled by Kakao.

Kakao offered SM shareholders 150,000 KRW ($115) per share which was 25% higher than what Hybe bid for. After the offer, Kakao – which held a 4.1% stake in SM Entertainment – increased its stake to 39.9%. After losing the bidding war, Hybe also sold some of the SM Entertainment shares to Kakao.

Regulators Gave Conditional Approval to Kakao’s Acquisition

The Korean Fair Trade Commission (KFTC) approved Kakao’s ownership of SM Entertainment only in May 2024 amid the pending probe into market manipulation.

The regulator however imposed several conditions on the deal. Among others, it said that Kakao’s Melon would also need to distribute music from SM Entertainment’s competitors unless there is a valid reason for not doing so.

Allegations of Stock Market Manipulation

Meanwhile, allegations of stock market manipulation started cropping up after Kakao acquired a stake in SM Entertainment, and in October 2023 Kakao’s Chief Investment Officer, Bae Jae-hyun, was arrested and later indicted on violations of the Capital Market Act.

Soon after Bae’s arrest, prosecutors started to focus on any role that Kim might have played in the alleged rigging of SM Entertainment shares. South Korean authorities have arrested Kim even though he hasn’t been officially charged yet. The court issued the arrest warrant to prevent him from destroying evidence related to the case or absconding.

His arrest would last up to a maximum of 20 days during which period prosecutors would investigate the case further before bringing charges against him.

Last week, Kakao said that during a company meeting, Kim said, “The allegations are not true. I have never instructed or condoned any illegal acts.” Commenting on Kim’s arrest, a Kakao spokeswoman said that “the current situation is unfortunate.”

In South Korea, Kakao dominates your digital life from messaging, mapping to ride-hailing. But when the super app KakaoTalk stopped working for hours, a nationwide chaos ensued, exposing how heavily reliant an entire country is on one app. https://t.co/mw7RtXxI63

— Hyunsu Yim (@hyunsuinseoul) October 17, 2022

Kakao Is a South Korean Superapp

Notably, Kakao has grown into a dominant superapp in South Korea.

It offers multiple services on its platform which include Kakao Bank, the on-demand taxi service Kakao Mobility, and the Melon music streaming service. KakaoTalk, one of its flagship products, is a hit messaging app that is already installed on over 90% of phones in the country.

The company’s banking arm could especially face strain if Kim is convicted as the country’s rule restricts those convicted of financial crime from owning over 10% stake in a bank.

Also, its international expansion and investment in artificial intelligence could take a back seat until the air clears over Kim.

Other Recent Cases of Market Manipulation and Insider Trading

To be sure, this is not the first such case of market manipulation and insider trading and we’ve seen several such cases.

For instance, the US SEC has sued Digital World Acquisition Corp’s former chief Patrick Orlando over failing to disclose that it was pursuing the acquisition of former US President Donald Trump’s Trump Media & Technology Group even before DWAC’s IPO, which is against the law.

Previously, two brothers Michael Shvartsman and Gerald Shvartsman pleaded guilty to making over $22 million in profits on insider news on DWAC’s merger with TMTG.

In another such famous case, Television personality and entrepreneur Martha Stewart spent five months in prison in 2004, after three years of investigation and a six-week trial.

She was also accused of insider trading as she sold four thousand ImClone shares a day before its flagship drug was denied approval by the FDA, causing its stock price to plummet.

Stewart wasn’t found guilty of insider trading though and has maintained her innocence to date.

She was however convicted on four counts, including lying to federal investigators, obstruction of justice, and conspiracy, after a series of events related to her ImClone Systems stock sale in 2001. Despite her controversies, Martha Stewart has a net worth of around $400 million in 2024.

Meanwhile, Kakao shares plummeted today after Kim’s arrest and are now approaching their 52-week lows.

The shares have lost around a quarter of their value this year among others due to uncertainty over Kim, who as the head of “corporate alignment” looks at the interests of Kakao’s 128 affiliate companies and decides on prioritizing the different businesses.