According to a Wall Street Journal report, Spirit Airlines (NYSE: SAVE) is in “advanced talks” over its bankruptcy filing. While the US aviation industry has been doing pretty well, Spirit has been in trouble with a debt-laden balance sheet and losses in five of the last six quarters.

While Spirit Airlines hasn’t officially said anything about its plans to file for bankruptcy, in a SEC filing it said that it won’t be able to file its Q3 2024 earnings within the prescribed time limit. It estimates that its adjusted operating margin will be around 12 percentage points lower as compared to Q2 which means that the company is set for yet another loss-making quarter.

Spirit said that it is in “active and constructive discussions” with bondholders over restructuring the obligations and “exploring strategic alternatives and other ways to improve liquidity.”

BREAKING: Spirit Airlines, $SAVE, is preparing to file for bankruptcy.

The stock just crashed -28%. pic.twitter.com/BHsxdYA88d

— The Kobeissi Letter (@KobeissiLetter) November 12, 2024

Spirit Airlines Is In Restructuring Talks With Bondholders

In its filings, Spirit said, “The negotiations, with a supermajority of the Noteholders, have remained productive, have advanced materially and are continuing in the near term, but have also diverted significant management time and internal resources from the Company’s processes for reviewing and completing its financial statements and related disclosures.”

The company said that if the agreement is effectuated, it is not expected to have any impact on unsecured creditors but is expected to lead to the cancellation of its current equity capital.

Spirit however warned, “If a definitive agreement with the Noteholders is not reached, the Company will consider all alternatives” and while it did not name these alternatives, bankruptcy might be one of them.

Spirit’s Merger with JetBlue Was Blocked by Court

Notably, reports of Spirit filing for bankruptcy come after its failed merger talks. It was originally in merger talks with Frontier Airlines but JetBlue offered a higher price to win over shareholders. However, that deal was blocked by a Federal Judge earlier this year who argued that it would hurt competition in the low-cost space.

The US Justice Department lauded the judgment and said, the “ruling is a victory for tens of millions of travelers who would have faced higher fares and fewer choices had the proposed merger between JetBlue and Spirit been allowed to move forward.”

Meanwhile, last month, the Wall Street Journal reported that Spirit and Frontier have revived merger talks.

Why Does Spirit Faced Financial Troubles

While most other US airline companies are having a good run, Spirit is failing to churn out profits. The company hasn’t posted an annual profit since even before the COVID-19 pandemic even as it had profitable quarters intermittently. After its disappointing Q2 earnings, it said, that “significant industry capacity increases together with ancillary pricing changes in the competitive environment have made it difficult to increase yields, resulting in disappointing revenue results” for the quarter.

Notably, while Spirit is known for cheap fares, other airlines have also started offering no-frills tickets, leading to increased competition in the budget airline industry. Given the slim margins that budget airlines work on even during good times, Spirit has really suffered amid rising competition.

While the fall in ticket prices hurt its revenues, even the non-ticket revenues were hit as it did away with cancelation fees and lowered prices of ancillary items to maintain competitive parity.

Spirit Airlines’ Debt Obligations Far Exceed Its Market Cap

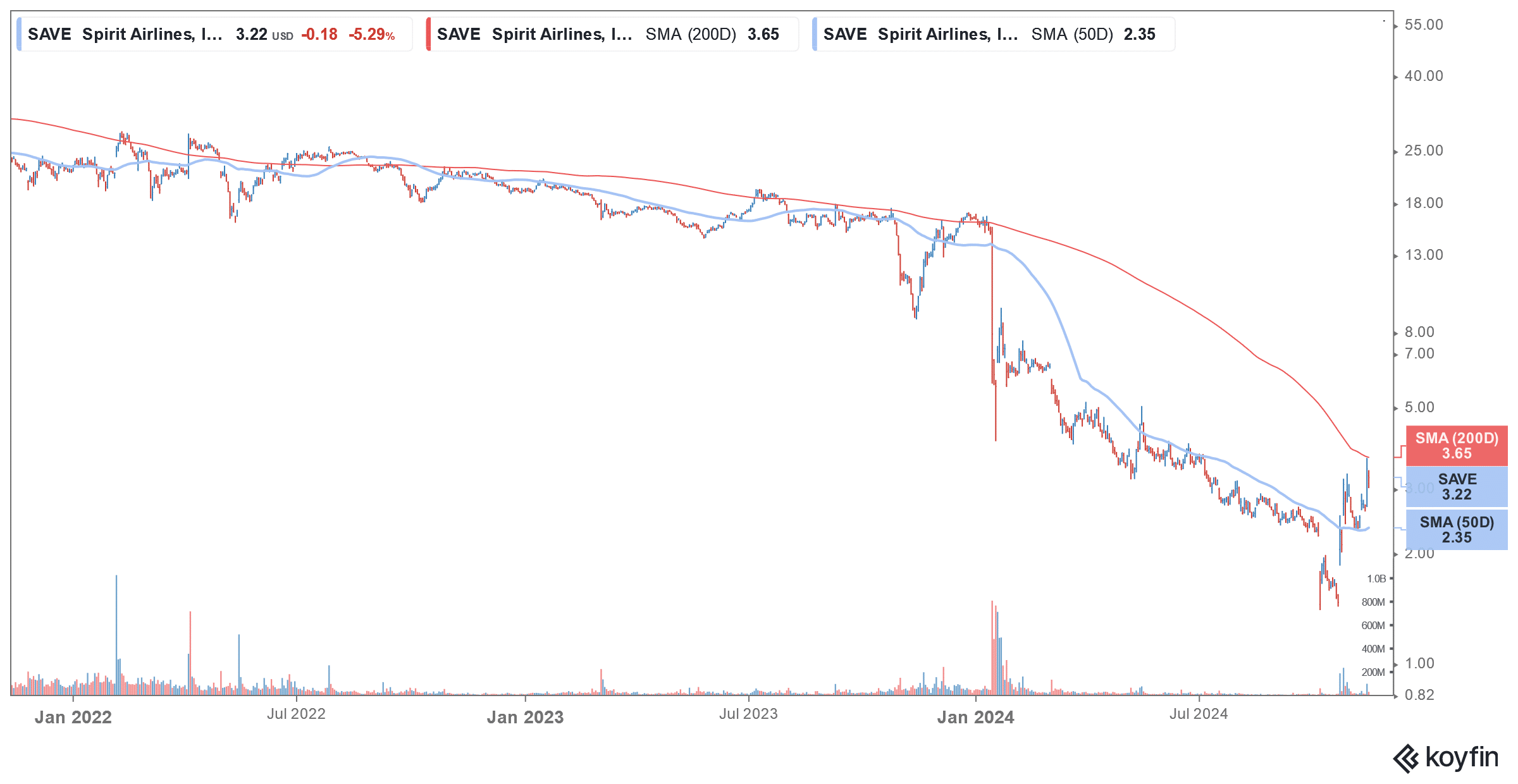

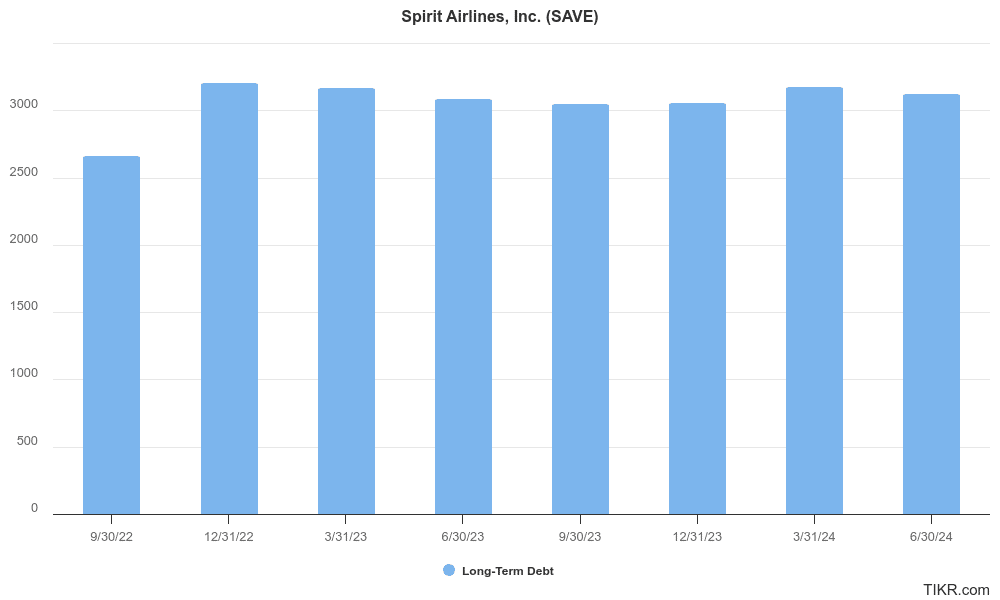

Spirit has a burgeoning debt pile and some of the secured debt is coming up for redemption in 2025. Spirit’s stock has cratered over 80% in 2024 as of yesterday and is down sharply in today’s price action after reports of it filing for bankruptcy. Plummeting stock prices makes it hard to raise capital by selling shares. The company’s market cap is much lower than its outstanding debt pile anyway so even a capital raise through stock sale might not have helped much.

Given its precarious financial condition, even a debt issuance is tough and no wonder Spirit is negotiating a deal with its creditors as raising debt to repay its near-term obligations looks tough.

The company has a debt pile of over $3 billion a third of which is secured bonds that are due for redemption within a year. In comparison, its market cap as of yesterday’s closing was just over $350 million which looks to fall even more sharply today looking at the slump in its share price.

How Does SAVE’s Bankruptcy Impacts US Airline Industry

According to the Bureau of Transportation Statistics, Spirit Airlines had a 5.1% market share between August 2023 and July 2024. Delta was the largest airline in the country followed by Southwest and American Airlines during that period with each holding over a 17% market share.

While SAVE’s bankruptcy might not have a serious impact on the US aviation industry, it could lead to higher fares as the budget segment will lose significant competition. Some of the other airlines that were offering cheaper fares might also consider raising fares after competing with Spirit for so long.

Also, it is worth noting that Spirit is considering filing a Chapter 11 bankruptcy which will help it keep operating the business while trying to restructure. It was already planning on cutting down its operations, including selling some aircraft, in a bid to cut losses and raise cash to fund its business.

That said, in the short term there could be mass cancelation by Spirit which could lead to higher airfares on those routes. However, since there is some overcapacity in the US airline industry, over the medium to long term things should stabilize.

Analysts Were Bearish on SAVE Stock

Wall Street analysts were anyways quite bearish on Spirit Airlines and of the 5 brokerages covering the stock, only 1 rated it as a hold while the remaining four as a sell. Amid reports of it filing for bankruptcy, TD Cowen slashed SAVE’s target price by 50% to $1.

Earlier this year, Citi downgraded SAVE stock to a sell, pretty much summing up the company’s woes in its note. “Although JetBlue and Spirit can still appeal Tuesday’s court ruling … it is unclear why JetBlue wouldn’t cut its losses here and recognize that it avoided a risky bid on a highly levered carrier with steep losses,” said Cowen analyst Stephen Trent.

Trent added, “Citi assumes that each carrier goes their separate way – and although it would be hard to rule out entirely the appearance of other Spirit Airlines suitors, a new bid seems unlikely w/o the carrier first restructuring its debt.”

It remains to be seen how Spirit restructures its debt as a company having a debt pile that excess of its market cap does not really stand to survive in a competitive industry like aviation where even Warren Buffett could not make a profit and ditched all airline stocks at a loss in 2020.