After dragging its feet on crypto ETFs for a decade, the US SEC approved 11 spot bitcoin ETFs in January of this year. The regulator has also changed rules to pave the way for ether ETFs even as it is yet to formally approve any funds based on the cryptocurrency. The new spot Ethereum ETFs are set to start trading in early July if all goes well.

Some experts think that the buck stops here, at least for now, but others are wondering if other top cryptos could get spot ETFs before too long. Bitcoin and Ethereum are far and away the largest and generally the most stable cryptocurrencies, making them safer underlying assets for spot ETFs than most of their competitors.

Here’s what’s driving SEC’s change of heart towards cryptocurrencies and which digital assets could be next on the list as such ETFs seem the hottest new trend on Wall Street.

SEC Believes Many Crypto Assets Are Securities

The SEC held quite a hawkish stance on cryptos and believes many of them are securities and fall under its jurisdiction. In the US, the Howey test is used to determine whether something is an investment contract or security. It was developed by the Supreme Court in the landmark case SEC vs W.J. Howey Co. to determine whether certain transactions qualify as investment contracts (and thus securities).

To be qualified as an investment contract, the Howey test requires 3 conditions which are: they should involve the investment of money, it should be in a common enterprise, and there should be a reasonable expectation of profits to be derived from the efforts of others. This test is rightly criticized because of how incredibly broad and vague it is. The crypto industry has pushed the SEC for more specific guidance for years and years, but it hasn’t been provided much, if any. Instead, the SEC seems to be trying to set boundaries with major lawsuits.

You can check out the above video for a more in-depth breakdown of the Howey test.

In 2021, while speaking with CNBC, SEC chair Gary Gensler said, “If somebody is raising money selling a token and the buyer is anticipating profits based on the efforts of that group to sponsor the seller, that fits into something that’s a security.” Notably, the SEC is in a legal slugfest with Coinbase and alleges that the crypto exchange engaged in unregistered offers and sale of securities.

Why Did the SEC Change Its Opinion Over Cryptos?

It’s important to note that the SEC hasn’t changed its opinion over cryptocurrencies even though it approved spot bitcoin ETFs. It only capitulated after it lost the legal battle against Grayscale, whose application to list a spot bitcoin ETF it initially delayed and rejected.

The three-judge panel concluded that the SEC could not provide a “coherent explanation” as to why it did not approve spot ETFs while having previously approved ETFs based on bitcoin futures. The judges said that the regulator acted “arbitrarily and capriciously” and the actions were in violation of the Administrative Procedure Act.

In his statement on approval of spot bitcoin ETFs, Gensler said, “It should in no way signal the Commission’s willingness to approve listing standards for crypto asset securities.”

Importantly, he added, “Nor does the approval signal anything about the Commission’s views as to the status of other crypto assets under the federal securities laws or about the current state of non-compliance of certain crypto asset market participants with the federal securities laws.”

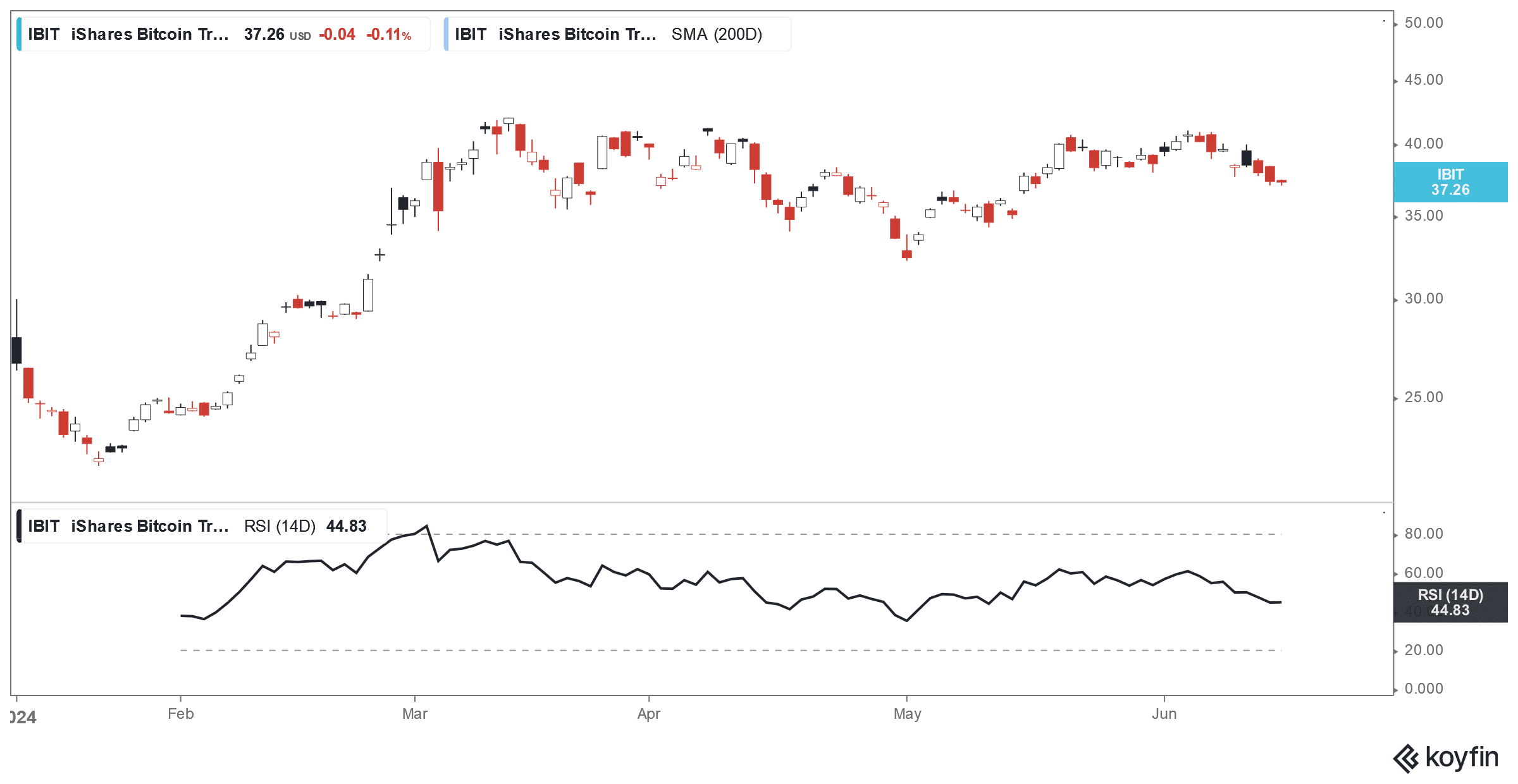

The SEC has since approved 11 spot bitcoin ETFs. The industry has grown in size rapidly, and Grayscale Bitcoin Trust and iShares Bitcoin Trust Registered which are two of the largest spot bitcoin ETFs, have assets of over $19 billion each.

SEC Approved the Sale of Spot Ether ETFs

Last month, the SEC approved a rule change that would allow the sale of spot ether ETFs in a surprise move. The regulator combined and heeded requests from Nasdaq, NYSE, and CBOE exchanges and changed the rules regarding the listing of ether ETFs.

SEC's Gensler Sees Ether ETF Approval By "End Of Summer" https://t.co/6hWFoHnGyw

— zerohedge (@zerohedge) June 13, 2024

The SEC order accepted the applications to list eight different ether funds. While it hasn’t yet approved any of the ETFs, Gensler said they would go live this summer in a recent Senate hearing. The crypto industry was quite overjoyed by the rule change that paved the way for ether ETFs.

Rob Marrocco, global head of ETP listings at Cboe Global Markets said, “The introduction of spot bitcoin ETFs has already demonstrated significant benefits for the digital assets and ETF space, and we believe that spot ether ETFs will similarly provide safeguards for U.S. investors.”

Bitwise Asset Management chief investment officer Matt Hogan, whose firm also has a spot bitcoin ETF, sees a “real sea change in Washington around crypto.” He added, “It looks like Washington has gotten the message that crypto is good for America and that it’s popular with American voters.”

Notably, former US President Donald Trump, the likely presidential candidate for the Republican Party for the 2024 election, has already declared himself a “crypto President,” and his win in the upcoming US elections would turbocharge the already hot crypto market.

Anthony Pompliano of Pomp Investments, the popular crypto influencer behind the Pomp Podcast, put forth a great argument. He said, “A bunch of people on the internet created a $2.6 trillion industry in the face of government pressure. Imagine what happens when the government is now actively courting these individuals and companies, along with embracing the technology. The headwind becomes a tailwind quickly.”

Which Cryptocurrency ETFs Are Next in Line?

The launch of crypto ETFs is a positive development for the industry and has funneled billions of dollars in inflows for Bitcoin. After spot ETFs start trading markets would then focus on next spot crypto ETFs. As things stand today, we can only speculate as to which crypto ETFs would be launched after Bitcoin and Ether.

However, so far, the launch process has followed the market cap pattern and after Bitcoin – which is the biggest cryptocurrency – we are set to have ETFs on ether which has the second largest market cap.

Next on the list of the largest cryptocurrencies are BNB, Solana, and XRP (not including stablecoins). Most experts seem to believe that Solana or BNB will be the next to get spot ETFs, but they are both considerably smaller than Bitcoin and Ethereum, so the SEC may be reluctant to list them. For comparison, BNB, the 4th largest crypto, has a market cap of nearly $90 billion. That’s pretty massive, but it’s much smaller than Bitcoin or Ethereum, which have market caps of $1.3 trillion and $430 billion, respectively. Solana is even smaller at $67 billion.

Dogecoin, the biggest meme coin, could also be on the list to get a spot ETF before too long. Arthur Hayes, co-founder of BitMEX is optimistic that a dogecoin ETF will become reality before too long. However, its relatively small market cap of $19.2 billion and its extreme volatility make it an unlikely candidate for a spot ETF (for now at least).

Cryptocurrency Regulations Might Also Strengthen

All said, after bitcoin and ether, crypto bulls would fancy their chances of more crypto ETFs. The wave of crypto ETFs might also lead to more regulatory clarity in the cryptocurrency markets which is still a grey area in some sense. Some experts even believe that as central banks diversify their holdings beyond the US dollars, they might consider adding some crypto assets to their reserves. While the idea looks far-fetched for now, it is not something that we can rule out in the future as the crypto markets mature.