Rakesh Jhunjhunwala, the late Indian billionaire investor, chartered accountant, and stock trader, has long held the position of one of the richest men in India. From his first investments in 1985 up to his death in 2022, Jhunjhunwala was able to earn a tremendous fortune.

At the time of his death, Rakesh Jhunjhunwala’s net worth was estimated at $5.8 billion.

Jhunjhunwala was an active stock trader and investor, but his versatile career did not end there. He was the director and chairperson for several companies and co-founded Akasa Air.

Keep reading to learn more about his life story and how he made his incredible wealth.

How Much Was Rakesh Jhunjhunwala Worth?

- Net Worth at Time of Death: Estimated at $5.8 billion (2022).

- Titan Stake: Held a 4.8% stake in Titan worth $1.89 billion.

- Star Health Stake: Owned 17%, valued at over $840 million.

- Real Estate: Owned properties valued at over $64 million, including a 13-story mansion in Mumbai.

- Stock Portfolio: Diverse investments across Tata Motors, Canara Bank, and others contributed significantly to his wealth.

Rakesh Jhunjhunwala’s Net Worth Breakdown:

Private people, including Rakesh Jhunjhunwala, generally don’t disclose details about their stock investments.

This is why the details surrounding how many shares the investor had in each company vary between different sources. As one of the biggest investors in the world, Jhunjhunwala constantly traded his stock, making new investments and getting rid of some of the stock he owned.

However, after a thorough research of his assets before his death in August 2022, we were able to build a holistic estimate of his net worth, pinpointing the main sources of his wealth.

| Asset or Income Source | Contribution to Net Worth |

| Stock portfolio in 2022 | $5.8 billion |

| Titan stake | 4.8% worth $1.89 billion |

| Star Health and Allied Insurance stakes | 17% worth $840+ million |

| 2021 SEBI Settlement | ₹18.5 crore worth $2,219,663 in 2024 |

| Real estate | $64+ million |

| Total Net Worth | $5.8 billion |

5 Fun Facts About Rakesh Jhunjhunwala

- Known as the “Warren Buffett of India,” Jhunjhunwala turned $60 into billions through savvy stock investments.

- His Titan shares were one of his best investments, contributing over $1 billion to his net worth.

- Jhunjhunwala was a chartered accountant by profession before becoming an investor.

- He co-founded Akasa Air, a low-cost Indian airline.

- Jhunjhunwala had planned to donate 25% of his wealth to charity before his death in 2022.

Latest News & Controversies

Though Rakesh Jhunjhunwala passed away in 2022, his investment portfolio continues to make headlines in 2024.

His Akasa Air has expanded operations rapidly, benefiting from India’s booming airline market, and the Jhunjhunwala family remains heavily invested in companies like Titan and Star Health. Posthumous investigations continue into insider trading allegations from 2021, related to his dealings with Aptech Computers.

Despite these controversies, his legacy as a financial titan in India remains intact.

Early Life and Education

Jhunjhunwala was born on July 5, 1960, in Hyderabad, India, in a Rajasthani Marwadi family. He studied at Sydenham College, where he obtained his BCom degree in 1985 before enrolling in the Institute of Chartered Accountants of India (ICAI).

Even though he initially became an accountant, Jhunjhunwala would eventually go on to focus on the world of investing instead. His passion for finance began at an unusually young age. He spent most of his childhood listening to his father, an income tax officer, passionately talking about financial markets and stocks, building his early interest in the field. Following his CA education, Rakesh Jhunjhunwala jumped into the stock market, building his path toward success and wealth.

“My father was also interested in stocks. When I was a young child, he and his friends would drink in the evening and discuss the stock market. I would listen to them and one day I asked him why do these prices fluctuate. He told me to check if there is a news item on Gwalior Rayon in the newspaper, and if there was Gwalio Rayon’s price would fluctuate the next day. I found it very interesting and I got fascinated by stocks, I self-taught myself. My father told me to do whatever I wanted in life but at least get professionally qualified.” – he shared.

In 1987, Jhunjhunwala married Rekha Jhunjhunwala, with whom he had three children: Nishtha, Aryaveer and Aryaman.

Rakesh Jhunjhunwala Net Worth: Becoming the “Warren Buffett of India”

In only a few years of investing, Rakesh Jhunjhunwala became famous worldwide for his smart investment choices and was even nicknamed the “Warren Buffett of India”. The stock market veteran began investing straight out of school, making his first profit in Tata Tea.

Let’s see how he navigated the stock markets to build such incredible wealth.

Jhunjhunwala’s Investing Career Over the Years

Rakesh Radheyshyam Jhunjhunwala entered the stock market with a minor investment when he spent his savings to acquire a few shares. He started studying the market trends and analyzing the performance of companies, primarily in the Indian stock market. He reportedly started with a ₹5,000 capital (around $60 today) in 1985.

Between 1986 and 1989, Jhunjhunwala invested more significantly in blue-chip companies such as Tata Power Ltd. The price of this venture’s stock rose to INR 1200, making his assets double from INR 2 million to INR 5.5 million (around $23,000 – $65,000 today). He initially bought 5,000 shares in Tata Tea at INR 43 per share but sold them for INR 143 per share.

Another especially profitable early investment for young Jhunjhunwala was in the mining giant Sesa Goa (later named Vedanta Ltd.). He acquired around 400,000 shares during a rough period for the business. At the time, the company was struggling due to the falling prices of iron ores, but it got back on its feet soon, giving the investor quite the return on his money. He also invested in Praj Industries Ltd., an ethanol plant sector in India. He kept the stock for quite some time but eventually made an appreciation of nearly 250% on this stock.

By 2022, his small investments turned into large investments as his net worth grew. At this point, he had invested over ₹11,000 crores, which would equal over $1.3 billion. If you aren’t familiar with Indian Rupees, a crore simply means 10 million.

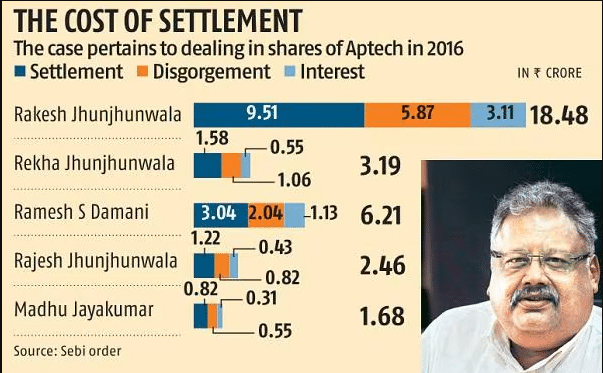

In 2021, Jhunjhunwala was investigated for insider trading for his dealing in shares of Aptech Computers. Investors alleged that he and other investors traded in the stock while in possession of unpublished information that was price-sensitive.

In July of that same year, the Securities and Exchange Board of India (SEBI) settled the issue after Jhunjhunwala and his associates paid ₹35 crore, out of which ₹18.5 crore came from him and ₹3.2 crore came from his wife.

Stock Market Investments at the Time of His Death

In 2002 and 2003, Rakesh Jhunjhunwala bought shares in the Titan company worth ₹3 a piece (around $0.036). This investment was the main factor that made him a billionaire, considering that their stock is currently trading at over ₹3700 a piece (around $44). His overall holding in Titan as of June 2022 was reportedly 4.8% in the company, which would be worth around $1.89 billion today.

Another significant stock that added a fortune to his net worth was his 17% holding in Star Health. At the time of his death, Jhunjhunwala reportedly owned 100.7 million shares of Star Health and Allied Insurance Company, worth ₹7017 crore (over $840 million today).

Before his death, Jhunjhunwala added Indian Hotels Company Limited to his investment portfolio, buying 12.5 million shares or a 1.05% stake in the business. Provided that his family still owns this stake, it would be worth $89.5 million today.

As previously mentioned, the exact stake in each of the companies in Jhunjhunwala’s investment portfolio can differ between sources. We do, however, know which companies made a big profit for the investor and contributed the most to his net worth at the time of his death. These included:

- Tata Communications – around 1.8%

- Canara Bank Ltd. – around 2.10%

- Fortis Healthcare Ltd. – 4.50%

- Tata Motors Ltd – 1.60%

- Federal Bank Ltd – 3.50%

- Agro Tech Foods Ltd – 8.10%

- Rallis India Ltd. – 7.80%

- Autoline Industries Ltd. – 4%

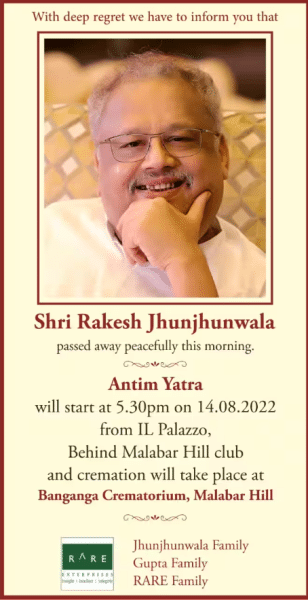

Rakesh Jhunjhunwala’s Death

In August 2022, Jhunjhunwala was rushed to Breach Candy Hospital in Mumbai, suffering from kidney-related problems. He succumbed to his disease due to an acute multiple organ failure and died the same day, aged 62.

Philanthropy

Before his untimely death in August 2022, Jhunjhunwala planned to donate a quarter of his wealth to charitable causes.

“I have made a pledge to myself that I shall donate 25 percent of my wealth in my lifetime. I am already supporting some causes and the other causes will be known once I start supporting them,” Jhunjhunwala said.

His philanthropic portfolio at the time included education-related and healthcare initiatives. He supported a variety of organizations including:

- Agastya International Foundation

- Ashoka University

- St. Jude

- Olympic Gold Quest

- Friends of Tribal Society

Rakesh Jhunjhunwala Net Worth: Other Assets and Investments

Businesses

Rakesh Jhunjhunwala managed his investments mainly through his asset management company Rare Enterprises. Founded in 2003, the private equity firm Rare Enterprises is now under the ownership of his family.

In July 2021, the famous investor acquired a 40% stake in Akasa Air, a low-cost Indian airline, for $400 million. Before his death, he increased this stake to 46%, which made him the largest stakeholder in the business. His latest public appearance before his death in August 2022 was at the inaugural flight of Akasa Air.

Other Positions

Besides his investments in the financial world, Jhunjhunwala held several prominent positions:

- Chairman of Aptech

- Chairman of Hungama Digital Media Entertainment

- Member of the board of directors of Prime Focus Limited

- Member of the board of directors of Geojit Financial Services

- Member of the board of directors of Viceroy Hotels

- Member of the board of directors of Nagarjuna Construction Company

- Member of the board of directors of Mid Day Multimedia Limited

- Member of the board of advisors of India’s International Movement to Unite Nations

Assets

In 2013, Jhunjhunwala bought half of the 12 units of Ridgeway apartments at Malabar Hill for ₹176 crore. In 2017, he bought the remaining 6 apartments from HSBC for ₹195 crore. In 2021, he demolished the old building and started constructing his 70,000-square-foot home spread across no less than 13 stores! His investment was worth over $64 million, while the current value of the property is unknown.

What Can We Learn from Rakesh Jhunjhunwala’s Story?

Rakesh Jhunjhunwala has made an indelible contribution to India’s progress through his remarkable success stories.

Often hailed as “India’s Warren Buffet”, his Midas touch transformed about $60 in starting capital into a multibillion-dollar empire. His story is truly inspiring, teaching us about the power of determination and astute investments.

Starting from his early days as a chartered accountant to his ascent as one of India’s most prominent investors, his journey exemplifies the potential for individuals to shape their success through strategic decision-making. His ability to identify lucrative opportunities teaches us the importance of thorough research and calculated risk-taking in life.

Jhunjhunwala’s story hasn’t been one without challenges.

Throughout his illustrious career, he used his expertise and experience to succeed in the complex stock market, which earned him the moniker of “The Big Bull of Dalal Street”. His resilience in the face of challenges such as market volatility and legal scrutiny teaches us the virtues of perseverance and fortitude, which are vital to achieving long-term success.

Finally, his commitment to philanthropy underscores the significance of giving back to society and using wealth for the greater good. Jhunjhunwala’s legacy remains strong following his untimely passing in August 2022.