A search for safe-haven alternatives to the traditional fiat-based, central bank-centered fractional reserve financial system has powered gold and Bitcoin higher in the last few weeks, with the two asset classes having developed a strong short-term correlation.

Earlier this month, three US banks folded (Silvergate, SVB and Signature Bank) and more look like they could be on the way out (like First Republic), while cracks are also appearing overseas, with UBS buying out Credit Suisse at a massive discount over the weekend.

Bank failures have triggered fears about financial stability and the safety of bank deposits while increasing the risk of bank runs. And as confidence in fiat currency wanes, investors have been flocking to alternative “currencies” that could for the bedrock of a future financial system.

Indeed, gold has a long history of being used as the main form of money upon which economic and financial systems have been built. But Bitcoin is increasingly touted as a viable digital alternative (indeed, that’s exactly what it was created for).

A chart shared on Twitter by popular crypto trader, author and influencer Glen Goodman emphasizes just how much gold and Bitcoin have been moving hand-in-hand over the last few days. Another key observation is that Bitcoin appears to be increasingly losing its correlations with US stock markets.

Four days on, and #Bitcoin is still correlating with #GOLD instead of with US stocks.

A week is not really long enough to comprehensively demolish the $BTC/stocks correlation that's lasted more than a year, but with every day that passes, that correlation looks more tenuous… https://t.co/m56xJQNSF1 pic.twitter.com/7E427lF034

— Glen Goodman (@glengoodman) March 17, 2023

Indeed, while Bitcoin is up 20% this month, the S&P 500 is basically flat. The two had traded pretty much in lockstep in 2022, a time when macro investors were viewing Bitcoin as more of a speculative technology that would move in tandem with tech stocks.

Why is Bitcoin Losing its Correlation to Stocks?

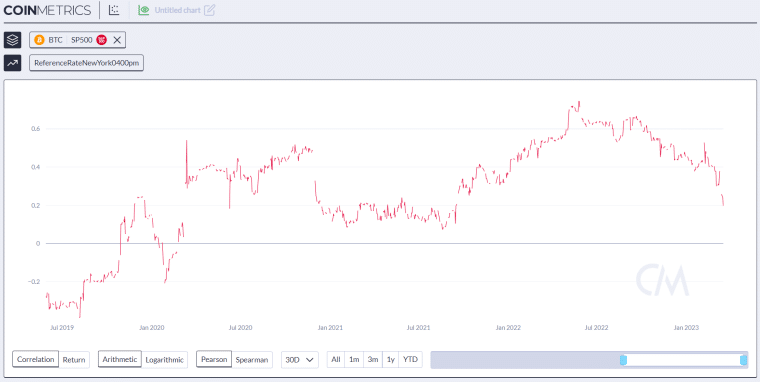

Analysts are putting the breakdown in the correlation to investors increasingly viewing Bitcoin as a safe-haven asset to financial stability concerns. The 30-day Pearson correlation between Bitcoin and the S&P 500 dropped under 0.2 last Friday for the first time since September 2021, according to data presented by CoinMetrics.

That relationship could soon shift to negative if Bitcoin keeps rising while US stocks keep facing challenges. And they might indeed face challenges – there’s an increase in bets that the Fed won’t do much more tightening, and a rate-cutting cycle seems to be approaching as issues arise in the financial system.

But the bank crisis could only be in its very early stages. If things turn out anything like the 2008/9 financial crisis, we could be in for a prolonged crisis and nasty recession. Historically the S&P 500 has never bottomed before the start of a Fed-cutting cycle (which is where we are now). It seems unlikely many investors will want to chase stocks higher from here given uncertainty about the economic and financial stability outlook.

Looking ahead, Bitcoin, gold and equity traders will be monitoring this week’s Fed meeting. US and international bank troubles should have thrown all of the central bank’s previous guidance on rate hikes out of the window. It’s now just a question of how soon the tightening cycle ends and when the rate hikes begin.

The Fed will be worried about 1) not wanting to make the crisis worse by being too hawkish versus 2) needing to still retain some credibility regarding its inflation-fighting capabilities (i.e. not being super dovish, given inflation still remains well above target). Either way, if the Fed fails to quell bank crisis worries, gold and Bitcoin look set up for further gains.

Related Articles

Bitcoin Price Prediction 2023 – 2040 – Business 2 Community

19+ Best Cryptocurrency to Invest In 2023 for 10x Gains

Wall Street Memes (WSM) - Newest Meme Coin

- Community of 1 Million Followers

- Experienced NFT Project Founders

- Listed On OKX

- Staking Rewards