Bitcoin (BTC) has sustained its upward momentum and remained well-bid at approximately the $28,000 level on Friday.

The surge in Bitcoin’s value has also caused an increase in the values of other cryptocurrencies like Ethereum (ETH), Dogecoin (DOGE), Ripple (XRP), Solana (SOL), and Litecoin (LTC).

Numerous factors have contributed to Bitcoin’s upward rally, such as optimistic predictions made by former Coinbase CTO, an increased interest in Bitcoin futures and options, and uncertainty surrounding US banks.

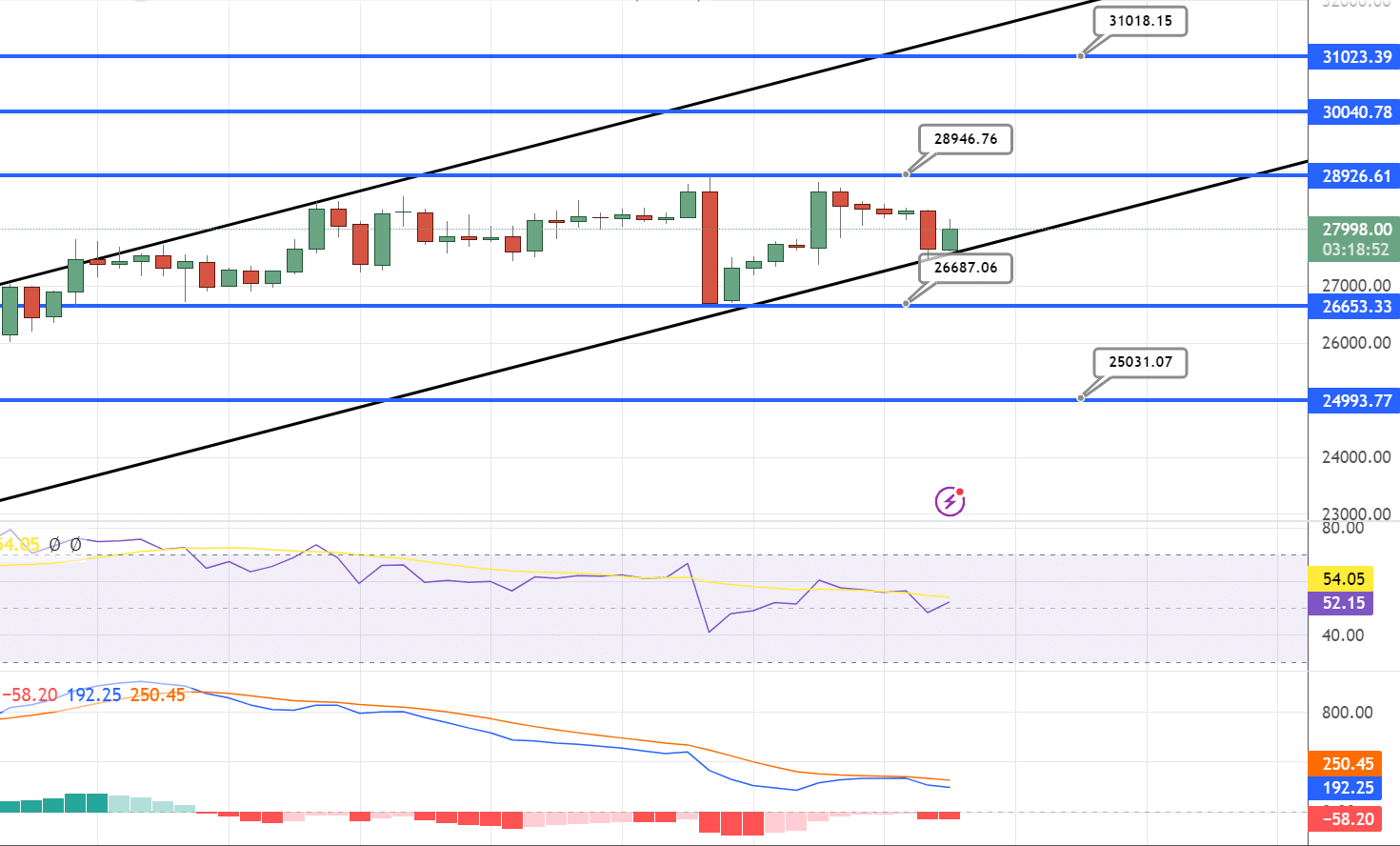

The BTC price analysis shows a positive sign, as the bull has succeeded in pushing the price higher. The BTC/USD has been currently trading above $28,0000 level representing a solid bullish trend. The upside momentum looks strong, and the price will continue to rise if the bulls pic.twitter.com/ff7SHhlMeK

— Chlóe (@stfu_minion) March 24, 2023

The #Crypto market is continuing to heat up, with various projects and tokens gaining traction.

The sentiment in the market appears to be positive overall, as indicated by the discussion around microcaps and the fact that many projects are seeing price pumps.#Bitcoin #NFT— Thomas Scott (@thomasscottweb) March 22, 2023

As traders await the release of Manufacturing and Services PMI statistics, they appear to be hesitant to place significant bids. While Bitcoin temporarily lost some ground following the Federal Reserve’s recent interest rate hike, the declines proved to be short-lived.

The growing interest in digital-asset futures and options has contributed to a resurgence in Bitcoin values once again.

US Econ's Calendar Fri 24/3/23

Durable Goods Orders

8:30 AM ETJames Bullard Speaks

9:30 AM ETPMI Composite Flash

9:45 AM ETBaker Hughes Rig Count

1:00 PM ET— DavMark Fx (@DSniperTrader) March 24, 2023

Bitcoin Price

Bitcoin’s current market price is $28,103, and it has a 24-hour trading volume of $23.5 billion. In the last 24 hours, Bitcoin has increased by 1.50%. As the market leader, Bitcoin’s live market cap now stands at $543 billion.

It has a total quantity of 21,000,000 BTC coins and a circulating supply of 19,326,712 BTC coins.

Coinbase’s Former CTO Bets $1M on Bitcoin Hitting $1M by June 2023

Former Coinbase CTO, Balaji Srinivasan, has recently captured attention by placing a $1 million bet on Bitcoin’s future – specifically, he believes that Bitcoin will reach $1 million by June 17, 2023.

Srinivasan argues that the ongoing devaluation of the US dollar will lead to ‘hyperbitcoinization’, ultimately resulting in Bitcoin becoming the cornerstone of the global economy as a digital gold standard.

Former Coinbase CTO makes $2M bet on Bitcoin’s performance

Balaji Srinivasan has predicted that Bitcoin will reach $1 million within 90 days due to hyperinflation in the United States.$BTC #Bitcoin— Grzegorz Gierek (@gierek_grzegorz) March 20, 2023

Srinivasan’s optimistic forecast has created a buzz in the cryptocurrency community and is considered to be a significant driving force behind the recent rise in BTC prices. His prediction holds weight in the industry, given his reputation as a prominent figure in the cryptocurrency space.

Furthermore, his bold wager has attracted the attention of influential investors, such as Cathie Wood of Ark Invest. It is anticipated that Srinivasan’s bullish prediction will generate greater interest and demand for BTC from investors, ultimately driving up its price.

Ex-Coinbase CTO Makes $2 Mln Bet Predicting BTC’s Price Will Exceed $1m In 90 Days Key Takeaways

Balaji Srinivasan has taken a bet initiated by pseudonymous Twitter user James Medlock on BTC’s price over the next 90 days, predicting the price would reach $1 million by June … pic.twitter.com/K4DX8KVddh

— Web3 Daily (@web3_247) March 19, 2023

Several experts have criticized Srinivasan’s projection, citing an unrealistic hope in a perilous macro environment. Some even believe that he is attempting to manipulate the BTC price or seeking attention for himself and the cryptocurrency.

Nevertheless, Srinivasan’s bullish prediction has sparked renewed excitement and hope in the crypto market after a challenging year in 2022. The impact on BTC’s price remains to be seen, but it has undoubtedly sparked lively debate and interest within the industry.

Cryptocurrency Derivatives Trading Boosts Bitcoin Prices and Attracts New Investors

Another factor that has been driving up BTC prices is the growing interest in cryptocurrency derivatives trading.

This has resulted in an increase in Bitcoin options contracts and open interest, which is regarded as a positive signal for potential new participants.

#Bitcoin Rally Driven By Record Open Interest In Derivatives Market pic.twitter.com/6v5V1q1BSS

— ⚡ Mr. Crypto Giants (@CryptoGiants_) March 22, 2023

The derivatives trading platform, Deribit, has reported an increase in interest, possibly due to instability in traditional financial institutions.

This news is expected to have a positive impact on Bitcoin prices, which have already risen by 22% in the past month and more than 65% since the beginning of the year.

16,000 #BTC inflows Derivatives Exchange in the last few hours

It is the highest peak since March 13 #BTC inside Derivatives can be traded from both sides! Volatility is certain! pic.twitter.com/XGqtrHf4hG

— G a a h (@gaah_im) March 18, 2023

The current bullish trend in the cryptocurrency market is likely to draw the attention of new investors.

Alternatives to Bitcoin

Besides BTC, various altcoins are displaying promising prospects in the market. The B2C team conducted an evaluation and created a roster of the best cryptocurrencies for the year 2023.

See Best Crypto to Invest in 2023

Related News

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops