Bitcoin (BTC) has undergone a turbulent week, with the emergence of BRC-20 tokens bringing swathes of new activity to the network, a temporary Binance withdrawal suspension spooking markets, and rumours of US Government Bitcoin dumping.

With many holders now rushing to move their Bitcoin off exchanges into cold-storage (stoked by fears of further withdrawal suspensions), on-chain data signals a shift into accumulation for Bitcoin.

Markets have been further bolstered by yesterday’s CPI reading, which came in below expected at 4.8%, indicating a turning tide for US economic woes.

Without much fanfare, Tether has started reinvesting some of their profits/excess reserves into Bitcoin. How much have they acquired in Q1, you ask? Just around 52,670. pic.twitter.com/NI3N0oICOz

— girevik (@girevik_) May 10, 2023

Despite a lack of fundamental drivers, trader sentiment is shifting bullish as an accumulation window emerges for big players – could $30k be the next stop?

Find out in this Bitcoin price analysis.

Bitcoin (BTC) Price Analysis

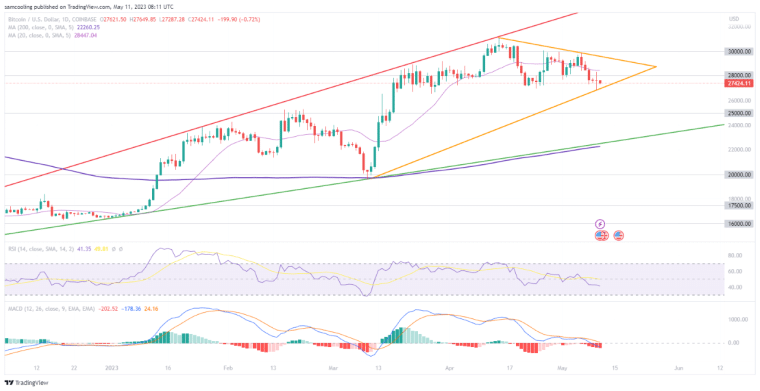

Bitcoin (BTC) is still in consolidatory price action above critical support at $27,000, this comes following a -11% retracement from a local high at $31,093 on April 14.

A double-rejection from topside resistance at $30,000 has sent price reeling lower, for a vital retest of the $27,000 support level.

Now trading at a current price of $27,5XX (representing a 24 hour change of -0.XX%), Bitcoin is down -7% Month-on-Month, while still riding at a +66% Year-to-Date gain.

Looking at technical structure, the loss of poised structure above the MA20 on May 7 (after rejection from resistance testing at $29,850) provides continual reason for concern.

This denotes the gently descending MA20 as a key level to reclaim if rallying structure is to resume.

As for Bitcoin’s main indicators, the RSI has cooled off significantly throughout the consolidation move to an oversold signal at 41 – indicating it could soon be time to push up.

However, the MACD contrasts this with substantial bearish divergence at -208, reflecting the loss of MA20 support.

Bitcoin (BTC) On-Chain Analysis

As for Bitcoin on-chain, the outlook is incredibly bullish with an apparent shift to accumulation sentiment accelerated by the temporary Binance withdrawal suspension, as holders rush to take self-custody of their BTC.

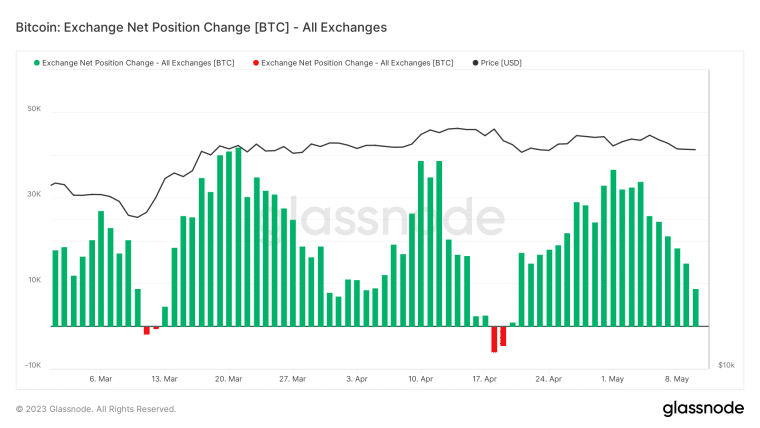

An overall view of Exchange Net Position Change (which assesses the 30d change in exchange supply) depicts a declining 21-day window of net inflow of BTC into exchange wallets.

As daily deposits continue to drop, this indicates a shifting sentiment from distribution to accumulation among holders.

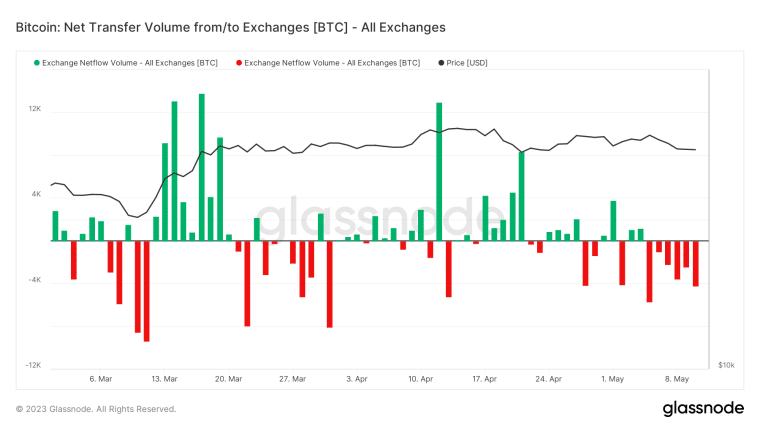

Net Transfer Volume reveals a more accurate picture, depicting the emerging accumulation window in full-form – with 6 days of net outflow of BTC to cold storage dominating exchange volumes.

Indeed, over the past 6 days – 19,234 BTC (worth around $520m) has moved out of exchange wallets – suggesting increasingly optimistic holders have no immediate intention of a sell-off.

And this is further reflected in the number of ‘wholecoiner’ wallets (addresses with >1 BTC), which continues to steadily increase in 2023 – now standing at 998,794 addresses – a +0.47% Month-on-Month gain.

This is a clear sign bigger fish are in accumulation.

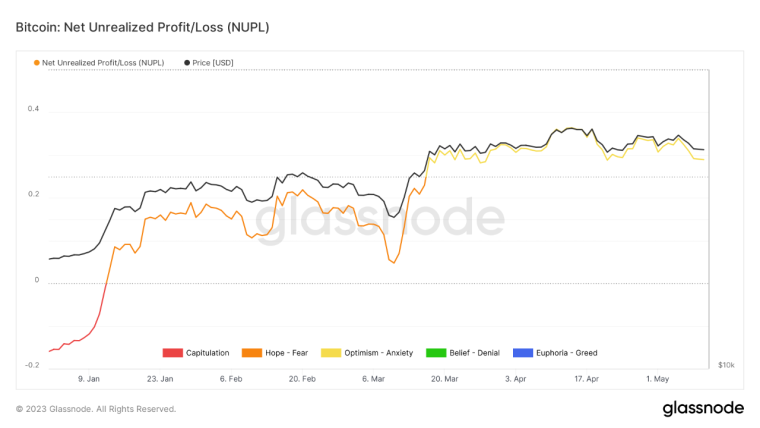

Net Unrealized Profit Loss provides some explanation, with more holders in profit than loss at 0.289.

This bullish optimistic-anxiety comes following a deep period of capitulative price action following the FTX collapse, and historical data suggests that NUPL is unlikely to return to hope-fear, which further confirms the belief that $25k is the new lower support level in the pre-halving run up.

Bitcoin (BTC) Open Interest Levels

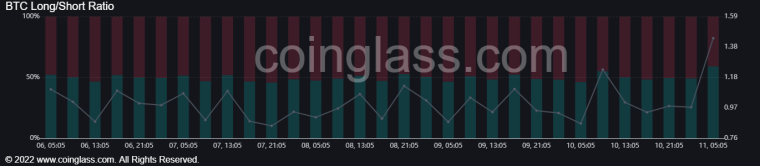

As for Open Interest, there is a clear bullish sentiment among traders as the majority lean long.

Across all exchanges there is currently $11.21bn on the table at derivatives markets, with a slight drop off last night as downside price action saw $756m removed from play.

Further clarification from the Long vs Short ratio reveals the extent of bullish sentiment at 1.44 – with a whopping 59% of traders holding long positions.

This could create the opportunity for market makers to push price down to $27,000 to flush out over-extended long and hunt stop-loss positions.

Bitcoin (BTC) Price Prediction (Short-Time Frame)

With markets on the edge, awaiting a decisive move from Bitcoin, on the immediate short-time frame (STF) Bitcoin looks to be poised for upside action.

Bitcoin’s STF upside target sits with the reclamation of the MA20 at $28,600 (a possible +4.42% move).

While downside risk on the STF is very limited, with a possible retest of support at $27,000 (a minimal -1.42% move) representing minimal risk.

This leaves Bitcoin’s STF Risk: Reward ratio at 3.1 – a great entry characterised by triple reward to risk.

Bitcoin (BTC) Price Prediction (Long-Time Frame)

Looking to the future, on the long-time frame (LTF) the source of market uncertainty is revealed as Bitcoin faces a decisive choice between $25,000 and $30,000.

An upside target at $30,000 could see Bitcoin climb as much as +9.5%.

However, downside risk is more significant – a breakdown from $27,000 would see BTC technical structure collapse to $25,000 (a -8.7% move).

Overall, this leaves Bitcoin with a LTF Risk: Reward at 1.09 – a mediocre entry, with marginally more reward than risk.

The Future of Bitcoin Looks Bright

Bitcoin has had a turbulent week, but signs point to a bullish shift.

With many moving their BTC to cold storage, on-chain data shows an accumulation trend. Despite market fluctuations, trader sentiment is turning positive, hinting at a potential rise to $30k.

Our recommendation: Protect your Bitcoin investments in the long term with Best Wallet, Business2Community’s top choice for security and usability.

Love Hate Inu - Next Big Meme Coin

- First Web3 Vote to Earn Platform

- Latest Meme Coin to List on OKX

- Staking Rewards

- Vote on Current Topics and Earn $LHINU Tokens