As Bitcoin markets look forward to the release of the Federal Open Market Committee’s (FOMC) meeting minutes this afternoon, the atmosphere is one of anticipation, mixed with a bit of worry. Will the gloomy month of May take an unexpected turn? Or is the market set for another round of financial ups and downs? Discover more in the Bitcoin price prediction.

One thing is certain, this financial litmus test could shape the very contours of Bitcoin’s monetary landscape in the coming months.

Last month, the FOMC threw a curveball into Bitcoin markets, hiking the federal funds rate by 25 basis points, stirring up an already tempestuous market.

With speculation rife about whether they’ll hit the pause button this time around, the stage is set for a high-stakes faceoff between the bulls and the bears.

Economic oracles, Bitcoin enthusiasts, and high-risk traders are scanning for clues buried within the Fed’s previous cryptic communications.

even though the low timeframes look good, the higher timeframes still look quite heavy.

cant help but feel this ends up resolving as some kind of higher timeframe bear flag on #btc and $eth.

will be keeping a very keen eye on 28.2-28.3k region, that is where id be watching for… pic.twitter.com/p3FZr5d5K5

— Bluntz (@Bluntz_Capital) May 23, 2023

Will they pause rate hikes, offering Bitcoin a lifeline, or will they double down on the rate hike, further exacerbating the market’s volatility?

The US Dollar Index’s bullish ascent is also adding to the tension.

If the FOMC minutes reflect a pessimistic outlook and the index plummets, Bitcoin might bear the brunt of the fallout.

However, as any seasoned crypto-enthusiast will tell you, where there’s volatility, there’s opportunity.

Despite the turbulence, one surprising trend emerges: Bitcoin’s HODLing spirit is stronger than ever, with Glassnode data showing 68% of BTC is being held for at least a year.

Could this signal a new bullish cycle on the horizon? Could the HODLers’ steadfastness spark a much-awaited mini-supply squeeze?

Hang tight! We’ll dive deeper into these market mysteries and pull back the curtain on the FOMC’s impact in the latest Bitcoin Price Prediction.

Bitcoin Technical Analysis:

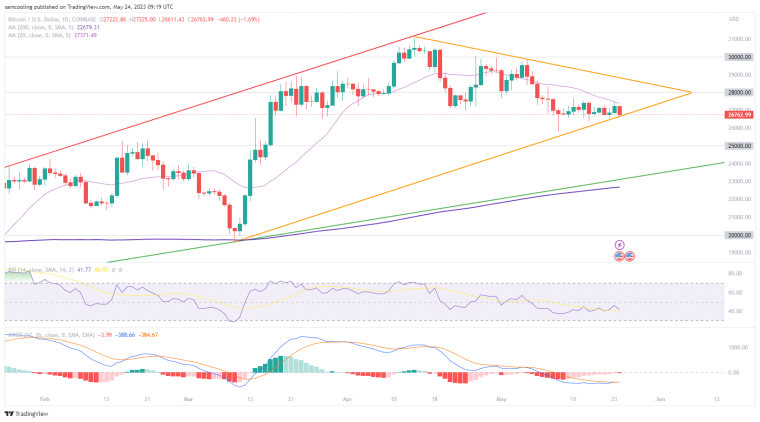

Bitcoin (BTC) remains caught in a tight ranging pattern as bulls fight with desperation to hold support above $26,750 despite tough local resistance from the MA20.

This morning Bitcoin is trading at $26,762 (a 24 hour change of -1.69%) ahead of the foreboding FOMC minutes later today.

Despite a minimal loss of -4.57% month-on-month, Bitcoin is facing tough technical structure following a double-top rejection from $30,000 at the beginning of May.

While the current support level (above $26,750) has been well-defended, BTC has failed to post a higher high for two weeks.

When coupled with the suffocating suppression of local resistance from the steadily descending MA20 – things could get ugly soon.

However, oscillators provide some silver lining, Bitcoin’s RSI remains at an oversold signal at 41 – although it has struggled to cool off significantly throughout the tight ranging pattern.

This could indicate a need to push down further, although the capacity certainly remains for an upside swing.

The MACD further cements the increasingly bearish outlook at -3.94 – with momentum stalling as BTC fails to break above the MA20.

Bitcoin On-Chain Analysis: Accumulation Could Reverse

As markets brace for the impact of FOMC later today, a look on-chain can reveal holder positioning ahead of the critical economic data release.

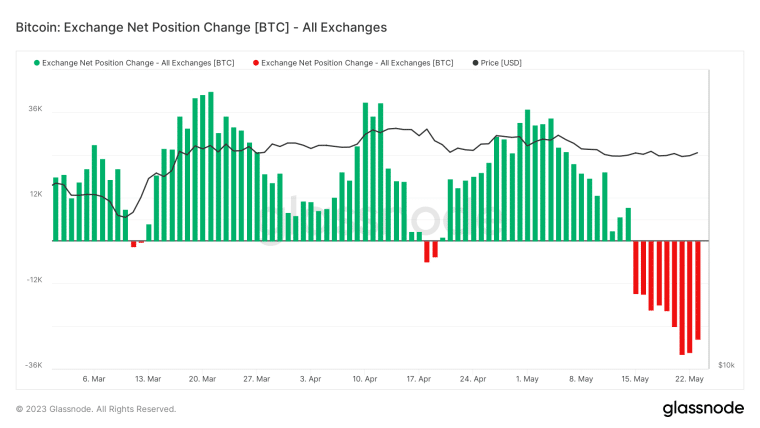

Initially looking at the Exchange Net Position Change (a measure of 30D average) illuminates a 9 day Bitcoin accumulation window, characterised by significant outflows of BTC into cold-storage.

This comes trailing significant distribution periods throughout March and April, providing some relief amid two-months of ranging price action.

However, three sequential days of declining outflows on the 30D average warrant a closer examination.

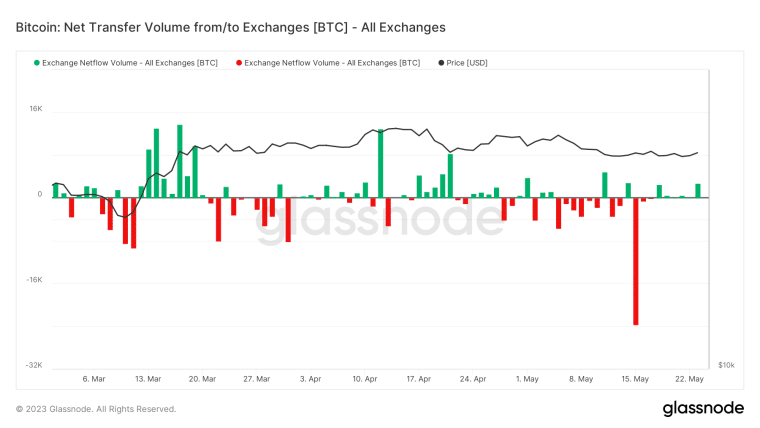

This leads to Net Transfer Volume from/to Exchanges, which provides a day-to-day insight into coin movements.

Curiously, this chart highlights that despite the ostensible image of a large accumulation window – the past five days have actually been characterised by small Net inflow into exchange wallets.

The significant accumulation window across a 30D average seems to have been skewed by a seismic outflow on May 15 which saw -23,661 BTC flood out into wallets (valued at $643m).

Despite this major outflow, over the past five days +5,677 BTC has dominated NetFlow (valued at $154m), this could suggest a growing reversal from accumulation to distribution as markets brace for a downturn due to macroeconomic turbulence.

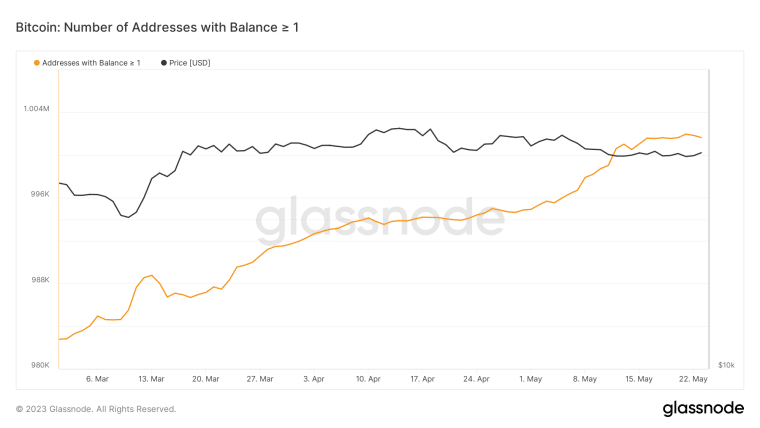

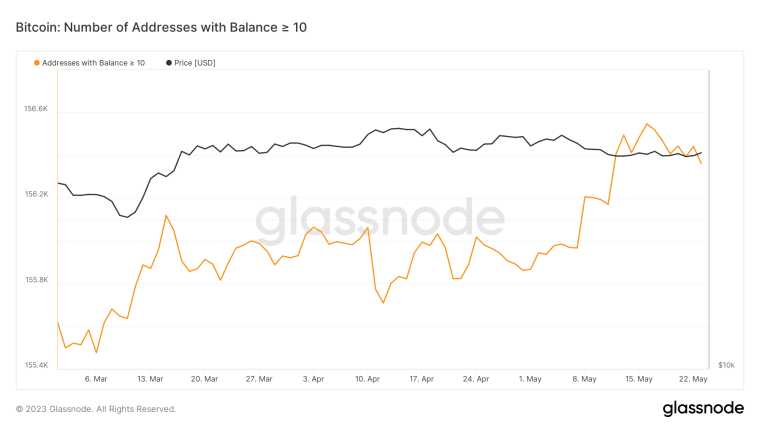

Further insight into this potential emerging reversal comes from an examination of changes in the number of addresses containing different quantities of Bitcoin.

Looking at so-called ‘whole coiner’ wallets (those containing > 1 BTC) depicts a steady increase on-chain – recently breaking a whopping 1 million wallets containing a whole Bitcoin.

However, despite the impressive growth of +6,719 whole coiner wallets over the course of May – these are still retail level holdings and don’t provide a picture of the big actors in the marketspace.

A look at bigger wallets (in this instance those containing > 10 BTC), an entirely different picture materialises – with an image of declining addresses since May 15.

Indeed, over the past 10 days 185 whales have reduced their stacks below this threshold – indicating that big holders of Bitcoin are in distribution now, not accumulation.

This suggests that whales are anticipating downside price action on the short-time frame, with big traders taking profit to buy-in at a cheaper price in the future.

Overall then, Bitcoin on-chain analysis reveals that despite an ostensible picture of accumulation – there is a growing reversal to in-flows predominantly driven by whales not retail holders.

This could indicate tough price action on the horizon, reflected in an increasingly bearish Bitcoin price prediction.

Bitcoin Open Interest Analysis: Market Leans Long

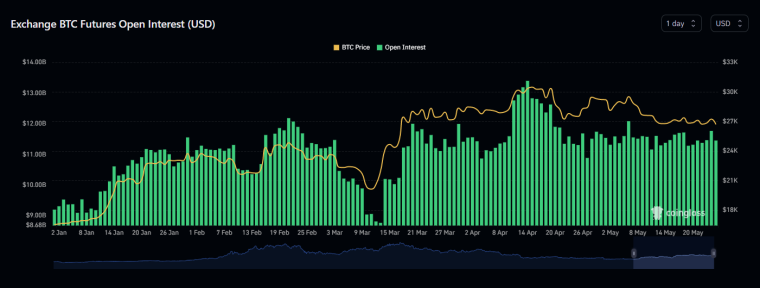

As for the behaviour of Bitcoin traders, open interest provides insight into active derivatives contracts across the marketplace – illuminating trader sentiment.

Across all exchanges, BTC open interest is holding stable at levels comparable to the past month with a slight downtick last night erasing $320m in exposed longs.

Now sitting at $11.45Bn on the table, current open interest levels provide little cause for concern – with no significant build-up to attract the wrath of whales or market makers.

This could be explained by the upcoming FOMC minutes later today, PCE numbers on Friday, and the growing anxiety about a potential US debt default on June 1 – with traders unsure of the knock on impacts.

While economic woes in the US would likely prove bullish for BTC in the long-term, the initial shock and inertia of troubled performance could fuel a panic dump – creating a dangerous paradigm to trade against.

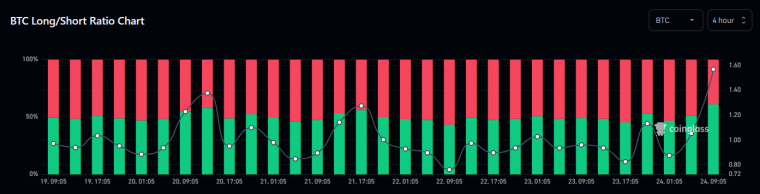

Of the $11.45Bn in open interest, trader sentiment seems to be leaning decidedly long – with the long short ratio at a divergent 1.56 (as 61% of traders assume taker buy positioning).

This is a significant divergence, and indicates market sentiment is firmly to the upside on the short-time frame – however, this could create an opportunity for a lucrative play by whales (which have shifted to distribution on-chain).

Bitcoin Price Prediction: All Eyes on FOMC

As markets sit on edge, patiently awaiting the latest US economic data, Bitcoin’s outlook seems increasingly bearish.

With technical structure pushing towards a depressive move to the downside, bulls are facing a make-or-break moment.

As whales shift to distribution on-chain, and open interest sits vulnerably long – a downside move seems likely.

However, with markets today trading on FOMC – short-time price action likely lives or dies by the comments of the Federal Reserve (expected at 14:00 ET) with further data from the PCE on Friday (8:30 AM ET).

If Bitcoin is able to push up above the MA20 resistance, price action will likely target historic local support level at $27,775 (a +3.58% upside swing).

However, if bearish concerns outlined in this article come to fruition, then downside could see price plummet to $25,000 (a -6.77% move).

This leaves the Bitcoin price prediction with a Risk: Reward ratio of 0.53 – almost double the downside risk.

Stay tuned to Business2Community for the latest crypto price analysis.

RELATED:

Love Hate Inu - Next Big Meme Coin

- First Web3 Vote to Earn Platform

- Latest Meme Coin to List on OKX

- Staking Rewards

- Vote on Current Topics and Earn $LHINU Tokens