The world’s largest asset management firm, BlackRock, has issued a warning on the proliferation of crypto investment scams across social media and the internet that is specifically targeting investors who may be interested in exchange-traded funds (ETFs) linked to digital assets.

According to an X post, the US-based financial giant, which oversees over $10 trillion in assets for investors, has seen a spike in this kind of fraudulent schemes and is cautioning investors to avoid falling prey to these bad actors.

In their July 29 post, they mentioned that scammers are typically resorting to social media platforms like X or instant messaging apps like Telegram and WhatsApp to lure investors.

There has been a spike in investment-related scams, including directing users toward crypto investment-related websites and/or social media platforms such as WhatsApp or Telegram. We urge caution in dealing with individuals, websites or social media platforms using our brand and…

— BlackRock (@BlackRock) July 28, 2024

“We urge caution in dealing with individuals, websites, or social media platforms using our brand and offering training or investments,” the statement reads. The company stressed that neither BlackRock nor its executives ever contact individuals through social media platforms with investment offerings or to solicit payments.

These bad actors typically try to impersonate BlackRock employees and executives by offering products that generate high yields. Some of the most common techniques spotted by BlackRock include offering training sessions on stock or crypto trading, groups where trading signals are shared, or the use of fake websites to steal people’s access credentials to trading platforms.

BlackRock Has Gone from Skeptic to the Most Successful Crypto ETF Provider

BlackRock has become one of the most successful providers of crypto-linked exchange-traded funds (ETFs) following the launch of the iShares Bitcoin Trust (IBIT) in January. The company has reportedly amassed over $23 billion in assets and it has also joined the group of firms that recently launched an ETH-linked spot ETF.

According to Robert Mitchnick, head of digital assets at the asset management giant, investors could progressively allocate around 20% of the funds they intend to invest in the crypto market to Ether (ETH). He stressed that the company is seeing much less interest in other digital assets aside from the latter and Bitcoin (BTC).

BlackRock moved from antagonizing BTC to becoming a powerhouse providing access to this digital asset to thousands of investors through its iShares funds. The financial firm’s Chief Executive Officer, Larry Fink, changed his perspective on BTC recently and now deems the asset as “digital gold”.

In a recent interview, he highlighted the benefits of investing in BTC and cited its relatively low correlation with other financial assets as one of its main appeals.

“It is a legitimate financial instrument that allows you to maybe have uncorrelated type of returns. I believe it is an instrument that you invest in when you’re more frightened, though,” the financial executive argued.

He also emphasized that BTC could serve as a reserve asset in countries with poor macroeconomics and that face constant devaluations of their currency as is the case of places like Argentina, Venezuela, and many African nations. It could provide many of the same benefits of keeping the USD as a reserve currency, without the downsides (like the potential for devastating sanctions).

BlackRock has stated that they have been taking legal action against the owners of fake websites and social media accounts that have tried to impersonate the company or its officials to defraud investors.

In December last year, a notable incident involving the submission of an application for an XRP-linked ETF called the “BlackRock iShares XRP Trust” triggered a rally in the price of this digital asset and forced the asset management company to issue a statement to clarify the situation.

Crypto Losses on the Rise in the United States

Artificial intelligence has made it more difficult for consumers to identify crypto scams as fraudsters have been relying on ‘deepfakes’ to create videos that depict executives and highly credible figures in the financial industry that they use to trick investors into buying certain assets or handing out their personal data.

BlackRock’s warning comes out just months after the Federal Bureau of Investigation (FBI) revealed that crypto scams caused losses exceeding $4 billion last year in the United States alone.

This resulted in a 53% increase in the amount lost by investors compared to the previous year. Moreover, crypto scams account for the largest percentage of investment frauds committed in the country in terms of total loss, which highlights how this nascent industry continues to be a high-priority target for criminals.

“Fraudsters are increasingly using custodial accounts held at financial institutions for cryptocurrency exchanges or third-party payment processors, or having targeted individuals send funds directly to these platforms where funds are quickly dispersed,” the FBI report noted.

Hackers Siphoned $500M from Crypto Protocol in First Half of 2024

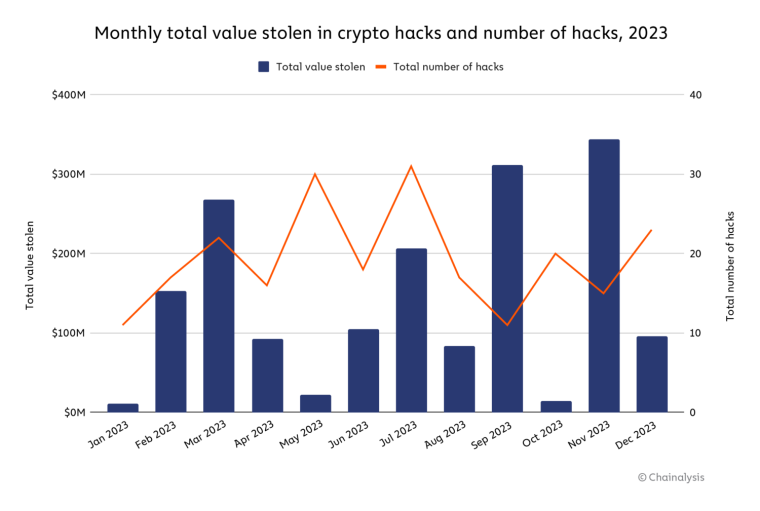

Cybersecurity incidents affecting blockchain applications have also kept plaguing the industry. According to Immunefi, a platform that offers bounties to developers for spotting bugs among crypto protocols, bad actors siphoned over $500 million from these projects during the first quarter of 2024. This represents a 91% increase compared to the same period a year ago.

Meanwhile, the Better Business Bureau (BBB) released a report this year as well where they revealed that 80% of Americans lost money on crypto or investment scams last year. According to their findings, the average loss per victim was $3,800. However, many of the respondents said that they lost much more.

The most frequent means used to defraud these victims included social media platforms, video games, and text messages. The report covered a total of 67,000 investors from the US who responded to several questions about their investment experiences in 2023.

Protect Yourself: Recommendations and Best Practices to Avoid Being Scammed

Considering the rapid and dangerous proliferation of crypto scams, investors should take precautions and follow the recommendations of experts to protect their assets and personal data.

It is important to verify the authenticity of any person who is claiming to represent a financial institution like BlackRock by either contacting the company directly to check or making sure the communications are coming from official channels like corporate emails.

Unsolicited contacts are very rare in the financial industry, especially when it comes to offering access to investment products or prompting users to provide their access credentials. Hence, investors should be cautious not to initiate conversations with unknown characters through social media as these are not the typical channels used by these firms to contact their clients.

BlackRock’s official products can be easily found on the company’s website. Most of them offer average returns that are similar to those offered by other reputable players in the asset management industry. Investors should stay away from being swayed by products that offer returns that are significantly higher than the industry’s average.

Finally, staying informed about the latest trends in crypto scams and fraud prevention techniques is helpful to avoid falling prey to sophisticated new techniques. The pace at which technological developments are advancing – i.e. artificial intelligence and augmented reality – is also used by criminals to come up with more elaborate schemes.

Staying Safe in a Rapidly-Evolving Crypto Landscape

As digital assets are increasingly and rapidly attracting more mainstream investors, the risks involved are rising in tandem. BlackRock’s warning should not be ignored as it comes from a highly reputed institution that has ample experience and experts who keep tabs on these trends.

As exchange-traded funds (ETFs) become a popular option to invest in cryptocurrencies, it is worth noting that the best way to buy them is through your traditional brokerage firm. These funds offer their shares in the open market and they can be bought as regular stocks. There is no need to go through a third party to get access to them nor this is a usual practice.

Staying informed, verifying all of the information provided by issuers, and approaching investment opportunities with a critical eye, are timeless recommendations that help investors to better navigate the complex and rapidly changing world of cryptocurrency investments.