According to Mizuho, Japan’s third-largest financial services company, Bitcoin transactions account for a small portion of total revenue, while they appear to consume excessive management time and attention.

Mizuho analyst Dan Dolev downgraded Square’s parent company, claiming that Block SQ officials focused too much on the wrong things. Andrew Bauch, an analyst at SMBC Nikko Securities America, downgraded the company the day before, and Dolev’s demotion follows in his footsteps.

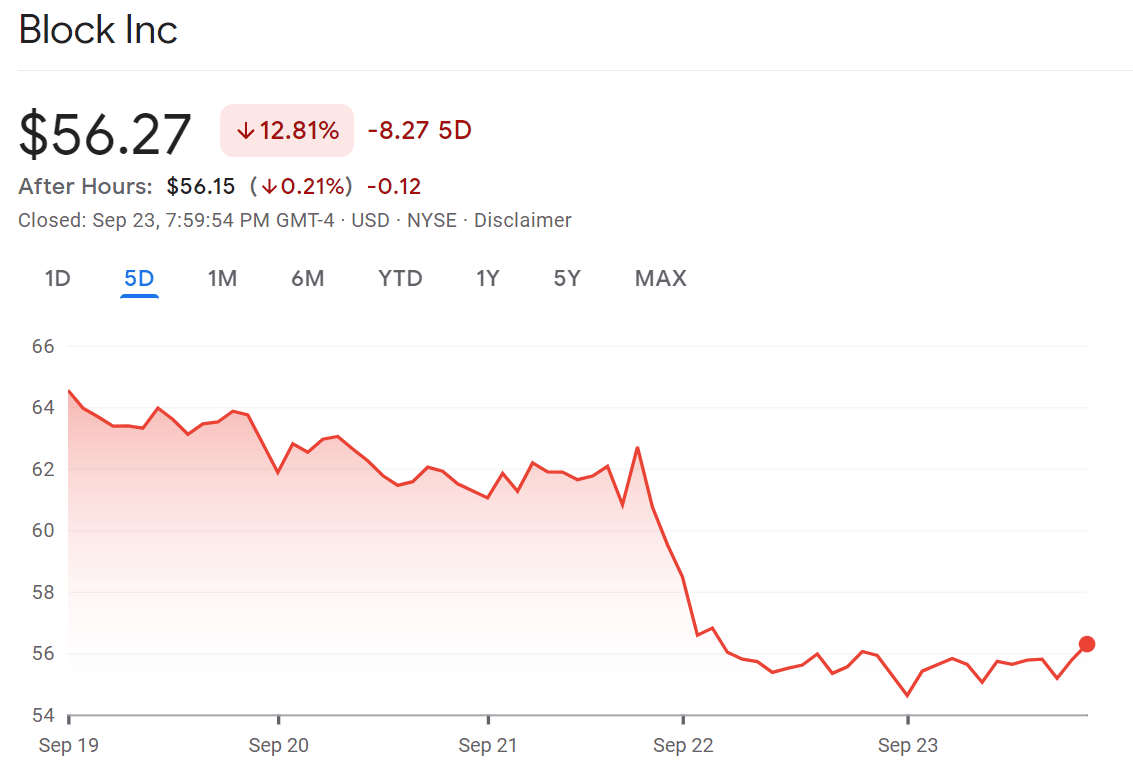

Block SQ Stock Is Downgraded

Bauch states that investors can overlook “second derivative” details of the company’s bitcoin trading, like how the cryptocurrency aspect impacts inflows. Dan Dolev has changed his rating on Block from buy to neutral and reduced his price target from $125 to $57, suggesting that the stock is fully valued, with shares going for over $56.

$SQ Mizuho analyst Dan Dolev downgraded Block to Neutral from Buy with a price target of $57, down from $125. @Crussian17

— akhenaton (@akhentravel) September 22, 2022

Dolev stated that “user fatigue, plateauing inflows, and the loss of the best-of-breed” point-of-sale company are the reasons he is less optimistic about Block’s development. He also chastised Block for employing “misexecution” in the buy now, pay later initiatives.

Dolev noted that Block still has enormous potential that is not being realized, which is why he no longer believes the firm warrants a high price target and valuation.

Why Are Shares Being Downgraded?

Mizuho Investment Bank downgraded Block (SQ), the payments firm led by Twitter co-founder and cryptocurrency supporter Jack Dorsey, from buy to neutral, citing “customer fatigue” and management’s focus on bitcoin (BTC).

According to analyst Dan Dolev’s note to clients, Cash App’s penetration among Americans aged 18 to 45 is expected to increase by 500 basis points in 2022, less than the 800-900 basis points observed annually over the previous three years.

It's another downgrade for Block, with Mizuho's formerly bullish Dan Dolev not a fan of management's fixation on #bitcoin. $SQ

@mikeybellusci reportshttps://t.co/Rr2NyofpeY

— CoinDesk (@CoinDesk) September 22, 2022

Furthermore, Dolev noted that, despite accounting for only about 5% of gross earnings in the first half of 2022, bitcoin occupied a larger portion of management’s attention. He stated that Block’s focus on bitcoin harmed the company’s stock performance and diverted attention away from the company’s other important platforms.

He said that Block gained from the rise in bitcoin prices. When a Cash App user sold bitcoin, it might have brought money into the app, which they could use in different ways. He thinks that the opposite is happening now that the price of bitcoin is almost 70% lower than its peak.

Block Stock Price Under Pressure

Shares of Block Inc, formerly known as Square, were trading above $200 per share in June 2021. However, its stock has suffered greatly this year, falling more than 65%. Block’s most recent quarterly financial report revealed a net loss of approximately $208 million, compared to a profit of $204 million in the second quarter of 2021.

Although gross payment volume increased by about $10 billion over the previous year, it fell short of experts’ expectations. Block’s stock fell 5.92% in morning trade and 64% this year. They closed at $59.45 on September 22 and are now trading at $55.93.

Related news:

- Best CFD Brokers of 2022 Reviewed

- Best Beginner Crypto to Invest in 2025

- Best Cryptocurrency to Invest in 2025 – Which is the Best Crypto to Buy Now?

Tamadoge - The Play to Earn Dogecoin

- '10x - 50x Potential' - CNBC Report

- Deflationary, Low Supply - 2 Billion

- Listed on Bybit, OKX, Bitmart, LBank, MEXC, Uniswap

- Move to Earn, Metaverse Integration on Roadmap

- NFT Doge Pets - Potential for Mass Adoption