In a world-changing move to harness the power of blockchain technology and digital assets, the Bank for International Settlements (BIS) has teamed up with seven major central banks to launch a groundbreaking initiative known as Project Agorá.

The goal of this ambitious project is to explore how the tokenization of central bank money and commercial bank deposits can enhance the functioning of the global monetary system and address the longstanding inefficiencies of cross-border payments.

The move follows explosive decisions from Blackrock to tokenize trillions of dollars of real world assets on the blockchain.

Project Agorá by BIS and Central Banks

- Purpose and Participants: The Bank for International Settlements (BIS) has partnered with seven central banks, including those from France, Japan, and the US, to launch Project Agorá. The initiative aims to explore how tokenization of central bank and commercial bank money can improve cross-border payments.

- Tokenization and Blockchain: Tokenization leverages blockchain technology to enable seamless ownership and transfer of assets, potentially making cross-border transactions faster and more cost-effective. Project Agorá explores integrating tokenized commercial bank deposits with central bank digital currencies (CBDCs).

- Smart Contracts Focus: A key element of the project is the use of smart contracts to automate compliance checks and settlement processes, aiming to streamline complex international transactions .

- Potential Implications: Successful implementation could transform the global payment system, making it more efficient while addressing longstanding inefficiencies in cross-border payments. The BIS sees this as a step towards a more inclusive financial infrastructure .

Defining Tokenization and Its Benefits

Tokenization uses blockchain technology to create proof of ownership over any kind of real-world assets (RWA) like real estate or commodities and facilitate the transfer of these assets.

Moving money and assets from one country to another has always been challenging and costly for both individuals and organizations. With tokenization, central banks are exploring a new way that facilitate these operations by improving settlement times and democratizing access to investment opportunities.

Project Agorá represents a concerted effort to harness the power of blockchain technology to transform the way cross-border payments are made.

Participating Entities Include Seven Central Banks and Various Private Companies

Project Agorá brings together the central banks of France (representing the Eurosystem), Japan, South Korea, Mexico, Switzerland, the United Kingdom, and the Federal Reserve Bank of New York.

This diverse group of monetary authorities will work in partnership with a large contingent of private financial firms convened by the Institute of International Finance (IIF) to develop a blockchain-based network where tokenized access can be seamlessly traded.

The BIS, which serves as the central bank for central banks, will act as the coordinator and facilitator of this collaborative initiative.

Cecilia Skingsley, Head of the BIS Innovation Hub, explains: “We will not just test the technology, we will test it within the specific operational, regulatory, and legal conditions of the participating currencies, together with financial companies operating in them”.

Addressing the Inefficiencies in Cross-Border Payments with Tokenization

The primary goal of Project Agorá is to overcome the structural inefficiencies that plague the current cross-border payment system. These inefficiencies stem from a myriad of factors, including:

- Differences in Legal, Regulatory, and Technical Requirements: The varying legal, regulatory, and technical frameworks across different jurisdictions add complexity and barriers to seamless international transactions.

- Disparate Operating Hours and Time Zones: The lack of harmonized operating hours and time zones between financial institutions and payment systems creates delays and complications in the settlement process.

- Increased Financial Integrity Controls: The need to comply with anti-money laundering (AML) and know-your-customer (KYC) regulations often leads to redundant verification processes, as each intermediary involved in a transaction must perform their own checks.

By leveraging the power of tokenization and smart contracts, Project Agorá aims to streamline these processes and create a more efficient, secure, and cost-effective cross-border payment infrastructure.

BIS Vision: Integrating Tokenized Commercial Bank Deposits and Central Bank Money

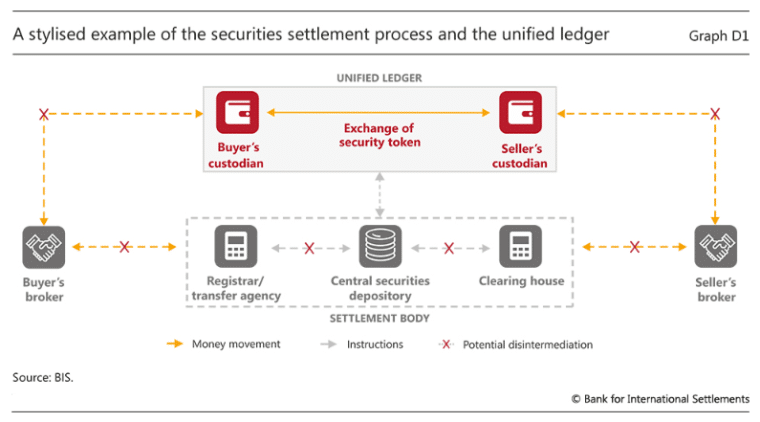

At the core of Project Agorá is the exploration of how tokenized commercial bank deposits can be seamlessly integrated with tokenized wholesale central bank money. This integration within a public-private programmable platform could enhance the overall functioning of the monetary system and unlock new functionalities through the use of smart contracts.

Also read: BlackRock’s $10 Trillion Leap into Ethereum: A New Era for Asset Tokenization Via BUIDL

Hyun Song Shin, BIS Economic Adviser and Head of Research, explains the potential benefits:

“Tokenization combines the record-keeping function of a traditional database with the rules and logic that govern transfers. With Project Agorá, we aim to improve existing capabilities and enable new ones, all based on the proven foundations of the two-tier monetary system with central banks at the core.”

He adds: “These functionalities will come without sacrificing the safeguards on the integrity and governance of the monetary system.”

Smart Contracts are at the Center of Project Agorá

One of the key features of Project Agorá is the exploration of how smart contracts and programmability can enhance the monetary system. Smart contracts are self-executing digital agreements that automatically trigger actions based on predefined conditions. They have the potential to revolutionize the way financial transactions are settled.

Through the integration of smart contracts, Project Agorá seeks to unlock new functionalities and enable transactions that were previously impractical or impossible.

This could result in faster settlement times, automated compliance checks, and the ability to bundle multiple transactions into a single package to reduce costs.

Cecilia Skingsley, Head of the BIS Innovation Hub, elaborates on this vision:

“Today, numerous payment systems, accounting ledgers and data registries require other complex systems to integrate them. In Project Agorá, we want to explore a new common payment infrastructure that could bring all these elements together and might make the system work more efficiently together on a digital core financial infrastructure.”

Bringing Together the Public and Private Sectors to Create a Seamless Cross-Border Payments Platform

The BIS, central banks and private sector are embarking on Project Agorá to explore #Tokenisation of cross-border payments @banquedefrance @Bank_of_Japan_e @bok_hub @Banxico @SNB_BNS @bankofengland @NewYorkFed https://t.co/mDFKBqNCqc pic.twitter.com/Rtbnqnk8cl

— Bank for International Settlements (@BIS_org) April 5, 2024

Project Agorá is a collaborative effort that brings together the public and private sectors to tackle the challenges of cross-border payments. The participation of central banks, representing the public sector along with a diverse group of financial institutions aims to create a comprehensive and balanced approach to the project.

By involving both these monetary authorities and private financial firms, Project Agorá can leverage the unique strengths and perspectives of each stakeholder group. Central banks can provide the foundational trust and stability of the monetary system while private sector participants can contribute their expertise in financial services, technology, and innovation.

This public-private partnership is crucial to ensure that the solutions developed within Project Agorá are not only technologically feasible but also operationally viable, regulatory compliant, and aligned with the broader goals of most central banks, which include financial stability and integrity.

Expanding the Scope of Central Bank Digital Currencies (CBDCs)

While the concept of central bank digital currencies (CBDCs) has gained significant traction in recent years, Project Agorá represents a broader exploration of how digital assets can be integrated into the monetary system.

Rather than focusing solely on CBDCs, the initiative will investigate the seamless integration of tokenized commercial bank deposits with tokenized wholesale central bank money. This approach recognizes the important role that both central bank and commercial bank money play in the functioning of the financial system.

Also read: 14 Best Crypto Wallets for Secure Transactions in 2024

By considering the interoperability and complementary nature of these digital assets, Project Agorá aims to create a more comprehensive and resilient monetary infrastructure that can better serve the needs of businesses and individuals engaged in cross-border transactions.

Overcoming Regulatory and Technical Hurdles of Tokenization

As with any significant innovation in the financial industry, Project Agorá will likely face a number of regulatory and technical challenges that need to be addressed.

The project’s success will depend on the ability of the participating central banks and private sector entities to navigate these hurdles effectively.

Some of the key issues to tackle include:

- Regulatory Alignment: Ensuring that the tokenization and smart contract frameworks developed within Project Agorá are aligned with the evolving regulatory landscape across many jurisdictions.

- Cybersecurity and Data Privacy: Addressing the security and privacy concerns inherent to the use of blockchain technology and digital assets.

- Interoperability and Scalability: Designing a system that can seamlessly integrate with existing financial infrastructure and accommodate the high transaction volumes and throughput required to support global payments.

- Governance and Risk Management: Establishing robust governance structures and risk management protocols to maintain the stability and integrity of the monetary system.

The BIS and the participating central banks have acknowledged these challenges and are committed to thoroughly test the technology and its compliance within the specific operational, regulatory, and legal conditions of the countries and financial institutions involved in the project.

Broader Implications and Outlook on the Adoption of Project Agorá’s Solution

The success of Project Agorá could no doubt have far-reaching implications for the global financial system.

By demonstrating the viability and benefits of tokenizing central bank money and commercial bank deposits, the initiative could pave the way for wider adoption of these technologies in cross-border payments and beyond.

The potential benefits of such a system are substantial, including faster settlement times, reduced transaction costs, increased transparency, and much improved financial inclusion. These benefits could have a significant impact on international trade, investing, and economic development, helping to boost the global economy while reducing inefficiencies.

Moreover, the lessons learned and the frameworks developed within Project Agorá could serve as a reference point for other central banks and financial institutions around the world that are exploring similar initiatives.

This collaborative approach could help establish common standards and best practices, promoting interoperability and further enhancing the global financial infrastructure.

Project Agorá represents a landmark initiative in the evolution of the global monetary system.

Through the power of tokenization, smart contracts, and public-private collaboration, the BIS and the participating central banks are taking a bold step towards reimagining the way cross-border payments are conducted.