The crypto market is experiencing some volatility ahead of the most important electoral event in the United States for this year – the Presidential election.

Volatility indicators are reaching levels not seen in months as market participants are keeping an eye on how the tight race between the two contenders – Kamala Harris and Donald Trump – unfolds.

The Bitcoin Implied Volatility Index (DVOL) from Deribit has experienced a 63% increase in the past 12 months and has reached its highest level since July this year.

Also read: What Would a Kamala Harris Presidency Mean For Crypto?

Meanwhile, the 7-day implied volatility has jumped by 74.4% on an annualized basis while the realized volatility is standing at 41.4%. The significant difference between these two metrics implies that traders are preparing for large price swings that would occur around the day that the election takes place.

In addition, traditional markets are also experiencing some turmoil. For example, the implied volatility of Treasury notes has reached 135% – a percentage not seen since October 2023. In a similar fashion, the all-important EUR/USD forex pair has seen its one-week implied volatility rise to its highest levels since March 2023 when the US banking sector experienced a minor crisis.

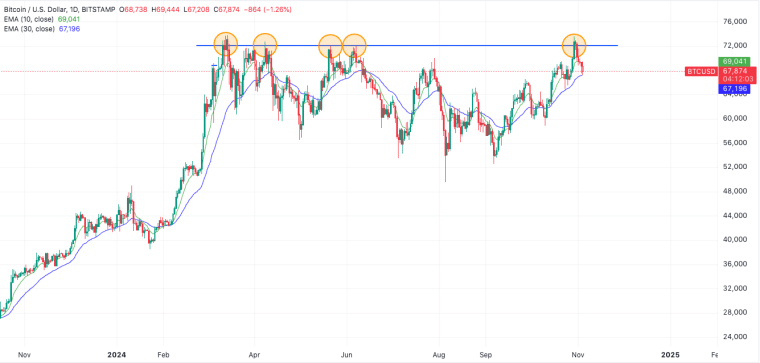

Bitcoin (BTC) Books Heavy Losses After Technical Double-Top

The price action of Bitcoin has also been quite volatile lately. Last week, it surged near its recent all-time highs at $73,600 and then collapsed to its current level of around $68,000 for a 7.6% drop in less than 7 days.

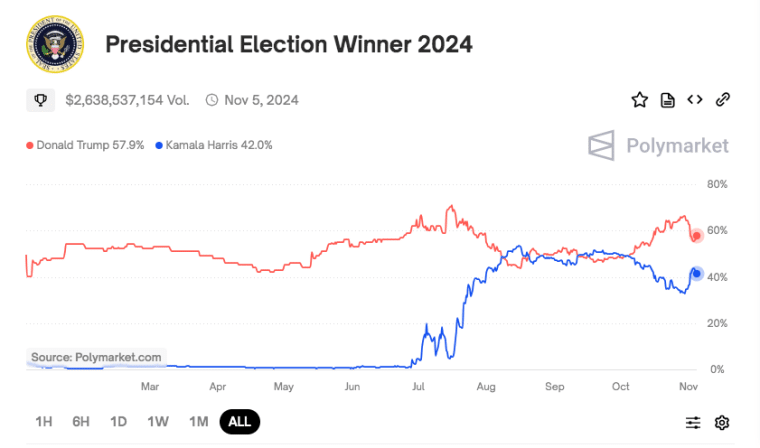

This movement coincides with a change in the perception of bettors as the odds of a Trump win shrunk in the past week. However, wagers in the prediction market Polymarket still favor the Republican candidates with a 58.2% chance. Other platforms like Kalshi and Robinhood have slightly better odds for Harris.

Trump started to gain an edge over Harris at the beginning of October as they were head-to-head on Polymarket at that point.

Meanwhile, the decline is not good news for Bitcoin (BTC) from a technical perspective as there has been some significant resistance around the $72,000 – $73,000 area. This second rejection of a move above $73,800 results in the formation of a double-top – a bearish technical formation that is often followed by a dramatic decline in the value of the asset. It’s important to note that technical analysis isn’t entirely predictive and is often more of an art than a science so take these indicators with a grain of salt.

Market analysts identify $69,200 as a crucial level to reclaim on lower timeframes while they claim that the $65,000-$66,000 range should be an area of “persistent demand.”

Past Presidential Elections Have Led to Short-Term Dips

Changes in poll results in crucial swing states have closed the gap between Harris and Trump to 48% each according to surveys from The New York Times and Siena.

Meanwhile, a well-known poll that provides a glimpse into who undecided voters may ultimately support gave Harris a two-point edge over her contender.

This level of uncertainty affects the price of Bitcoin as Trump is generally considered the most pro-crypto candidate of the two. Any drop in his odds of winning may result in an increase in BTC’s short-term volatility.

Maria Carola, CEO of crypto exchange StealthEX, indicates that BTC has behaved quite differently during election times but has mostly experienced declines. In 2020, for example, the price of the digital asset dropped by 6.1% while, during the 2016 election, its value plummeted by 10.2%.

It is worth noting that although Presidential elections have mostly been unfavorable to BTC, market conditions have changed significantly lately.

For example, the cryptocurrency recently experienced its fourth halving – an event that immediately reduces its rate of inflation and tends to push the value up in the long term – while the approval of spot Bitcoin ETFs in the United States has attracted institutional interest and billions of dollars in capital inflows to the market.

Carola emphasized that most of these drops have been temporary as they were followed by significant post-election rallies. In 2016, the market saw Bitcoin surging to $1,110 while the price surpassed $40,000 right after the 2020 election.

Spot Bitcoin ETFs Book Largest Single-Day Capital Inflows Since March

Institutional interest in Bitcoin continues to be robust despite the short-term uncertainty that this electoral event brings to the table. Data shows that inflows to Bitcoin ETFs have surged lately. The group of funds tracking the spot price of Bitcoin recorded net inflows of $917.2 million in a single day this last Wednesday. This has been the largest one-day increase since March.

BlackRock’s iShares Bitcoin Trust ETF (IBIT.O) alone attracted $872 million in positive capital flows. This was the largest one-day figure since the fund was launched in January.

Meanwhile, the derivatives market has also seen a spike in activity as open interest on crypto exchanges for this type of instrument jumped to an all-time high of nearly $44 billion. The implied volatility of the Deribit index suggests that traders are preparing for a 4% price swing in either direction until November 8.

While the outcome of the election is still quite an uncertain variable, crypto enthusiasts maintain a long-term bullish outlook for Bitcoin. Charles Edwards, founder of Capriole Fund, suggests that the current Bitcoin ETF trend indicates the market’s resilience to political outcomes.

However, analysts warn that a Harris victory could trigger short-term price declines as traders may opt to deleverage their positions due to the relative obscurity of her views and plans for the sector. This doesn’t mean that the crypto market sees a Harris presidency as entirely devastating for the industry, but it does seem to clearly prefer Trump.

The market is also watching other important economic events this week like the Federal Reserve meeting on Thursday. Depending on the result of the meeting, it could impact crypto prices even more than the election.

Most economists anticipate a 25 basis point rate cut, while other market-moving events include the US trade balance and ISM service index releases on Tuesday, labor market data on Thursday, and the University of Michigan’s consumer sentiment index on Friday.

The 2024 election is considered a major event for the crypto industry as it has become a prominent source of donations to politicians during this cycle.

With over 40% of Americans now holding some form of cryptocurrency, both major political parties are currently supporting, one more than the other, supportive legislation for the sector. This increased focus on cryptocurrency policy adds another layer of significance to the outcome of this election and its ability to impact the digital asset market.

“Unlike past elections, both major parties are advocating for clearer, supportive regulations,” commented Mudrex CEO, Edul Patel.