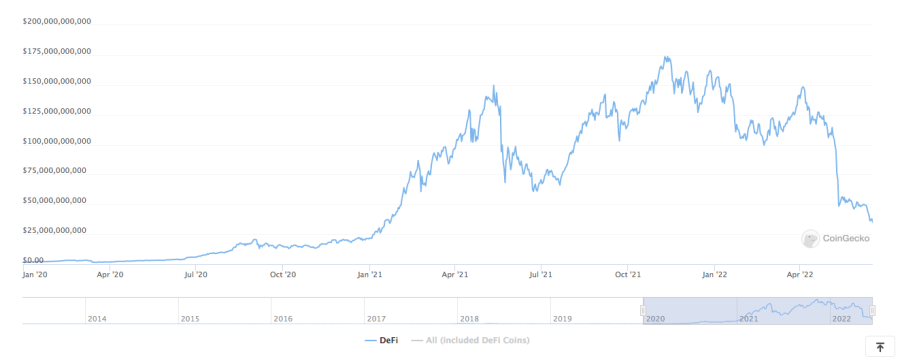

The market capitalization of the top 100 digital assets considered a part of the up-and-coming decentralized finance (DeFi) ecosystem has collapsed from a peak of $175 billion to as little as $40 billion according to data compiled by CoinGecko.

A sharp decline in the value of top cryptocurrencies, the demise of multiple stablecoins including Terra’s flagship token UST, along with multiple cyber security incidents that led to the siphoning of millions of dollars in funds from investors have been some of the factors contributing to the drop.

Meanwhile, data compiled by Defi Llama indicates that the total value locked (TVL) within DeFi protocols has dropped from a peak of $240 billion back in December last year to $74.5 billion right now.

According to data from CoinMarketCap, projects such as Terra Classic (LUNC) and Fantom (FTM) are leading the scoreboard in terms of losses as they have shed 100% and 91% of their value so far in 2022 respectively.

Other popular protocols that have suffered sharp losses this year include SushiSwap (-89%), yearn.finance (-87%), Avalanche (-86%), and Compound (-85%).

The market capitalization of cryptocurrencies as a whole has declined from $3 trillion in November to less than $1 trillion as of now while the total market cap of all coins excluding Bitcoin has dropped from $1.6 billion to around $500 billion as of this morning.

Celsius Network – The Latest DeFi Darling to Succumb to the Turmoil

The crypto savings and lending platform Celsius Network has been one of the latest prominent DeFi protocols to succumb amid the overall turmoil that the crypto markets are experiencing.

.@CelsiusNetwork is pausing all withdrawals, Swap, and transfers between accounts. Acting in the interest of our community is our top priority. Our operations continue and we will continue to share information with the community. More here: https://t.co/CvjORUICs2

— Celsius (@CelsiusNetwork) June 13, 2022

On 12 June, Celsius paused all withdrawals, swaps, and transfers within its platform. To date, there have been no updates to the situation and experts within the ecosystem are fearing that the collapse of the protocol could lead to an even worst winter for the entire industry.

Once valued at around $2 billion, the market capitalization of Celsius’s native token CEL has declined to around $153 million as of today with year-to-date losses for the token currently standing at 85.4%.

The collapse of Terra, however, remains the most prominent incident so far this year affecting the DeFi ecosystem as more than $60 billion evaporated from the project’s market capitalization after its flagship stablecoin UST suffered a concerted attack that ultimately pushed it off its peg.

The algorithmic stablecoin, which should have supposedly maintained the peg via some complex mint and burn mechanisms of the network’s native token LUNA, failed at its goal and pushed the Luna Foundation Guard (LFG) to sell billions of dollars worth of Bitcoin (BTC) in a – failed – attempt to contain the meltdown.

The Collapse of Celsius Could Have Catastrophic Effects

The Senior Director of Financial Institutions at Fitch Ratings recently commented on the situation of the DeFi ecosystem during an interview with CNBC. The industry professional stated that a full-blown liquidation of Celsius may “further rock the valuation of cryptoassets, leading to a wider round of contagion within the crypto sphere”.

Meanwhile, Mikkel Morch, the head of crypto hedge fund ARK36 stated: “Bear markets have a way of exposing previously hidden weaknesses and overleveraged projects so it is possible that we see events like last month’s unwinding of the Terra ecosystem repeat”.

Celsius has reportedly been adding more collateral to its position to prevent a liquidation event. Reports indicate that the liquidation price at which the company’s entire portfolio of BTC may be automatically sold stands at $16,852.

Crypto enthusiasts who are carefully monitoring the Celsius situation indicate that, if the protocol goes down, it could have a dramatic effect on the value of Bitcoin and cryptos as a whole for that matter as thousands of tokens will flood the market in an instant causing the value of the digital asset to flash-crash.

As of this morning, the price of BTC is rising 2.5% at $20,888 as bulls appear to be fighting with everything they have to prevent the token from breaking the $20K psychological support area.

Other Related Articles:

- Is Celsius Network Safe? Licensing & Security Reviewed

- Best DeFi Exchanges in June 2022

- Best DeFi Coins to Buy in 2022

- Best Crypto To Buy Now

- Best Crypto Presales – Compare Pre-ICO Projects

- New Cryptocurrencies to Invest in 2025

DeFi Coin (DEFC) - Undervalued Project

- Listed on Bitmart, Pancakeswap

- Native Token of New DEX - defiswap.io

- Up to 75% APY Staking

- Whitepaper and DeFi Tutorials - deficoins.io