The Sui blockchain is at the center of controversy this week amid allegations that insiders sold a significant amount of its native token, $SUI, shortly after it experienced a remarkable surge.

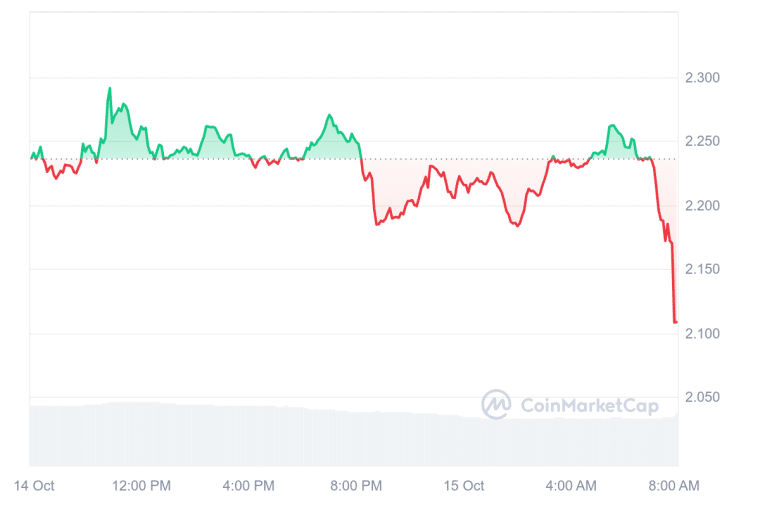

In a single month, the value of SUI has more than doubled. This rapid appreciation of the token caught the attention of blockchain analysts and the crypto community and prompted multiple parties to scrutinize the transactions made during this period.

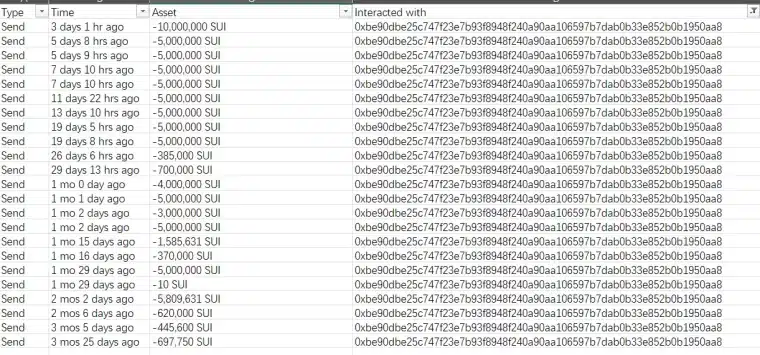

A pseudonymous crypto analyst whose X handle is “Lightcrypto” took to social media what he claims to be evidence of insider selling of a staggering total of $400 million worth of SUI during the recent rally.

Lightcrypto revealed a list of wallets associated with the project’s initial coin offering (ICO) and identified them as the source of massive token sales.

One thing that I've found more and more baffling in the last few weeks is the vertical ascent of SUI, with it quintupling off the lows (Ex 1). The market is starved for winners, and believes it has found one here, yet it all feels awfully chintzy for two reasons that I think feed… pic.twitter.com/VKISXpdxp1

— light (@lightcrypto) October 14, 2024

Large-scale selling by insiders is often a bad sign for the crypto community as it is often interpreted as a lack of long-term commitment by the developing team.

Sui Denies Insider Selling and Claims that Infrastructure Partner May Have Been Behind It

In response to the controversy, the Sui Foundation issued a statement on October 15 via their official X account. The foundation categorically denied the accusations of insider trading and emphasized that no insiders, including employees of the Foundation, Mysten Labs founders, or investors, had sold $400 million worth of tokens during the period in question.

Following an allegation of “Sui insiders selling $400M in tokens throughout this run-up,” Sui Foundation would like to respond directly to this individual:

1. No insiders, neither employees of the Foundation or Mysten Labs (including Mysten Labs founders), nor ML investors,…

— Sui (@SuiNetwork) October 14, 2024

The foundation offered an alternative explanation for the observed token movements, suggesting that the wallet in question likely belonged to an “infrastructure partner” that owns SUI tokens under a predetermined lockup schedule.

To address concerns about potential breaches of token lockup agreements, the Sui Foundation emphasized its rigorous oversight process and stated that all token lockups are enforced by qualified custodians and are continuously monitored by the entity.

However, some questioned the wording and phrasing of the statement.

“This is written as deceptively as possible. Perhaps the insiders collectively sold $399 million. Who knows? The obvious party that is explicitly excluded from the list is the foundation itself! DYOR,” argued the managing partner of Multicoin Capital, Kyle Samani.

According to data from CoinMarketCap, the SUI token has experienced a 93.3% surge in the past 30 days. However, following these insider selling allegations, the token has dropped 5.5% in the past 24 hours.

The community appears to be skeptical about the Sui Foundation’s explanation of Lightcrypto’s revelations.

Regarding the sales, Lightcrypto further commented: “It does not bring comfort that the people building this ecosystem, the people who arguably know this token’s value best, are unloading hundreds of millions of dollars of the token into less informed buyers chasing momentum.”

Media Outlets and Regulators in South Korea Get Involved in the Case

An in-depth investigation of on-chain data revealed a complex series of token transfers involving wallets associated with the Sui Foundation.

The analysis, which began in June 2024, tracked the movement of 82.6 million SUI tokens from a staking account to multiple exchanges through intermediary wallets.

These complex token movements raised questions about the transparency of the Sui Foundation’s token management practices and their potential impact on market dynamics.

The controversy attracted the attention of regulators as well as the South Korean National Assembly has already raised questions about Sui’s token allocation practices.

Meanwhile, Block Media, a South Korean specialized online magazine focused on the blockchain industry, stated the following after they investigated the token sales:

“Of particular note is the absence of any direct coin transfer from the Sui Foundation to Upbit. Instead, Block Media’s investigation has uncovered a series of transfers totaling 95 million Sui coins from Binance, OKX, and Bithumb to Upbit.”

The report adds: “There has been a record of the SUI Foundation using five wallets to transfer coins to major exchanges such as Binance and OKX.”

Understanding Sui: Technology, Tokenomics, and Team

To provide context to the ongoing controversy, it’s important to understand the fundamentals of the Sui blockchain and its native SUI token. Sui is a layer-1 blockchain designed to optimize for low-latency transfers and high transaction throughput. The protocol employs a unique consensus mechanism that differs from traditional blockchain architectures.

The SUI token has multiple functions within the ecosystem. It is used to pay for gas fees, storage fund allocation, staking, and governance.

With a maximum supply of 10 billion tokens and only about 24% currently in circulation, the remaining tokens are set to be released gradually according to a predetermined schedule. Sui was developed by Mysten Labs, a startup founded by five former Meta Platforms (META) engineers with significant expertise in blockchain technology and distributed ledger systems.

The project has attracted substantial investment from prominent venture capital firms and crypto-focused funds, including a $300 million Series B round that valued Mysten Labs at $2 billion.

Sui Should Provide Verifiable Data That These Were Not Insider Sales

The controversy surrounding the alleged $400 million token sale could potentially impact Sui’s reputation within the crypto community, where trust and transparency are crucial factors for success.

The situation may attract increased regulatory scrutiny. Insider selling is often tied to scams and fraudulent crypto projects and could shed a negative light on the reputation of Sui. There is a growing need for clear guidelines and best practices in token issuance, distribution, and management across the industry.

Also read: New Cryptocurrency to Invest In October — New Crypto Coins in 2024

While the SUI token has shown resilience in terms of price action despite the controversy, the long-term impact on investor sentiment remains to be seen.

The project’s ability to address these concerns transparently and implement robust governance measures may play a crucial role in maintaining the market’s confidence.

As the situation continues to unfold, it will be crucial for the Sui Foundation and Mysten Labs to provide clear and verifiable information about token allocations and transfers that debunk the idea that these were insider sales.