The Department of Justice (DOJ) has filed the paperwork required to seize approximately $16 million in cryptocurrency linked to the bankrupted crypto exchange FTX. The funds were held in a Binance account and are allegedly connected to bribe payments.

According to court documents, the account was created in November 2023, almost exactly a year after the exchange filed its Chapter 11 bankruptcy. The account contains several different digital assets including Ripple (XRP), Cardano (ADA), and Solana (SOL) that were valued at around $8.5 million.

Authorities emphasize that the money was used for illegal activities. The account’s origins were traced back to 2021 when Sam Bankman-Fried, the former CEO of FTX, transferred nearly $40 million worth of USDT from a wallet owned by Alameda Research.

His intention was to bribe Chinese officials to unfreeze around $1 billion worth of assets that were held in two accounts at different crypto exchanges based in China.

After the bribe was completed, the funds were moved through multiple private wallets and were finally deposited in this Binance account that is now being targeted by the DOJ.

Caroline Ellison, the former head of Alameda Research, reported that the total bribe paid to Chinese officials amounted to $150 million and confirmed that these funds were used for this purpose.

Also read: FTX’s Second-in-Command Caroline Ellison Gets Two Years in Prison

“After confirmation the accounts were unfrozen, Bankman-Fried authorized additional payments to be made in the amount of tens of millions of dollars in cryptocurrency to complete the bribe,” prosecutors argued.

Crypto examiners and blockchain analysts flagged the account after identifying multiple suspicious operations that involved swapping and converting stablecoin and Bitcoin (BTC) deposits into other crypto through over-the-counter transactions.

The Assets Seized Doubled in Value in a Year

Bankman-Fried has appealed his conviction, with his lawyer claiming that the former CEO was “presumed guilty—before he was even charged.” The DOJ’s pursuit of the Binance account assets suggests that authorities are still actively investigating and pursuing other FTX-related crimes.

Tracing these assets was complicated as they doubled in value since December 2023. Although the account’s book value was initially $8.5 million, its market value has reportedly doubled as the crypto market has been recovering lately.

Moreover, Donald Trump’s win also propelled the price of crypto assets to record highs this past week, meaning that the account is now worth even more.

The DOJ’s move to recover these bribery-linked assets indicates that the government’s effort to untangle the complex web of political affiliations and devious activities continues even after a court approved the repayment of billions to the exchange’s creditors.

Bankman-Fried is currently serving a 25-year prison sentence for his involvement and actions as the head of FTX. He was found guilty of several counts including wire fraud and money laundering.

Although prosecutors initially included bribery charges in the original case, they later decided to pursue a separate cause for these allegations.

Other Cases Against FTX Keep Moving Forward Despite Initial Sentence

These bribery allegations and the web of transactions identified by the DOJ during their efforts to trace the funds highlight the sophisticated methods allegedly employed by Bankman-Fried and his associates to conceal their illicit activities.

This could have significant implications for the broader FTX case as it could uncover additional wrongdoing and lead to further legal actions against Bankman-Fried and others involved in the scandal.

Moreover, the seizure shows that US authorities are not done with the FTX case and have not stopped pursuing other causes against Bankman-Fried despite his severe sentence.

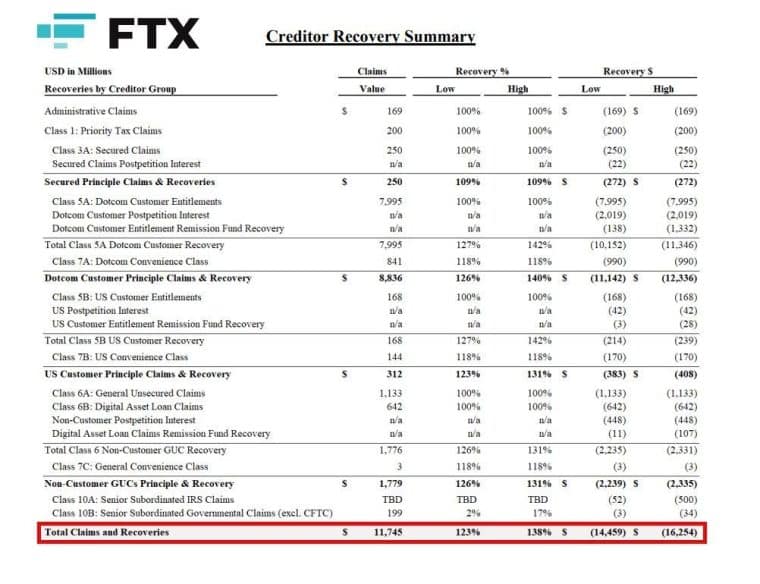

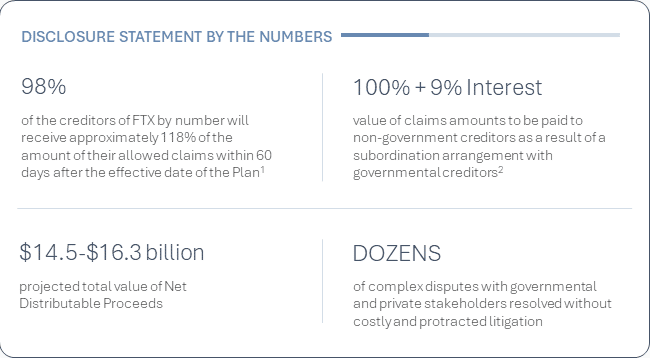

Last month, Bankruptcy Judge John Dorsey approved the reorganization plan proposed by the legal team overseeing the FTX bankruptcy. The proposal resulted in the distribution of nearly $17 billion in digital assets and cash to creditors that represented 119% of their original claim.

The judge commended those who handled this complex case for achieving this remarkable result.

“I think this is a model case for how to deal with a very complex Chapter 11 proceeding,” Dorsey emphasized. “I applaud everyone involved in the negotiation process.”

The bankruptcy lawyers who were in charge of recovering the funds linked to FTX found that Bankman-Fried and his colleagues used billions in customers’ assets to finance their lavish lifestyle, buy luxury real estate, and bribe politicians.

The Internal Revenue Service (IRS) also received a windfall of $200 million from the case although it agreed to forfeit part of its claim to benefit creditors.

Not All Creditors Are Happy with the Outcome

Even though the outcome of the bankruptcy case was considered a positive one by the judge and prosecutors of the case, a group of creditors was disgruntled that the court granted immunity to those who were appointed to oversee the recovery and distribution of the funds.

The group alleges that the fact that they got cash instead of digital assets triggers costly taxable events while the actual value of the assets they owned was much higher than the cash payment they are receiving as a result of the settlement.

“I understand why the bankruptcy process needs to work this way but let’s not pretend victims are getting their money back,” commented Mike Belshe, the CEO of BitGo in regards to the proposed distribution.

In any case, the DOJ’s move to seize the $16 million in FTX-linked cryptocurrency is the latest development in the multifaceted legal saga surrounding the collapse of this prominent crypto exchange.

This alleged connection to bribery activities opens up a new chapter that could lead to new sentences and convictions from the Justice Department for those who were somehow associated with the illicit activities that FTX carried out to keep its fraudulent endeavor running.