Marathon Digital Holdings, one of the most popular cryptocurrency mining companies, has suffered a significant setback in its hopes to maintain its operations even amid the market downturn.

Marathon Digital Holdings, one of the most popular cryptocurrency mining companies, has suffered a significant setback in its hopes to maintain its operations even amid the market downturn.

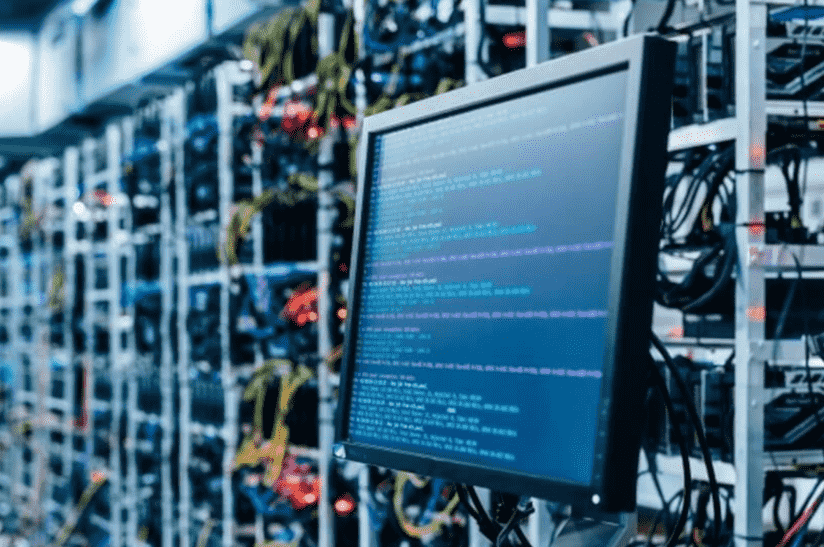

Earlier this week, the company’s flagship mining location in Montana was dealt a major blow after a sandstorm struck the facility and destroyed most of the company’s miners.

Raining on Marathon’s Parade

According to an official announcement, Marathon reported that a storm hit the town of Hardin, Montana. This serious event took place on June 11 and caused major damage to the power facility that provided energy to most of its local mining operations. Marathon, one of the top bitcoin mining sites, mentioned that the storm has impacted around 30,000 mining devices, which is about 75% of its total fleet.

Data from Blockchain Explorers shows that the miners have been out of operation for almost three weeks. Marathon Digital has claimed that most of its operation is expected to be reduced drastically until power is restored in Montana.

BTC Accumulation Plans Thwarted

With the market experiencing a significant downturn, it has truly been a challenging time for the crypto mining space. Mining companies have been forced to tighten their budgets and dip into their crypto reserves to keep their operations running, and several of them have also had to take massive losses.

Voyager Digital, one of the few publicly listed mining companies, has seen its stock plunge by 96% since the start of the year. The company, which claimed that it had been significantly exposed to the insolvency of the Three Arrows Capital (3AC) hedge fund, has issued a default notice to the latter. The notice is related to 3AC’s loan of 15,250 BTC and $350 million in USDC tokens.

The company had assured users that it wasn’t insolvent, pointing out that it had $137 million in cash and owned crypto on hand. At the same time, it accepted a $750 million lifeline from Alameda Research.

While several of these mining firms have been facing hard times, Marathon Digital has maintained its commitment to stay operational. Last week, the company’s vice president of corporate communications, Charlie Schumacher, pointed out to industry news sources that the company had been prepared for the current market condition.

“For reference, in Q1 2022, our cost to produce a Bitcoin was approximately $6,200. We also have fixed pricing for power, so we are not subject to changes in the energy markets,” Schumacher explained.

The executive added that the company has focused more on its Bitcoin production and accumulation. They believe that the leading cryptocurrency will still appreciate in the future and are committed to holding it in the long run.

Sadly, things would be much more difficult for the company now that a storm has hampered its operations. The market will be looking to see how Marathon weathers this storm. Will the utility providers in Hardin get power back up quickly, or will Marathon move out of the city?

Related News

Lucky Block - Undervalued Crypto

- Listed on Gate.io, LBank, MEXC, PancakeSwap

- NFT Competitions, Jackpot Draws

- Powers Casino & Sportsbook Platform - luckyblock.com

- 10,000 NFTs Minted

- $2M+ in Prizes Awarded