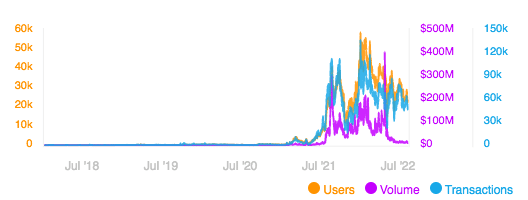

The daily trading volume of the popular marketplace for non-fungible tokens (NFTs), OpenSea, has reportedly dropped to its lowest level in the past 13 months as interest for these novel digital assets continues to tank.

According to data from DappRadar, only $10.1 million worth of NFTs exchanged hands through the platform on 9 August compared to $184.5 million users traded exactly 7 months ago when they reached all-time highs.

These daily volumes are the lowest recorded by the platform since July 2021 and they indicate that both the value of this so-called “digital art” and the number of transactions taking place have suffered dramatically as a result of the crypto winter.

In this regard, only 54,100 transactions occurred on 9 August compared to 137,500 back on 9 January this year.

Top collections have also been experiencing severe downturns in both volumes and number of sales. For example, the popular Bored Ape Yacht Club NFTs have experienced a 13% drop in trading volumes in the past 30 days to $39.6 million as of today along with a 32% drop in sales.

Meanwhile, CryptoPunks NFTs have seen their volumes drop by 53% to $29.6 million while the number of sales made in the past 30 days has declined 64% as well.

Dollar Value of NFT Transactions Drops By Nearly 25% in Q2 2022

A recent report from NonFungible.com, a website that tracks the performance of this up-and-coming market, indicated that the dollar value of NFT transactions experienced a 24.8% decline compared to the previous quarter to $8.1 billion.

Notably, the number of active wallets that transacted with these digital assets experienced a 33.1% drop to 1.25 million compared to Q1 2022 while total profits at resell came down 46% as the value of digital artworks suffered during this period.

In addition, search volumes related to NFTs have also experienced a severe decline according to this same report as they have dropped to levels seen in September 2021 and roughly 80% from their peak.

The NFTs created by Yuga Labs continue to dominate the marketplace in terms of value and trading volumes including BAYC NFTs and the new Otherside NFTs, which were created as part of the launch of the company’s brand new metaverse.

“The very least we can say is that the market has changed pretty dramatically over just one quarter”, the authors of the report stated.

They added: “Without doubt the hopes and dreams a booming industry created has impacted many, newcomers especially and this new downward turn has been a reminder to everyone of the volatility of the crypto space as a whole”.

OpenSea Was Forced to Lay Off People After the Market’s Tectonic Shift

Last month, OpenSea stated that current market conditions forced the company to make the difficult decision of laying off 20% of its workforce as the firm has to prepare for what could be “a prolonged downturn”.

“The reality is that we have entered an unprecedented combination of crypto winter and broad macroeconomic instability”, the Chief Executive Officer of the crypto firm, David Finzer, told his staff.

He added: “The changes we’re making today put us in a position to maintain multiple years of runway under various crypto winter scenarios and give us high confidence that we will only have to go through this process once”.

OpenSea’s choice to reduce its workforce happened just 6 months after the company raised $300 million in a funding round led by Paradigm and Coatue, valuing the company at $13.3 billion. At that time, the CEO mentioned plans to rapidly expand his team as transaction volumes were increasing swiftly.

However, the tables turned rather quickly for the web3 company as the collapse of the Terra ecosystem, a tectonic shift in macroeconomic conditions, and other important incidents led to a sharp drop in the value of cryptos and the market’s tolerance for risk as well.

That said, even though the company may be worth much less now considering the latest drop in trading volumes and the current macro backdrop, the funding it obtained during this round could now be critical to ensure it can withstand the current headwinds.

Other Related Articles:

- Best NFTs to Buy in 2022

- Top NFT Marketplaces Reviewed – Where to Buy NFTs Safely in 2022

- Binance NFT Marketplace Review

Tamadoge - The Play to Earn Dogecoin

- '10x - 50x Potential' - CNBC Report

- Deflationary, Low Supply - 2 Billion

- Listed on Bybit, OKX, Bitmart, LBank, MEXC, Uniswap

- Move to Earn, Metaverse Integration on Roadmap

- NFT Doge Pets - Potential for Mass Adoption