Paxos International is coming out with a new stablecoin called the Lift Dollar that delivers daily yields earned on the reserves that back it in a move that may change the way that this whole segment of the market works.

The company, which is based in the United Arab Emirates (UAE), named this new token the Lift Dollar, ticker symbol USDL, and will rely on a smart contract built on the Ethereum blockchain to distribute daily payments to all eligible wallets that are holding the USDL token.

USDL Pioneers a New Model for Stablecoins

Charles Cascarilla, Member of the Board of Directors of Paxos International, hailed USDL as a “first-of-its-kind” regulated stablecoin product that safely pays out yield directly to holders.

“Up to this point, only centralized issuers have gained from the economics of stablecoin reserves,” Cascarilla said. “Paxos International has changed this situation so that all token holders can securely use and expand their regulated USD stablecoin assets. Our aim is to create a financial market that is more democratic, inclusive, and accessible. USDL is an important step toward reaching that goal.”

The USDL reserves managed by Paxos International consist only of high-quality liquid assets approved by UAE authorities, which include U.S. dollar deposits, short-term U.S. Treasuries, and cash equivalents. This setup guarantees a strong 1:1 peg with the U.S. dollar, enabling USDL to provide low-risk overnight returns for its holders.

The company is regulated by the Financial Services Authority (FSRA) of Abu Dhabi Global Monetary (ADGM), to assure investors that they are carrying out their operations to meet the highest regulatory standards.

Annual Yield Currently Stands Close to the Federal Funds Rate

According to Ronak Daya, Head of Product at Paxos, users can currently earn around 5% annualized yield on their USDL holdings – a rate that is close to the current effective federal funds rate (EFFR).

Paxos will charge a 0.2% distribution fee and a 0.3% issuer fee to investors and will distribute the remaining yield to all holders of USDL.

Also read: Earn Interest on Stablecoins – Anchor Protocol Alternatives

“Lift Dollar is the first stablecoin designed to benefit both end users and distributors in a safe manner,” Daya highlighted. “We are excited for the opportunities this will create for businesses and individuals. We look forward to growing our partner network globally this year.”

To incentivize initial adoption, Paxos will waive its issuer fee during an unspecified promotional period, allowing USDL holders to earn the full yield generated by the reserves net of just the distribution fee.

US and UK Investors Won’t Be Able to Buy USDL At The Moment

Arvind Ramamurthy, Chief of Market Development at ADGM applauded Paxos for this innovative USDL offering, stating that it “underscores the industry’s growth and innovation in the UAE and the wider region, made possible through FSRA’s progressive and credible regulatory oversight.”

For its inaugural launch, USDL will be distributed to individual users in Argentina through partnerships with leading local crypto platforms Ripio, Buenbit, and TiendaCrypto.

Argentina is a country where the government has imposed strict foreign exchange controls that prevent the population from accessing US dollars. Cryptocurrencies have allowed citizens to circumvent these restrictions by using Argentinian pesos to buy USDT and other similar stablecoins via peer-to-peer (P2P) platforms and crypto exchanges.

In the case of USDL, the added component of delivering attractive and relatively predictable interest payments to holders daily would probably be enticing enough to incentivize some holders of other stablecoins to switch providers.

“Stablecoins inherently are about helping those people who are unbanked or underbanked, who don’t have access to dollars, for a number of different reasons,” explained Cascarilla about USDL’s accessibility focus beyond the initial Argentina launch.

However, the stablecoin will not be available in several major jurisdictions including the United States due to potential breaches of the country’s securities laws affecting yield-bearing products. Other restricted regions include the UAE (except ADGM), the UK, the European Union, Canada, Hong Kong, Japan, and Singapore.

Most of these countries are still working to pass comprehensive legal frameworks that regulate cryptocurrency offerings, especially those that can be considered investments or interest-bearing financial instruments.

In the case of the use, there is hope that the latest crypto bill named FIT21 may open up the door for the adoption and commercialization of products like USDL to both retail and institutional investors who can diversify their holdings by embracing innovative financial products.

Stablecoin Providers Are Moving Toward More Transparent Models

The introduction of USDL marks a paradigm shift in how stablecoins operate and deliver value to their holders. By distributing the yields that the token’s reserve assets generate, Paxos International is pioneering a more equitable and transparent model compared to its rivals.

This approach stands in stark contrast to recent stablecoin failures and controversies where systemic risks, a lack of oversight, and excessive for-profit motives ended up in catastrophic losses for investors and severely damaged the credibility of the sector.

The fact that Paxos is heavily regulated would probably include frequent audits of its liquid reserves to ensure that the token has sufficient backing that covers its circulating supply.

Paxos Sees a Significant Expansion of the Stablecoin Market

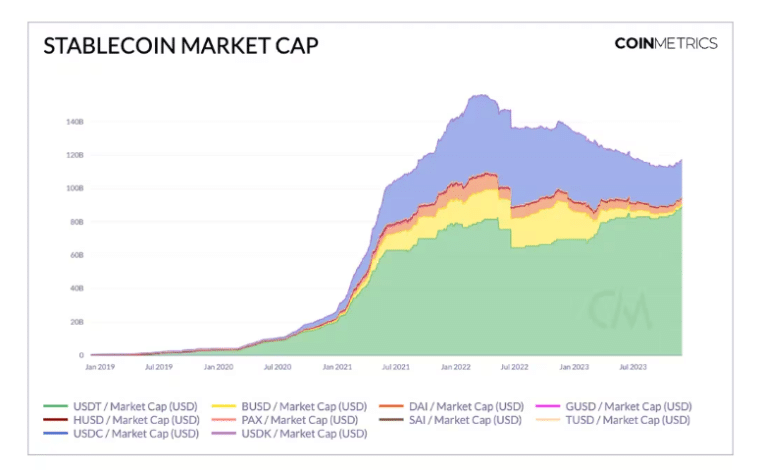

“We believe that the stablecoin market will 20x from now over the next five years, and we believe that we’ll be able to capture a large portion of the future growth and take market share from existing incumbents,” Paxos’s Daya commented.

As a trusted partner to major enterprises for blockchain infrastructure, tokenization, and digital asset custody, Paxos relies on an extensive network of allies that it can leverage to expand USDL’s footprint across both institutional and retail markets.

The launch of USDL addresses a critical void in the stablecoin market today – a fully blockchain-native, transparent, regulated, and secure digital dollar product that shares its yield directly with token holders.

Recent stablecoin debacles have undermined the public’s confidence in these products. In the case of USDL, the oversight provided by regulators in the UAE helps reinforce the project’s credibility from the get-go and may provide some much-needed transparency to ensure its success.

Millions of unbanked individuals have probably been waiting to get their hands on blockchain-native interest-bearing products for years that can offer both safety and attractive yields. If the UAE delivers in terms of oversight and Paxos lives up to the promises of this ambitious model, it will likely be adopted in countries where banking solutions are scarce or limited to certain social spheres.

That said, while USDL presents an innovative new paradigm for stablecoins, there are still a few challenges to tackle.

The first would be restricted access in markets that are worth trillions of dollars like the United States and the United Kingdom. Overcoming the regulatory hurdles imposed by the absence of comprehensive legislation for this type of product will be an important task for Paxos to expand USDL’s reach.

Moreover, even though Paxos may be pioneering this type of product, the business model can be easily replicated by its competitors. If proven successful and adoption rates hit the roof, other companies in the sector like Circle and Tether.

Regardless of the challenges, this first step from Paxos is probably marking a whole new season for stablecoins that would push companies in the sector to look for competitive ways to attract the billions of dollars that are still on the fence due to a lack of trust in stablecoins amid the absence of regulatory oversight and other limitations.