Ripple announced that it plans to launch its very own stablecoin which will be pegged 1:1 to the US dollar and backed by dollar deposits, short-term US government treasuries, and other cash equivalents.

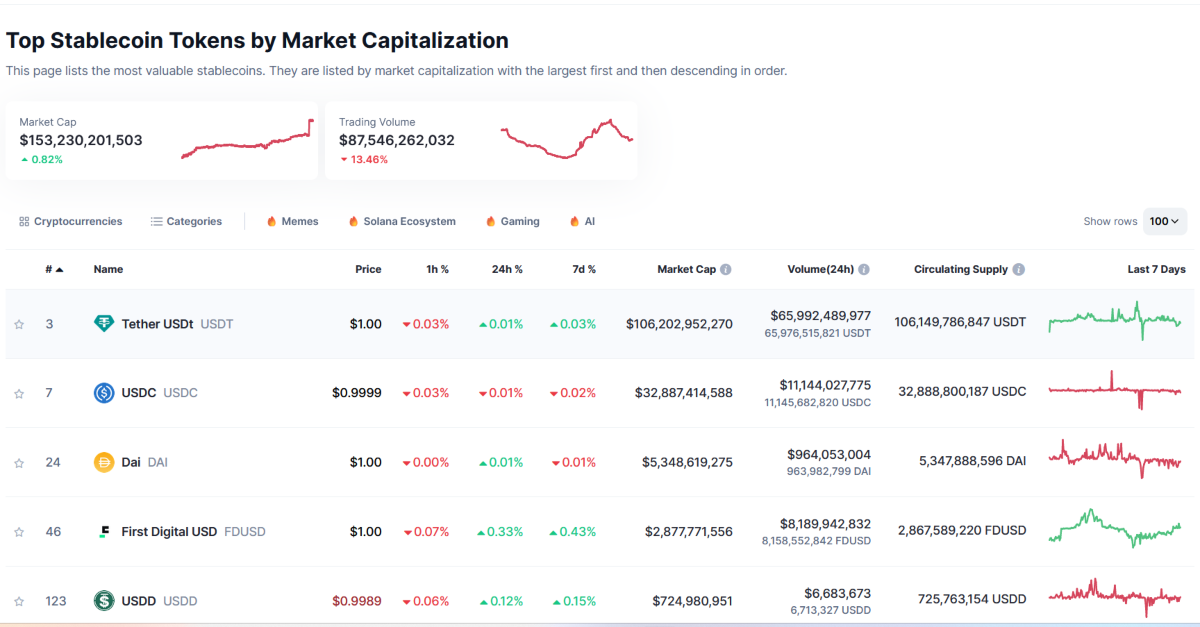

Could the stablecoin take in Tether’s USDT and Circle’s USDC which currently dominate the $150 billion stablecoin market?

Ripple expects the stablecoin market to balloon to $2.8 trillion by 2028 and stressed that there’s strong demand for stablecoins “that deliver trust, stability, and utility.” It added, “To meet this growing demand, Ripple will issue a stablecoin, leveraging its decade-plus of experience building real-world financial solutions for institutions around the world.”

Key Highlights: Ripple Announces USD-Pegged Stablecoin

- Launch and Features: Ripple has unveiled plans for a US dollar-pegged stablecoin, aiming to enhance trust and transparency within the stablecoin market. The new stablecoin will be backed by cash, short-term US government treasuries, and undergo regular third-party audits to ensure transparency .

- Initial Rollout and Expansion: At launch, it will be available on the XRP Ledger and Ethereum, with future plans for expansion across additional blockchains and DeFi protocols. Ripple targets institutional and decentralized finance (DeFi) users, offering a stable alternative amidst ongoing concerns in the stablecoin industry .

- Competitive Edge: Ripple’s strong regulatory compliance, including holding licenses in the U.S., Singapore, and Ireland, positions it as a stable alternative to competitors like Tether (USDT) and Circle (USDC). Its entry comes amidst a predicted boom in the stablecoin market, expected to reach $2.8 trillion by 2028 .

Why Now?

Many long-time crypto enthusiasts are likely rejoicing at this announcement as there has been endless controversy in the stablecoin space for years and years, especially surrounding Tether (USDT), the largest USD stablecoin.

USDT is absolutely vital in the crypto space as a way to easily sell cryptocurrencies for USD-pegged assets.

However, USDT is often considered a massive risk for the market as well.

It has market cap exceeding $100 billion despite its many controversies including its bold faced lies that it was backed 1:1 by USD for years after this was no longer the case. The company was eventually forced to admit that some of its reserves were indeed in non-US dollar assets after it was investigated by the New York Attorney General, unearthing its lies.

The controversies don’t end there either. Tether lied, saying that it was not affiliated with the crypto exchange Bitfinex. It was revealed later on in the Panama Papers leak that they were actually owned by the same company and shared countless executives.

The stablecoin woes even helped crash the crypto market in 2022 when the algorithmic stablecoin TerraUSD crumbled and became worthless in just a few days. Last year, USDC also lost its peg against the US dollar after it revealed exposure to the now-collapsed Silicon Valley Bank. However, USD-USDC swaps were never frozen despite the major short-term loss, indicating that the price decrease was mostly harmless.

To instill confidence in its stablecoin, Ripple would get the reserve assets audited by a yet-undisclosed third party and would publish monthly attestations. Tether, on the other hand, has claimed that it has sought 3rd party audits and attestations for years and years but still has failed to complete a single one.

In its release, it said that its stablecoin will initially be available on the XRP Ledger and Ethereum blockchains. Subsequently, it intends to expand it to additional blockchains and decentralized finance protocols and apps.

How Could Ripple’s Stablecoin Be Different?

Ripple listed several benefits of its stablecoin. These include

- Enterprise Grade solutions: Ripple argues that there is strong demand from its customers in emerging markets to enable stablecoin payouts and it will use both the stablecoin and XRP in its payment solution.

- Regulatory compliance: Ripple highlighted its commitment to regulatory compliance and said it holds a New York BitLicense and another almost 40 money transmitter licenses across the US. In addition, it holds licensees in regions like Singapore and Ireland. That said, Ripple has been in the crosshairs of US regulators which alleged that the company’s distribution of XRP was an unregistered security offering. While Ripple secured a partial win, last month the SEC asked a federal judge to impose a fine of nearly $2 billion on Ripple Labs for violation of investor protection laws for its sale of Ripple to institutional investors.

- Transparency: In the past, stablecoins have been marred by a lack of transparency. With its audits and monthly attestations, Ripple plans to address this lacuna in the industry.

- Interoperability and multichain compatibility: Ripple said that its stablecoin will expand native issuance to other blockchains, which would let users benefit from cross-chain interoperability.

It expects to launch the stablecoin later this year beginning with the US but could consider launching it to other regions also.

2/ This move extends Ripple's reach into both institutional and DeFi realms, diversifying use cases and enhancing our payments infrastructure, to bring the worlds of traditional and decentralized finance closer together.

— Ripple (@Ripple) April 4, 2024

Could Ripple Stablecoin Become Mainstream?

Ripple plans to target financial institutions and other enterprises with its stablecoin and said that its strong balance sheet and transparent reserves would help it gain a foothold in that market.

“Issuing our stablecoin on the XRP Ledger and Ethereum will serve as a pivotal entry point to unlock new opportunities for institutional and DeFi use cases across multiple ecosystems,” it said in its release.

There indeed is a case for mainstreaming of stablecoins as currently, users have to convert them into fiat currency for real-world use.

Ripple believes that integration with RippleNet would help it make transactions seamless but it won’t be a feature that would be initially available.