A striking decision left regulators probably perplexed as a judge instructed the almighty United States Securities and Exchange Commission (SEC) to pay $1.8 million in legal costs incurred by the blockchain firm DEBT Box upon finalizing a legal proceeding against the company.

The decision by Chief District Judge Robert J. Shelby is the result of a failed lawsuit against DEBT Box that accused the crypto mining company of defrauding investors in an alleged $50 million scheme involving the offering of supposed unregistered securities.

Judge Shelby slammed the SEC for what he deemed as “bad faith conduct” and a “gross abuse of power” in obtaining and implementing emergency orders to freeze DEBT Box’s assets based on admittedly flawed evidence and misrepresentations.

As a result of the SEC’s improper procedures, the judge has mandated that the institution cover $1,821,824 in attorney’s fees and legal costs incurred by DEBT Box to fight the now-dismissed case.

The SEC Provided Inaccurate Evidence to Freeze DEBT Box’s Assets

This saga began in July 2023 when the SEC filed an explosive complaint accusing DEBT Box and its executives of carrying out a “fraudulent scheme” that involved the sale of assets that were not registered as securities following the agency’s procedures.

The agency obtained an ex parte temporary restraining order (TRO) and froze the assets of DEBT Box. The order was issued without informing the company, meaning that they did not have the chance to respond or prepare for them accordingly.

The SEC justified these emergency measures by alleging that there was a risk that DEBT Box would spread and disappear the funds held in its accounts by sending them overseas. However, the judge soon found that the evidence used to back this claim was severely flawed.

Specifically, the SEC claimed that DEBT Box was shutting down its bank accounts, arguing that the company was trying to flee and destroy evidence. However, DEBT Box only shut down a few accounts, not including its main account, and it did so long before the SEC lawsuit was launched.

DEBT Box initially denied the fraud allegations, accusing the SEC of regulatory overreach. The legal battle reached a turning point in March when Shelby slammed the agency for misrepresenting key facts to secure those emergency orders.

The court ultimately ruled that there were no grounds to justify a TRO and that the SEC’s actions were not proportionate to the risks faced by investors who were involved with the project.

In March, the judge called out specific inaccuracies concerning the SEC’s procedures including mistakenly flagging domestic transactions as international and using that to sustain that DEBT Box could have been engaged or could engage in money laundering activities if the TRO was not issued.

DEBT Box and Industry Observers Welcome the Decision Against the SEC

For DEBT Box, getting a refund on their legal fees and winning a case against the SEC is being considered “a monumental victory” not just for them but also for the entire industry, which experts and insiders believe has been besieged and attacked by officials within the agency for years.

“[this victory] underscores the importance of integrity and fairness in regulatory practices,” the developing team behind the project shared in a social media post on X (formerly Twitter).

🚀 We have some fantastic news to share with our D.E.B.T. Box community today!

The U.S. District Court for the District of Utah has officially dismissed the SEC's case against us without prejudice. This means the case is closed, and any future action by the SEC would have to go… pic.twitter.com/aGiNVxMYbz

— CHRYSALIS (@Chrysalis_Web3) May 28, 2024

The blockchain company was not alone in rebuking the SEC and prompting regulators to adopt a more balanced approach when judging and overseeing the activities of companies in this space.

“[We] hope that this legal penalty has the intended effect of discouraging the SEC from utilizing unfair and deceptive tactics against any subject of an enforcement action,” commented Laura Sanders, policy counsel for the Blockchain Association, in a statement sent to Decrypt.

Meanwhile, the Republican Congressman Tom Emmer, who is known for backing the latest piece of regulation for the sector named FIT 21, criticized the head of the SEC, Gary Gensler, for his approach by stating sarcastically that he is surely “making great use of Americans’ taxpayer dollars.”

In essence, the SEC is paying back DEBT Box for prosecuting them. Their flawed proceedings are costing the agency $1.8 million and backfiring.

Meanwhile, Amanda Tuminelli from the DeFi Education Fund emphasized another important provision included in the DEBT Box’s ruling that prevents the SEC from prosecuting these defendants again in this case.

“We know that Judge Shelby will not forget what happened the first time around,” she stressed.

SEC Apologizes for Making Inaccurate Statements and Falling Short of their Duties

For its part, the SEC ultimately succeeded in convincing Judge Shelby to dismiss its DEBT Box lawsuit without prejudice, meaning that the agency could potentially refile its fraud claims against the company.

In this case, any future DEBT Box-related proceeding would be heard by Shelby himself, to ensure that the judge maintains oversight amid his harsh criticism of the SEC’s conduct thus far.

“The Commission argues dismissal without prejudice is appropriate because it will protect investors and the public interest, and will not cause Defendants legal prejudice,” Shelby wrote in his ruling.

The SEC also accepted responsibility for its missteps, with Enforcement Chief Gurbir Grewal apologizing for the agency’s “inaccurate statements and actions that “fell short” of what their duties and responsibilities are.

Still, Shelby insisted that the agency’s actions went beyond simple oversights to deliberately skew proceedings against Debt BOX and decided that a penalty would be in order to make the agency think twice before taking similar steps against other crypto firms.

DEBT Box Token Keeps Dropping Despite Favorable Decision

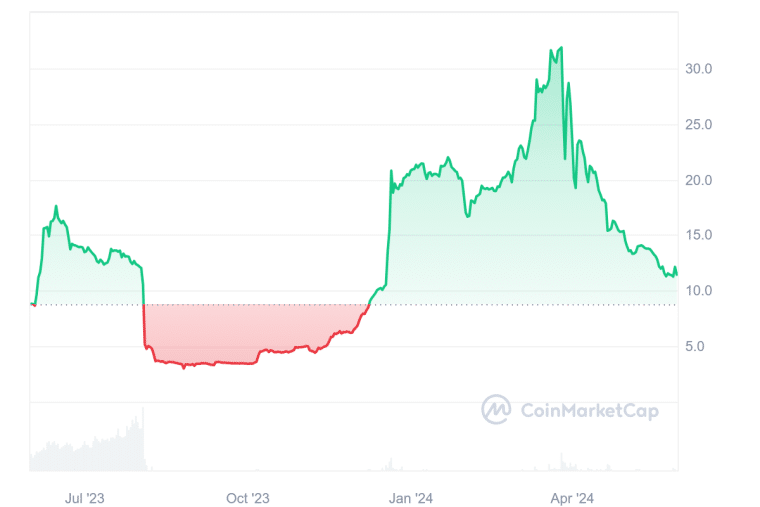

The value of the DEBT Box token did not experience significant changes despite the favorable ruling. Back in March, when it became known that the judge’s decision was leaning toward dismissing the case, the DEBT token rose to over $30 apiece.

However, since then, its value has declined by over two-thirds.

While the SEC could choose to appeal the judge’s decision to pay back the legal fees to the company, the judgment represents an undeniable win for DEBT Box and the crypto industry, which has been pushing back against the SEC’s aggressive regulatory oversight through high-profile lawsuits for years.

“The time of America becoming a digital desert must end,” said Miguel Francis-Santiago, Chief Marketing Officer for DEBT Box. “We have fallen behind on the world stage, and if we don’t turn this around, America will be left behind.”

He stressed that his company’s win was one “for the Web3 industry as a whole.”

Those sentiments are shared by many in the blockchain space who see an opportunity to leverage this legal victory to keep forcing a change in the regulatory landscape affecting the crypto industry.

With regulators like the Commodity Futures Trading Commission (CFTC) also advocating for having greater authority over the crypto sector, the DEBT Box ruling could tilt the scale in favor of the former and away from the highly criticized SEC when it comes to solidifying compliance rules for digital assets.