Bitcoin, the leading cryptocurrency, has gained 0.21% to trade at $19,095.91 after losing more than 6% in the previous seven days and more than 18% since August. Several factors are keeping bitcoin and the overall cryptocurrency market under pressure. The stronger-than-expected US economic events are one of the main reasons for the continued downtrend in Bitcoin.

According to the September Federal Open Market Committee meeting minutes, committee members agreed that a more restrictive policy stance was necessary for the Fed to achieve its maximum employment and price stability goals.

In addition, Federal Reserve agreed that a faster rate hike now would:

“avoid the greater economic suffering associated with entrenched high inflation, including the significantly tighter policy and more severe restraint on economic activity that would eventually be needed to restore price stability.”

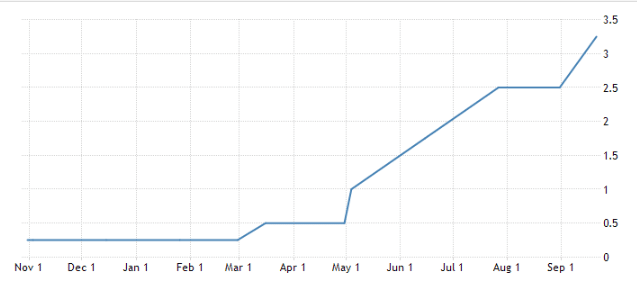

US Interest Rate – Source: Federal Reserve

During its September meeting, the Fed hiked the federal funds rate by 75 basis points to the 3%-3.25% range, the third consecutive three-quarter point rise, raising borrowing prices to their highest level since 2008.

4 Reasons Why the Bitcoin Price Could Be Ready to Explode

So now that you know the full story behind bearish bitcoin, let’s look at the four factors listed below that could cause the price of bitcoin to skyrocket.

US Fed Pressured to Slow Rate Hikes

The two most important economic announcements this week will be the release of September PPI data on October 12 and the CPI report on October 13. The US PPI figure is already out; the final demand PPI increased by 0.4%, exceeding the 0.2% gain forecast by experts. The PPI rose 8.5% in September, following an 8.7% increase in August.

Now that the unemployment rate has fallen to a half-century low in September, the Fed is only concerned with controlling inflation. As a result, the Fed is under pressure to ease up on rate hikes. The United Nations (UN) has advised the Federal Reserve to postpone raising the federal funds rate in order to avoid a recession.

Furthermore, Ark Invest CEO Catherine Wood has written an open letter to the Federal Reserve in which she criticizes the institution for taking unnecessary risks with its aggressive benchmark bank rate increases. However, the Fed has not indicated any intention of changing its stance.

Bitcoin’s value will rise, and it may even explode if the Fed helps ease up on rate hikes.

Upcoming Short-term Volatility Could be the Final Capitulation Before take-off

The world’s leading cryptocurrency, Bitcoin, is well-known for its volatility. However, since hitting a low in mid-June, Bitcoin has resisted this stigma by fluctuating in a narrow range around the $20,000 mark. Several significant economic events are scheduled to occur in the next two weeks, which may encourage traders to remain passive and observe.

Even though it is difficult to predict which way the price of Bitcoin will move once volatility rises. However, reviewing on-chain data to understand what market participants are doing under nearly identical market conditions may assist investors in determining what to do when the price begins to move. Many investors believe that BTC’s short-term volatility is the final capitulation before it rises in value.

BNY Mellon Custody Transfer

On October 11, the oldest bank in the United States, Bank of New York Mellon (BNY Mellon), announced that customers would be able to hold crypto assets alongside traditional investments on the same platform. This makes it the first bank in the United States to allow this. BNY Mellon has been granted permission by New York’s financial authorities to begin accepting Bitcoin and Ether deposits from a limited number of customers.

We are reimagining financial markets through blockchain & digital assets. Select U.S. institutional clients can now view traditional & digital assets on one platform. Secure and resilient, Digital Asset Custody—a milestone in our innovation journey. https://t.co/DsdUboOPWj pic.twitter.com/r0vvqoVfqT

— BNY Mellon (@BNYMellon) October 11, 2022

Furthermore, the bank has decided to launch its new Digital Asset Custody platform this week. Through this service, BNY Mellon will provide the same bookkeeping services for a customer’s digital assets. It will also enable investors to have access to and transfer a customer’s digital assets. This move could be significant in the long run during a crypto winter, and BTC could explode as a result of it.

Google accepts bitcoin payments for cloud services

Google announced a new partnership with Coinbase that would allow a select group of users to pay for its cloud services using cryptocurrencies such as Bitcoin. It will be operational in early 2023. At first, only a small number of Web3 clients will be able to make cryptocurrency payments. Google will also use Coinbase Prime, the exchange’s institutional cryptocurrency custody and investment platform.

— Watcher.Guru (@WatcherGuru) October 12, 2022

Google Cloud CEO Thomas Kurian stated that the company’s goal is to make scalability, dependability, security, and data services accessible to all customers. As a result, customers can focus on inventing the cryptocurrency field. According to the statement, the integration would also allow developers to run Web3-based solutions quickly and reliably without the need for costly and complicated infrastructure.

As a result of this collaboration, BTC/USD will become more usable and may explode soon.

Related News:

- Crypto Buy Signal – Coinbase and Google in Cloud Partnership for Crypto Payments

- Bitcoin Price Prediction 2022 – 2030

- Dogecoin Price Prediction – Google to Accept for its Cloud Payments, DOGE to Kill a Zero?

IMPT - New Eco Friendly Crypto

- Carbon Offsetting Crypto & NFT Project

- Industry Partnerships, Public Team

- Listed on LBank, Uniswap

- Upcoming Listings - Bitmart Dec 28, Gate.io Jan 1st