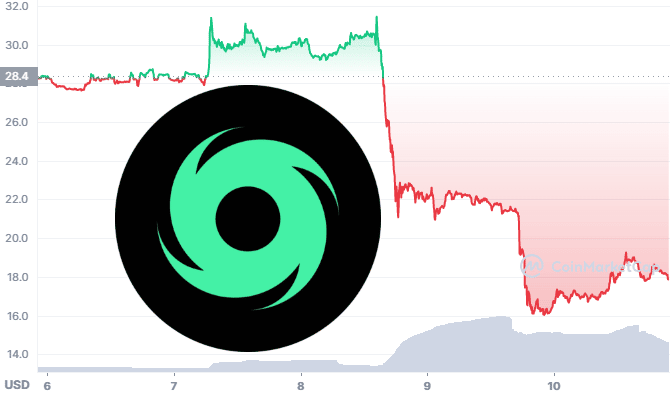

The price of Tornado Cash (TORN) token lost almost 50% of its value since news broke this week of a US government clampdown and ban.

As the August 8th news made headlines around the world including on the New York Times, TORN token crashed from around $31 to $16.

Tornado Cash Banned – BackGround

The US Treasury Department blacklisted the decentralized privacy solution, alleging it has been used to launder $7 billion of cryptocurrency stolen in scams and cyber crime. TORN is its governance token, its value a reflection of investor confidence in the platform.

‘Treasury is sanctioning Tornado Cash, a virtual currency mixer that launders the proceeds of cybercrimes, including those committed against victims in the United States. Despite public assurances, Tornado Cash has repeatedly failed to impose effective controls designed to stop it from laundering funds for malicious cyber actors on a regular basis and without basic measures to address its risks.

This includes over $455 million stolen by the Lazarus Group, a Democratic People’s Republic of Korea (DPRK) state-sponsored hacking group that was sanctioned by the U.S. in 2019, in the largest known virtual currency heist to date. Tornado Cash was subsequently used to launder more than $96 million of malicious cyber actors’ funds derived from the June 24, 2022 Harmony Bridge Heist, and at least $7.8 million from the August 2, 2022 Nomad Heist.’

Read the full press release at home.treasury.gov.

Tornado Cash Price Prediction

Potentially a 50% dip in such a short space of time could be a market inefficiency and overreaction or ‘FUD’ (fear, uncertainty and doubt) as a result of the crackdown – and therefore $TORN would be a good buying opportunity.

Bullish Case for Tornado Cash

The Tornado Cash platform has a unique use case and utility. Its smart contracts break the on-chain link between recipient and destination addresses, so that it’s impossible to track where funds are sent – no electronic paper trail – with the use of zero knowledge proofs (zk-SNARKs) to achieve that privacy.

It is true that its technology is used by criminals to obfuscate transactions and escape tracking when laundering stolen funds. For example when the Bored Ape Yacht Club Instagram was hacked and NFT holders phished by scammers.

Some people say 10% of illicit funds in Tornado is a lot, but let's look at the bigger picture.

Crypto overall is an order of magnitude cleaner than fiat, with just 0.15% of illicit activity whereas 3.6% is casually laundered by the big banks.https://t.co/xtpxQzfVUH pic.twitter.com/yIodecOIjE

— banteg (@bantg) August 10, 2022

However as commentators in the crypto market have pointed out, laundering of fiat currency by big banks is much more commonplace.

There are many proponents of privacy coins or tokens related to anonymity within the cryptocurrency space – many would argue, as @bantg does in the thread above, that privacy needs to be normalized.

From a fundamental analysis standpoint, some crypto investors see that as an inevitability – which would make TORN token a good buy now.

Bearish Case for Tornado Cash

On the other hand, the privacy coins narrative has been around for years, surrounding coins like Monero (XMR), ZCash (ZEC) and not yet materialized.

Many investors that decided to buy privacy coins are now down on their investment – the market can stay irrational longer than you can stay solvent. Altcoins can trend down for years – ZEC is down massively since 2016.

XMR has a better price chart but as of August 2022 is still priced at levels seen in the middle of the 2017 bull run.

TORN Token Technical Analysis

Tornado Cash token today has a live market cap of under $20 million, ranked outside the top 600 crypto coins on CoinMarketCap.

Tornado cash token price history

Nothing about the chart above is bullish as TORN has been printing lower highs and lower lows since its all time high of just over $400 in February 2021.

Is TORN Token a Good Buy Now?

It’s possible TORN is in a reaccumulation cycle before a move to the upside to take out some highs at around the $80 levels but conservative investors would wait for TORN token to first recover to reclaim the $40 level and flip it as support before entering a position.

If Tornado Cash token can do and flip its market structure bullish – macro higher highs and higher lows – then the TORN price forecast would be better.

Only 11% of the total supply of 10,000,000 TORN tokens is unlocked – the circulating supply now is 1.1 million. Token unlocks can deflate price further.

One of the best performing assets currently is the native token of a centralized platform – Binance Coin – outperforming the native coins of DEX platforms like UNI, CAKE, DEFC etc. The main exchange TORN token is traded on is Binance, which now displays risk warnings for its TORN trading pairs.

The currently 2022 low for TORN against USDT on Binance is $15.63, hit in June 2022 when Bitcoin dropped to $17,600 and Ethereum under $900. TORN didn’t break that low this week, bouncing at $15.83.

Circle & Tornado Cash

Circle, the company behind USDC, has also blacklisted all Ethereum addresses owned by Tornado Cash – meaning USD Coin can’t be used on Tornado Cash anymore. The effect of that may not yet be priced in – it’s difficult to make a Tornado Cash price prediction after such as massive event.

Investors that rushed to buy the dip when Terra (LUNA) crashed 50% over the space of a few days lost a lot more as it went on to collapse over 99.99%.

There are both bullish and bearish cases for Tornado Cash. Some argue that a Tornado Cash ban and more regulation is a positive move for the reputation and continued legalization of cryptocurrency.

Governance tokens for decentralized stablecoin projects are up as much as 40% over the past week.

This follows $USDC issuer Circle blacklisting 44 Tornado Cash addresses that have been sanctioned by the US Treasury Department. pic.twitter.com/HVrrNfGqAu

— Delphi Digital (@Delphi_Digital) August 10, 2022

Since Circle made that move the market cap of decentralized stablecoins has significantly increased as investors divest from centralized stablecoins like USDC.

Tornado Cash Alternatives

Is Tornado Cash a good investment? It’s difficult to say until more price action plays out and the markets have had time to react to the recent FUD, and TORN forms a new trading range.

An alternative to trading, or holding an asset like Tornado Cash potentially for years hoping for a recovery, is to invest in a new crypto project at presale.

One we’re reviewed recently is Tamadoge, a high-utility meme coin and the rewards token of an upcoming play to earn crypto game.

Often the most explosive bull runs in crypto are not made by assets with interesting technology and applications in industry – although that was the case for e.g. Solana – but instead by meme cryptocurrencies with mass appeal.

Dogecoin and Shiba Inu for example outperformed the crypto market last year as retail investors FOMO’d into them. People that would ask ‘what is Tornado Cash’ and not understand its utility will hit market buy on a dog crypto with funny memes – that’s also the rationale billionaire Elon Musk gave on a recent Full Send podcast appearance.

Speculating on a new altcoin currently at presale or ICO is often more profitable than trying to make for example a long term Tornado Cash price prediction based the slow adoption of privacy tokens.

Related

- Crypto Personalities Subjected to Tornado Cash Inspired ETH Dusting

- Curve Finance Frontend Exploit Leads to 362 ETH Theft

Tamadoge - The Play to Earn Dogecoin

- '10x - 50x Potential' - CNBC Report

- Deflationary, Low Supply - 2 Billion

- Listed on Bybit, OKX, Bitmart, LBank, MEXC, Uniswap

- Move to Earn, Metaverse Integration on Roadmap

- NFT Doge Pets - Potential for Mass Adoption