Last Saturday, the former President of the United States and Republican candidate, Donald Trump, narrowly survived an assassination attempt during an in-person rally in Butler, Pennsylvania. The event was reminiscent of the attempted assassination of Ronald Reagan in 1981 (though Reagan was much more seriously injured).

The jaw-dropping incident sent shockwaves across the financial markets and, somehow oddly, triggered a three-day winning streak for Bitcoin (BTC) as market participants appear to have embraced political turmoil as a positive catalyst for digital assets as a whole and possibly as a tailwind to Trump’s campaign.

Foiled Trump Assassination Attempt Bolsters His Campaign

According to the latest reports, a 20-year-old boy named Matthew Crooks opened fire on Trump by using an AR-16 rifle from a nearby rooftop. The former president was hit in the ear but managed to escape the attack with just minor injuries.

However, one attendee was sadly killed as a result of Crooks’ actions and 2 more were critically injured. Meanwhile, right after being hit, Trump showed a remarkable display of resilience as he briefly stood up and raised his fist as a sign to his followers that he was alright and ready to fight any kind of opposition, even as blood was dropping off his ear. The image quickly went viral and immediately became the leading symbol for the Trump campaign.

Experts immediately claimed that Trump’s survival could bolster his presidential campaign as his followers may rally behind him if they believe this was not an isolated event but rather an attempt from conspirators to prevent him from returning to the Oval Office.

Meanwhile, despite the incident, Trump confirmed his attendance to key events including the upcoming Bitcoin Conference, which is scheduled to take place on July 27 in Nashville.

The Chief Executive Officer of BTC Inc., the company that organizes the event, confirmed: “I have just spoken with the President’s team. He is in good spirits and is excited to see you all in Nashville and deliver a speech that is heard around the world.”

Cryptocurrencies Rally Following Trump’s Attack

In the wake of the assassination attempt, cryptocurrencies went on to experience sizable gains both on Saturday and the days that followed. Bitcoin, the largest digital asset in the market, rose 2.3% on the day of the attack and accumulates gains of nearly 10% thus far since that day.

This is the first time that BTC has broken above the $60,000 barrier since July 2 when the token started to drift until hitting its lowest levels in 2 months. Thus far in 2024, Bitcoin is accumulating gains of 50% as digital assets have made a strong comeback on the back of expectations that the Federal Reserve will ease its monetary policy and possibly reduce interest rates in the second semester of the year.

Rich Rosenblum, co-founder of trading firm GSR, told Decrypt: “Political volatility is a catalyst for Bitcoin buying, and an assassination attempt on the leading Presidential candidate of the US is an affront to democracy globally and reminds people of just how fragile the status quo is today.”

Ether (ETH) the second largest cryptocurrency by market capitalization, managed to continue its latest winning streak as it has posted gains in 7 of the past 8 days. Since the attempt, its price has soared by 8.4% to $3,399. Same as Bitcoin, ETH accumulates gains of nearly 50% so far since the year started.

Meme Coins and Betting Markets Show Support for Trump

Cryptocurrencies associated with Trump or the Republican Party have experienced dramatic surges after the assassination attempt as well. The MAGA token ($TRUMP) is gaining 4.6% today and its market cap surged from $276 million to $367 million since Saturday resulting in a 33% gain in just three days.

Meanwhile, a meme coin called Doland Tremp ($TREMP) that features a cartoonish portrait of the former president also saw its price jump from $0.3861 on Saturday to $0.47 today for a 21.7% short-term gain.

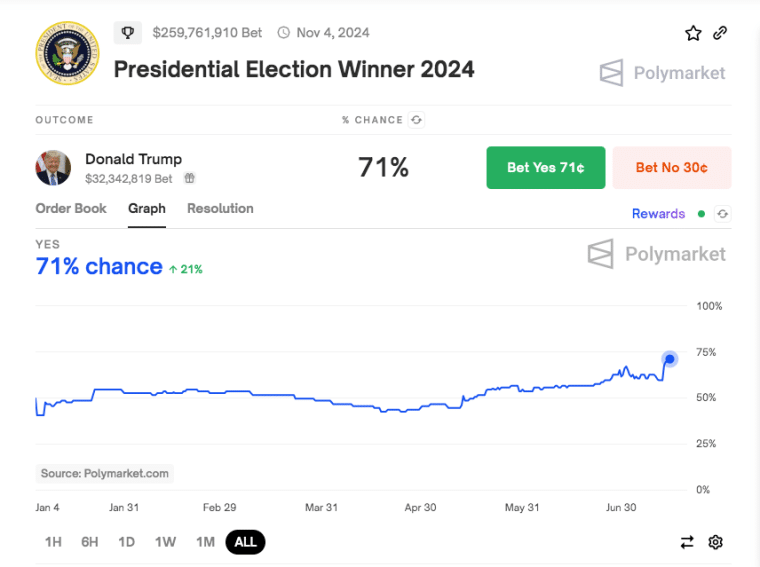

Most pundits and analysts argue that assassination attempt appears to have strengthened Trump’s position in the presidential race. Wagers on the blockchain-based predictions market Polymarket now give Trump a 70% chance of winning the November election, up from 60% before the incident.

This shift in his winning odds is significant for cryptocurrency markets due to the potentially significant differences between Trump’s and Biden’s stances on digital assets. Trump has recently positioned himself as a supporter of the cryptocurrency industry and has shown his positive view of the sector by becoming the first candidate to ever accept crypto donations for his campaign while also expressing support for Bitcoin miners.

In contrast, President Biden has advocated for tighter regulation of the cryptocurrency sector (though he hasn’t done much if anything to further this goal). However, crypto investors are likely expecting Trump to help pass a crypto-friendly bill that expands on the extremely vague securities laws that the SEC abuses to sue crypto companies.

Greg Magadini, director of derivatives at Amberdata, commented on the market’s reaction: “The biggest fundamental news over the weekend was the Trump assassination attempt. Absolutely insane. This has improved the odds of a Trump presidency. Trump being the pro-crypto president should help galvanize the cryptocurrency bids.”

The Attack Ripples Through All Markets

Trump’s assassination attempt has affected the markets beyond cryptocurrencies as the odds of him winning the presidential election have increased. The stock market opened the week with gain while the Chinese yuan and Mexican peso both weakened against the US dollar as market participants may fear that Trump will increase tariffs and renegotiate trade agreements as part of his “Make America Great Again” agenda.

Meanwhile, the Secret Service came under scrutiny as a result of the incident as videos circulated online about the attacker who was clearly visible on the rooftop from which he may have fired. Despite repeated calls from people who were hearing Trump’s speech in the surroundings, no law enforcement personnel or members of the Secret Service approached to remove the person from the premises.

The Service and the Federal Bureau of Investigation (FBI) have launched independent investigations to clarify what happened.

The intersection of politics and finance, exemplified by the surge in “Trump trades” and crypto assets, showcases the complex relationship between political events and market movements. As the 2024 election approaches, it’s clear that the cryptocurrency market will remain highly sensitive to developments in the political arena.