A new rumor concerning Donald Trump’s campaign is making the headlines and it involves a controverted strategy that the former president would allegedly make Bitcoin a part of a strategic reserve for the United States.

These reports appear to have their origin in the comments made by the co-founder of the non-profit organization Satoshi Act, Dennis Porter. He said in a lengthy post published on the social media platform X (formerly Twitter) that the president’s team was actively considering such a move.

HUGE BREAKING: Trump to announce a USA #Bitcoin strategic reserve in Nashville 🇺🇸 – Sources

— Dennis Porter (@Dennis_Porter_) July 18, 2024

He cited anonymous sources from within Trump’s inner circle and went on to share his insights, stating: “Adding #Bitcoin as a ‘strategic reserve’ to the US Treasury is a no brainer and once the USA does it, the paradigm will shift and the world will understand they must also have a #Bitcoin position. When the USA leads, the world follows.”

Porter claims that Trump’s team may be gearing up to make the announcement during the upcoming Bitcoin 2024 Conference in Nashville – a widely-followed industry event organized by BTC Media LLC.

In 2021, the President of El Salvador, known for being one of the few world leaders who openly supports Bitcoin, used this conference to announce that his country would adopt BTC as a legal tender.

Making such a bold announcement about BTC would be in line with Trump’s latest supportive comments about digital assets and the industry as a whole.

During a fundraising event held in early June, the Republican candidate referred to himself as the “crypto president”.

Moreover, he named JD Vance, a well-known supporter of the crypto space, as his Vice President.

These moves have all been interpreted by the crypto community as clear signs that Trump is ready to embrace digital assets and support the development of the entire industry (though some crypto experts are hesitant that voting him in would be worth the other consequences).

How Would a Bitcoin Strategic Reserve Work?

Establishing Bitcoin as a reserve asset for the United States government is not a new proposal.

Vivek Ramaswamy, a former presidential candidate and one of Trump’s advisors on the topic of digital assets, floated a proposal that would consist of the creation of a strategic fund backed by various commodities including Bitcoin that would help stabilize the value of the US dollar over time while also combating inflation.

If Trump were to pursue this strategy, one potential avenue for implementation could be through the Exchange Stabilization Fund (ESF) at the US Treasury. “The ESF provides the Treasury with a tool to engage in currency and gold operations to influence exchange rates and promote stability in the foreign exchange markets,” Porter highlighted.

#Bitcoin is a strategic asset.

The world is beginning to realize this.

Now the USA has a shot to lead the globe.

Don’t blink, you will miss history.

— Dennis Porter (@Dennis_Porter_) July 18, 2024

He also outlined several potential approaches that the Trump administration could take to integrate Bitcoin into the ESF:

- Holding Bitcoin as a Reserve Asset: “The ESF could start by holding Bitcoin as part of its reserve assets, similar to how it holds foreign currencies and gold.”

- Bitcoin Interventions: “The ESF could use Bitcoin in its interventions to stabilize the dollar or other currencies.”

- Liquidity Provision: “During periods of financial stress, the ESF could provide liquidity in Bitcoin to markets or institutions in need.”

- Policy Coordination: Any move to integrate #Bitcoin into the ESF would require close coordination with financial regulatory bodies to ensure the process is smooth and consistent.”

In addition, Porter signaled that the United States government already owns approximately $5.5 billion worth of BTC that have been seized by various law enforcement agencies. These could be transferred to the Treasury Department via an executive order, forming the foundation of a Bitcoin strategic reserve.

Many Experts Support Adding BTC as a Reserve Asset – Here’s Why

The potential for Bitcoin to become a strategic reserve asset has sparked discussions among experts in the cryptocurrency and financial sectors.

Tayler McCracken, Editor-in-Chief at Coin Bureau, suggests that Bitcoin could eventually become a global reserve currency.

He highlighted that embracing BTC as a reserve currency could “reshape our reality” as this system would “eliminate inflation, currency manipulation, and government restrictions on bank access.”

McCracken believes that even though it may take a while for governments to fully embrace BTC to this extent, the latest decline in the public’s trust in fiat currencies may accelerate the process.

As a result, central banks may be forced to progressively incorporate BTC into their reserves. He estimates that the digital asset may, at some point, account for 2% to 5% of the assets owned by these powerful institutions.

“The risk of not adopting Bitcoin is too significant to be overlooked and we are seeing nations waking up to that fact. It’s similar to the Artificial Intelligence adoption trends we are seeing,” he argued.

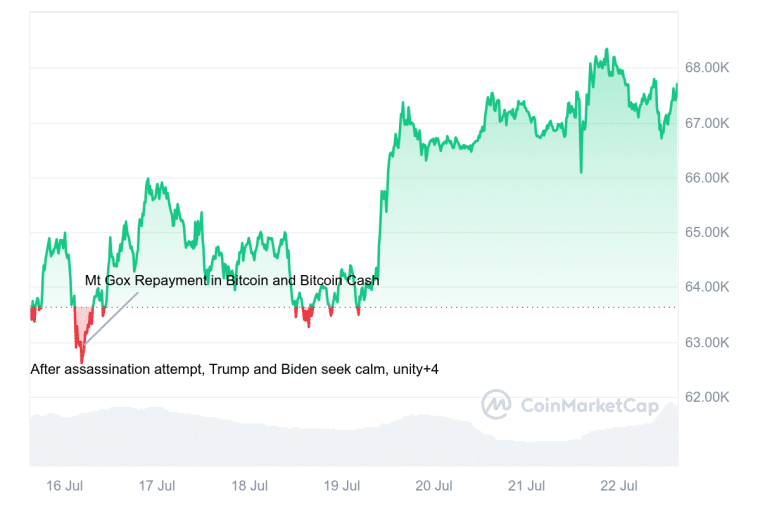

BTC Prices Rise by 6% in the Past 7 Days

The rumors surrounding Trump’s potential Bitcoin strategy have already had a noticeable impact on the cryptocurrency market. Bitcoin’s price has experienced a significant increase in the past 7 days, adding almost 6% to its value during that period.

Markus Thielen from the crypto-focused research firm 10x Research said that Bitcoin’s price had already been positively impacted when Trump took office the last time. He said that BTC rose by 1,900% during the president’s previous tenure.

Meanwhile, he said that the decision to incorporate BTC into the United States’ strategic assets’ reserve would be positive as it would reduce the country’s “reliance on traditional assets like hold and foreign currencies.”

He claims that the federal government currently holds 212,000 BTC tokens that are worth around $15 billion.

“If the USA can be bold and lead the world here, we will have a strategic #Bitcoin advantage that could bolster the US economy and the dollar for decades to come,” Satoshi Act’s Porter further commented.

“People don’t believe the USA could implement a bitcoin strategic reserve but at this point it is inevitable,” he concluded.

On the popular prediction market platform Polymarket, users have already dumped thousands of dollars into bets surrounding this question. However, only 23% of bettors have said “Yes” to the possibility that Trump will announce a strategic Bitcoin reserve.

Thus far, the wager has attracted almost $100,000.

The deadline for an outcome is July 28. “The primary resolution source for this market will be official recordings or transcripts of any such speech, however a consensus of credible reporting will also be used,” the wager reads.

Congress and the Federal Reserve Will Still Have to Approve a BTC Reserve

Although the idea of classifying BTC as a reserve asset is interesting and may be supported by experts and financial professionals, it will face a steep climb to be implemented in practice.

Any significant changes to the composition of the ESF may require the approval of Congress. Moreover, the Federal Reserve is in charge of overseeing the country’s reserve assets pool and it may deal with unprecedented challenges to develop policies to deal with such a novel and highly volatile asset like BTC.

In addition, BTC is not a physical asset and its ownership is determined by the records held within its decentralized ledger – known as the blockchain.

Even though the consensus is that blockchain records cannot be tempered, it is hard to imagine that the United States government will fully rely on this collective opinion as the basis for investing billions of dollars in BTC.

As the cryptocurrency community eagerly awaits Trump’s appearance at the Bitcoin 2024 Conference, speculation continues to mount about the possibility that he could announce his intentions of creating such a reserve.

While the idea that Bitcoin will become a strategic reserve asset for the United States remains hypothetical at this point, the mere possibility has already had a significant impact on the market’s sentiment and the price of the digital asset.

Final tip: As rumors of a Bitcoin strategic reserve circulate, securing your crypto assets becomes a crucial part of your investment strategy. Best Wallet offers top-notch security and user-friendly features. Discover more on their website.