The US Securities and Exchange Commission (SEC) has filed a notice of appeal to the Second Circuit Court of Appeals, challenging Judge Analisa Torres’ ruling in its case against Ripple Labs. This move comes nearly two months after the judge’s final judgment in the regulator’s four-year-old case.

The SEC’s decision to appeal follows a July 2023 ruling where the judge determined that, although Ripple violated federal securities law through its institutional sales of XRP, its programmatic sales to retail exchanges did not violate securities rules.

An SEC spokesperson stated: “We believe that the district court decision in the Ripple matter conflicts with decades of Supreme Court precedent and securities laws and look forward to making our case to the Second Circuit.”

The statement highlights the agency’s determination to challenge the ruling as it is inconsistent, in their view, with existing legal precedents.

In December 2020, the SEC filed a lawsuit against Ripple Labs and its top executives claiming that they engaged in the sale of unregistered securities by offering XRP tokens to retail investors.

Judge Torres emphasized in her 2023 ruling that, upon applying the Howey test, this financial asset did not qualify as an investment contract – a distinction that was crucial to the SEC’s core complaint. As a result, the court determined that the sale of XRP was not in breach of US securities laws.

However, the judge also ruled that early sales from Ripple founders to institutional investors did constitute securities sales due to the manner in which they were conducted. The company was fined $125 million and issued an injunction that forces Ripple to register any securities that they intend to sell in the future.

This decision highlighted the complexity of applying traditional securities laws to the rapidly evolving cryptocurrency market.

Ripple v. SEC Case Could End Up in The Supreme Court

The SEC’s decision to appeal has several potential implications for the cryptocurrency industry. It prolongs the period of regulatory uncertainty for XRP and potentially other cryptocurrencies, which could impact investment decisions and market dynamics in the crypto space.

If the appeals court overturns or significantly modifies the district court’s ruling, it could set a new precedent for how cryptocurrencies are classified and regulated under U.S. securities laws.

The outcome of this appeal could influence other ongoing and future legal battles between the SEC and crypto companies. In addition, if the case continues to be contested, it is possible that it could eventually reach the Supreme Court. This would lead to a definitive ruling on the status of cryptocurrencies under US securities law.

The appeal process opens up several possible scenarios, each with its own set of implications. If the appeals court upholds Judge Torres’ decision, it would strengthen the precedent that programmatic sales of cryptocurrencies to retail investors may not constitute securities offerings.

Also read: Is The SEC Changing Its Tune on Crypto? Claims it Regrets Confusion it Caused

The crypto community would see this as a positive development as it would open up the pathways for companies to safely engage in similar offerings in the future. However, if the appeals court sides with the SEC, it could give the regulator additional authority to classify these assets as securities and treat them – and the companies that issue them – accordingly.

Alternatively, the case could be sent back to the district court for additional fact-finding or reconsideration of specific issues. Any of these outcomes could have a far-reaching impact on the cryptocurrency market and may influence how digital assets are classified, offered to the public, and traded.

XRP Token Drops by 8% Following the News

News of the appeal quickly prompted an 8% decline in the value of XRP, which is now trading at around $0.52 per coin. In the past 7 days, the token accumulates a loss of nearly 11% as a result of the weakness that the market has experienced as a whole following the Federal Reserve’s decision to slash its interest rate by 50 basis points.

Just before the SEC’s announcement, Bitwise Asset Management had submitted a registration filing for what would be the first XRP ETF.

Ripple’s leadership has responded to the SEC’s appeal with a mix of disappointment and defiance. CEO Brad Garlinghouse stated on X (formerly Twitter): “XRP’s status as a non-security is the law of the land today – and that does not change even in the face of this misguided – and infuriating – appeal.”

He further criticized the SEC’s decision, saying: “If Gensler and the SEC were rational, they would have moved on from this case long ago. It certainly hasn’t protected investors and instead has damaged the credibility and reputation of the SEC.”

(1) The SEC's decision to appeal is disappointing, but not surprising. This just prolongs what's already a complete embarrassment for the agency. The Court already rejected the SEC’s suggestion that Ripple acted recklessly, and there were no allegations of fraud and, of course,… https://t.co/PQozMMtthf

— Stuart Alderoty (@s_alderoty) October 2, 2024

Meanwhile, Stuart Alderoty, Ripple’s Chief Legal Officer, called the appeal “disappointing, but not surprising.”

Also read: SEC Approves Options Contracts for Spot BTC ETF IBIT

He mentioned that Ripple is evaluating whether to file a cross-appeal, suggesting that the legal battle may continue on multiple fronts. The crypto industry is tracking all of these developments as a new chapter in this legal saga opens up.

SEC Enforcement Chief Departs On the Same Day the SEC Files Appeal

The SEC’s decision to appeal the Ripple ruling comes at a time when the agency’s approach to cryptocurrency regulation has been under scrutiny. Under Chair Gary Gensler, the SEC has been criticized for its “regulation by enforcement” strategy, which some in the industry argue has created an unclear and challenging environment for crypto businesses.

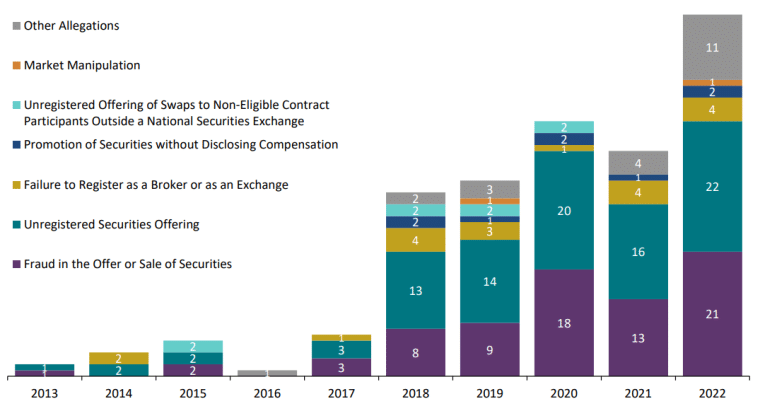

Interestingly, on the same day that the SEC filed its notice of appeal, the agency announced that its chief enforcement officer, Gubir Grewal, would be stepping down. Grewal, who has been criticized for bringing numerous enforcement actions against the crypto industry, oversaw more than 100 separate enforcement actions during his tenure.

The timing for this change in leadership may not be a coincidence. Grewal will be replaced by Sanjay Wadhwa – the division’s deputy director. However, the decision to appeal suggests that the SEC remains committed to its current enforcement strategy in the near term.

“From recalibrating penalties and remedies to confronting emerging risks to holding issuers, insiders, and gatekeepers accountable, I am incredibly proud of all that we’ve accomplished as a Division during my tenure,” Grewal mentioned in a statement that accompanied the announcement.

The SEC’s appeal of the Ripple ruling marks a critical juncture in the ongoing rifts between regulators and the crypto industry. As the case moves to the appeals court, it carries with it the potential to reshape the regulatory landscape for digital assets in the United States.

The outcome of this appeal could have far-reaching consequences, not just for Ripple and XRP, but for the entire crypto ecosystem.

The case underscores the ongoing challenge of applying traditional securities laws to innovative technologies and highlights the need for clear, forward-thinking regulation that balances investor protection with innovation.