Approximately the entire Internet is buzzing with excitement over Facebook’s pending IPO, set to debut this Friday with a valuation in the neighborhood of $100 billion cash money dollars. While the hype is staggering, most people know that huge buildups often lead to huge disappointments. Could we be in for the granddaddy of all let downs?

Following Up with the Famous

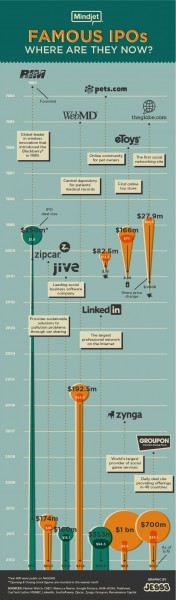

Since history often repeats itself, we looked to JESS3 to help us put together an infographic that examines the outcome of a few well known IPOs (click to expand):

Note that the only companies whose investor returns have seen an increase since going public are those that focus on corporate users and business folk.

Obviously hype doesn’t help numbers. The press was all over Groupon when it dissed Google’s purchase offer and instead continued down its own public path. It was considered brave at the time, but now that the company is trading at roughly half of its debut price, many wonder if it was the right move. Zynga, an immensely popular gaming company (responsible for a whopping 19 percent of Facebook’s revenue in 2011) is another recent and surprising disappointment.

Meanwhile, Jive, RIM and LinkedIn are all currently enjoying a trading price that is higher than it was when they made their first public appearance.

This paradox hasn’t gone unnoticed. Tableau Software Inc., for example, offers a very cool interactive report on “The Forgotten Enterprise IPOs” here.

Facebook as the Exception?

If the trend continues, then we can ultimately expect to see a dip in Facebook’s valuation. But then again, the social network has been something of an exception since inception (please forgive the rhyme).

Even its route to IPO-land has been an unusual one. Most technology startups with sizable audiences either seek a buyer or go public as quickly as possible. Facebook has done neither of those things, choosing instead to focus primarily on building up its user base and business model. While this makes for a much more mature debut than than the typical consumer-focused IPO, one could also argue that it means much less growth potential.

The uncertainty surrounding this move is being reflected pretty much everywhere. Bloomberg and Reuters are even battling it out with titles like Facebook IPO Said to Get Weaker-Than-Forecast Demand and Facebook’s IPO Already Oversubscribed: Source, respectively.

Place Your Bets

If there’s one thing we can be sure of in this rare intersection of Wall Street cats, Silicon Valley nerds, and everyone in between, it’s that it will be the ultimate test of Mark Zuckerberg’s genius. And I hope that the lessons we learn from the outcome, whatever that outcome may be, will far outweigh any commentary about what one should or shouldn’t wear in a board room.

Care to share which side of the fence you’re on? Please do in the comments below.

Infographic from Mindjet