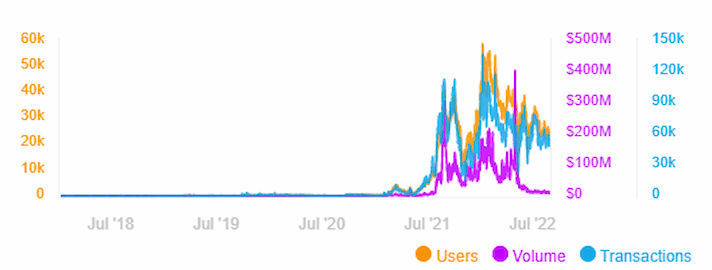

Market analysis confirms that daily non-fungible token (NFT) trading volume on the world’s largest NFT marketplace OpenSea, has plunged approximately 99% in the past 90 days from its previous record high in earlier May.

Data acquired from DappRadar confirmed that daily NFT trading volume on the OpenSea marketplace declined approximately 99 percent from its record high of $405.75 million on May 1 to only $5 million on August 28.

According to many industry experts, the recent general crypto market meltdown that left the flagship crypto “Bitcoin” trading below $20,000 earlier this week might have aggregated to the poor performance. Many investors and institutions have recently shifted their focus to less risky digital assets.

Data analysis reveals that the number of users and transactions has also dramatically shrunk over the same period. DappRadar analysis suggests that the crypto winter has also impacted value and interest in blockchain-based digital assets in recent months.

Crypto Winter’s Impact On Workforce

Unfortunately, the massive decline in daily trading volume has attracted OpenSea to slash some of its workforce. In a recent exclusive interview, Devin Finzer, the CEO of OpenSea, confirmed that the NFT marketplace has laid off 20% of its workforce. The top executive cited that the company needs to adapt to the current crypto market condition:

“We need to prepare the company for the possibility of a prolonged downturn.”

In the same context, other notable companies, including Coinbase, Gemini, and BlockFi, announced laying off some of their staff members, citing the same concerns.

It’s worth noting that the recent massive decline in NFT trading volume appears almost the same time the value of stocks experienced a drastic drop over panic selling off of more risky digital assets. In this case, many investors feared that the soaring inflation might force the U.S Federal Reserve to aggressively raise interest rates and drive the economy into a recession.

Crypto Winter’s Impact On NFT Floor Prices

According to DappRadar, the recent general crypto market meltdown has also impacted the minimum prices of many NFTs. In this case, many top collections have seen a severe downturn in volume and sales in the past 90 days.

The famous Bored Ape Yacht Club (BAYC) NFT is a perfect example, experiencing more than a 15% drop in daily trading volume in the past 30 days. Its floor price dropped by 53% to 72.5 ETH on August 28 from a high of 153 ETH on May 1.

CryptoPunks NFT collection is another example, plunging almost 20% from its all-time minimum price of 83.72 ETH in July.

Elsewhere, the search volume of NFT- related terms has also experienced a severe decline over the past three months. According to NonFungible.com, a platform tracking the performance of the NFT market, the search volume has dropped roughly 80% from its previous peak levels.

Tamadoge is another meme-themed token that has been performing well despite the recent general crypto downturn. Tamadoge has already raised more than $9.3 million from presale.

Related

Tamadoge - The Play to Earn Dogecoin

- '10x - 50x Potential' - CNBC Report

- Deflationary, Low Supply - 2 Billion

- Listed on Bybit, OKX, Bitmart, LBank, MEXC, Uniswap

- Move to Earn, Metaverse Integration on Roadmap

- NFT Doge Pets - Potential for Mass Adoption