AI is radically transforming the way banks operate. From higher revenues to more personalized, rewarding customer interactions, its technologies are giving banks the edge to thrive in a highly competitive industry.

As the banking sector undergoes disruption, keeping up with all the latest developments can be quite challenging. That’s why we’ve put together a comprehensive report detailing over 80 AI in banking statistics.

Keep reading to discover the current state of AI in banking, how the industry will change, and more.

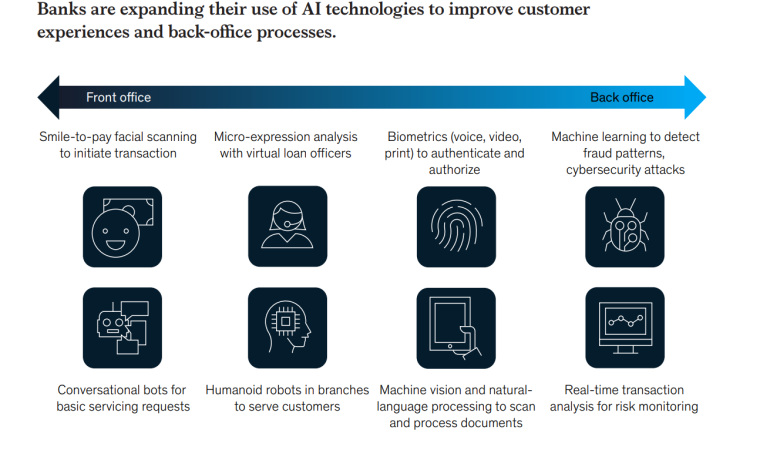

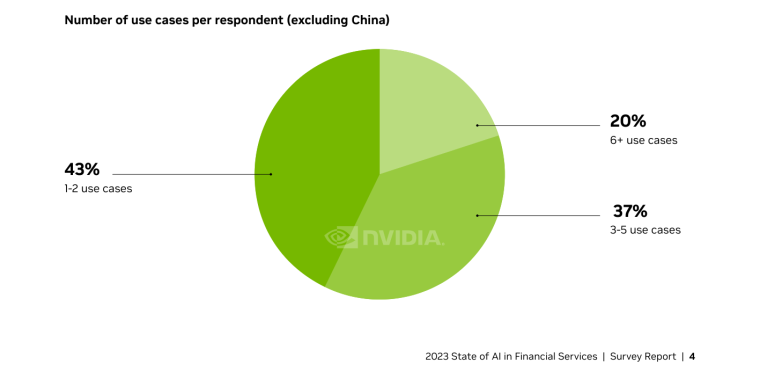

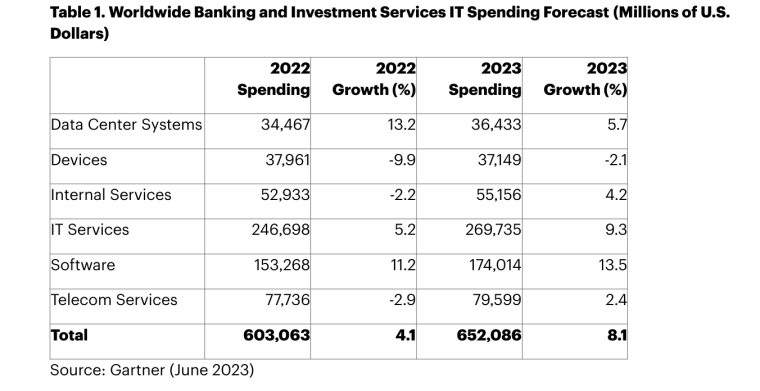

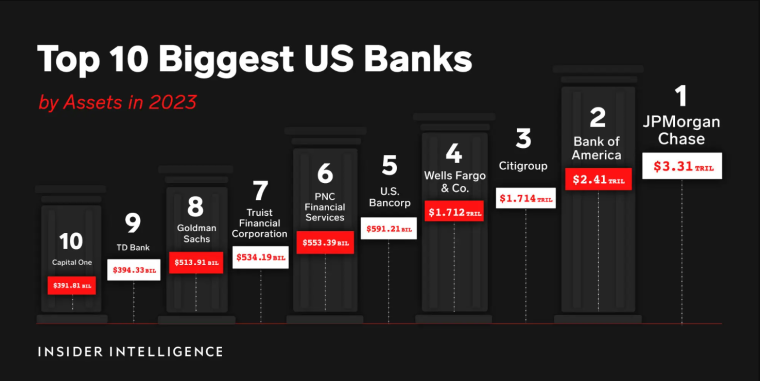

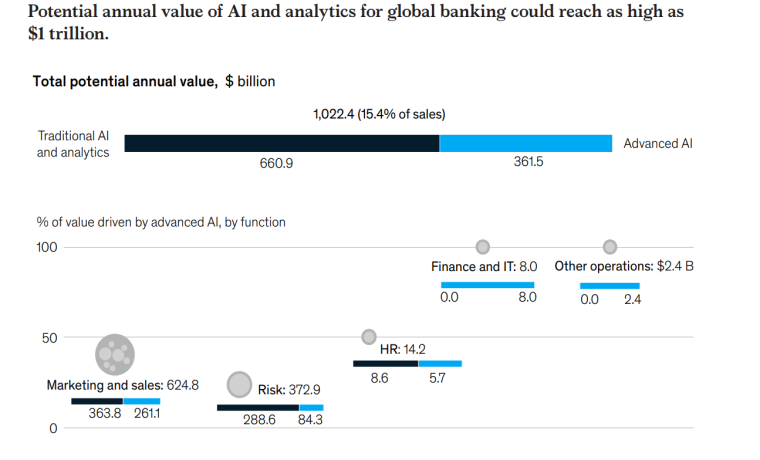

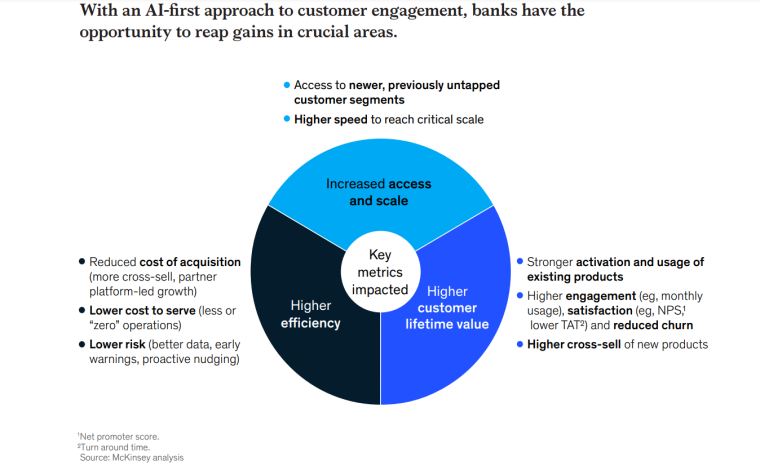

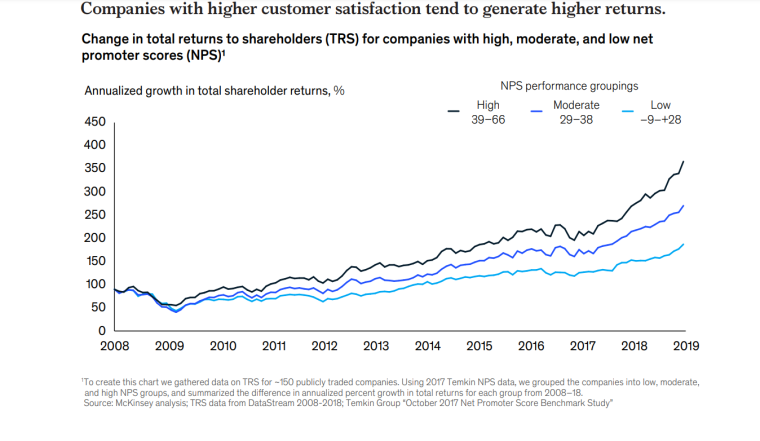

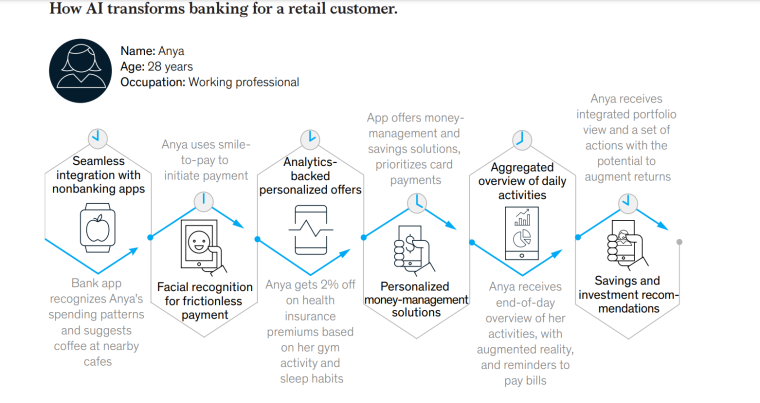

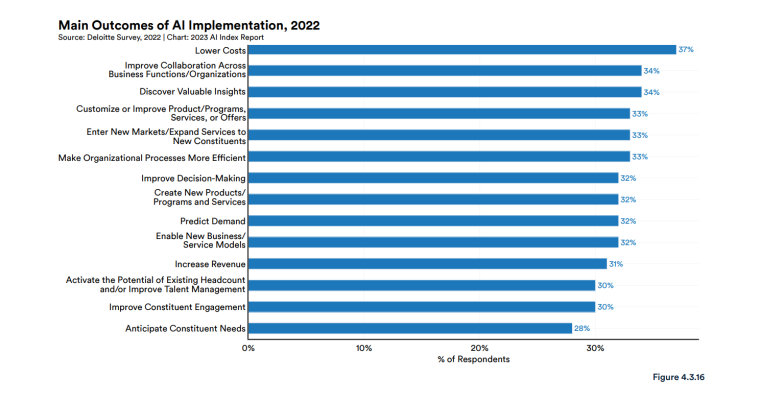

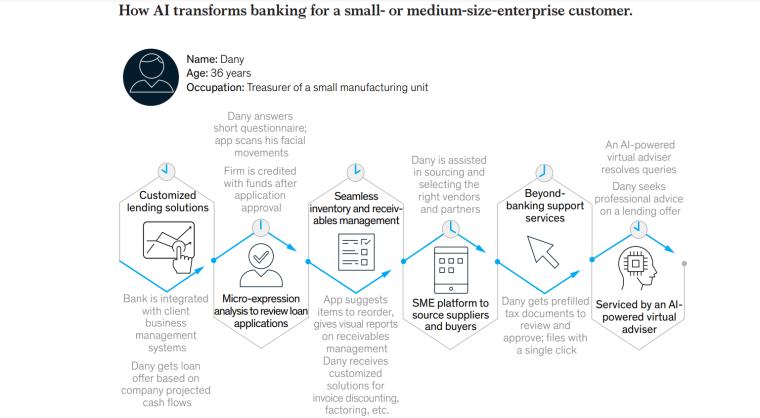

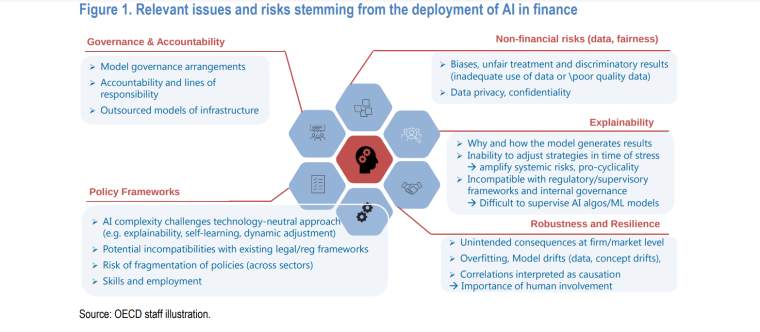

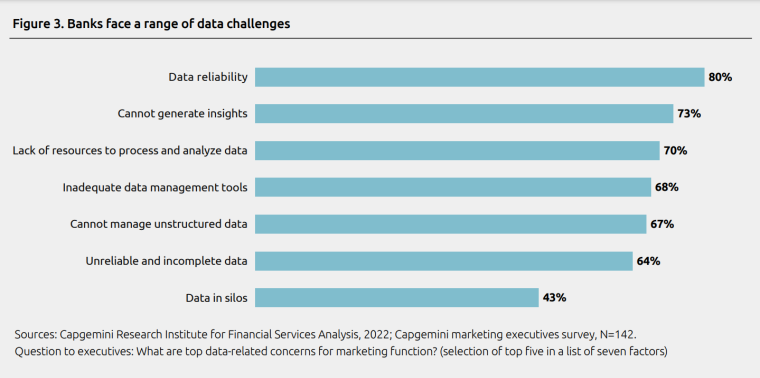

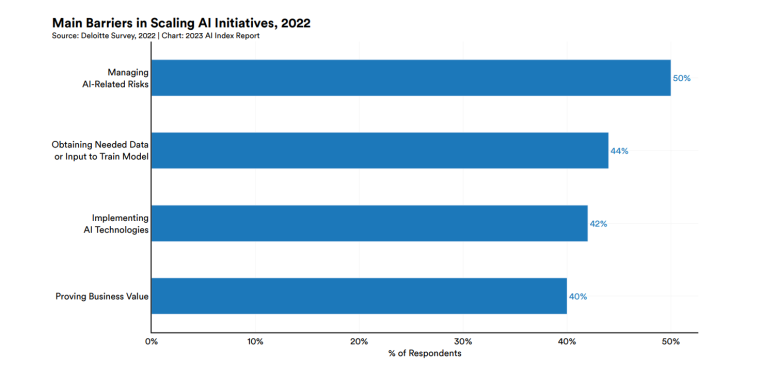

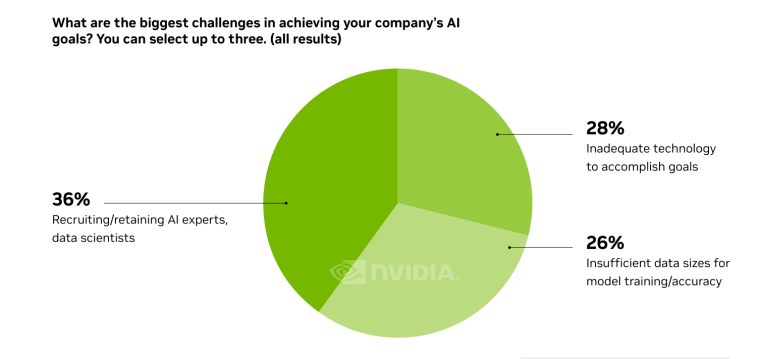

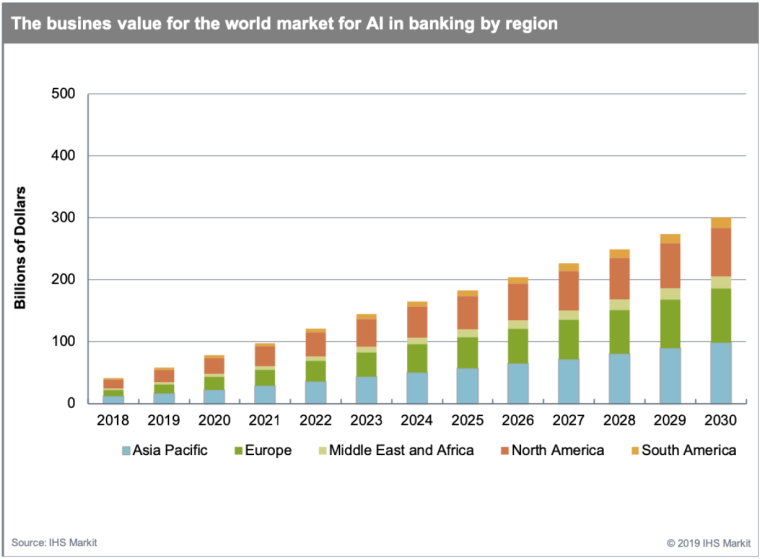

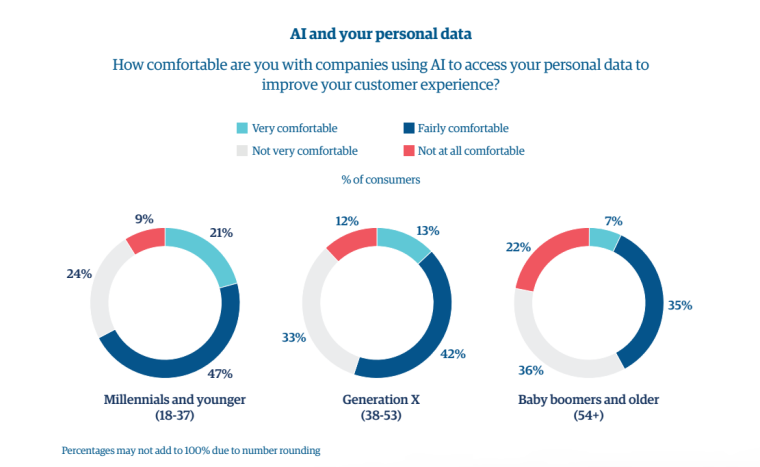

Globally, artificial intelligence (AI) is increasingly being implemented throughout the entire banking value chain, including the front, middle, and back offices. In 2021 alone, banks invested $124 billion in new technology, a 24% increase from 2019 and a testament to the potential of AI in banking. Disruptive AI technologies are being used to achieve excellence in areas such as profits, personalization, omnichannel experiences, innovation, security, and more. It’s no wonder 90% of C-suite executives believe AI is the next technological revolution. Key underlying AI technologies used in banking include: According to research by Forrester, banks are prioritizing their spending across 30 different AI technologies. However, the six key AI technologies decision-makers are backing to get results in 2023 are: According to Accenture, 57% of banks had AI in wide use or at scale compared to an average of 60% for other industries in 2022. This represents a major leap from 2020 when 32% of banks used AI technologies such as predictive analytics, voice recognition, and others to gain a competitive advantage. SAS surveyed over 300 banking executives across the world and found that 74.5% of respondents cited external communications (marketing, social media, and public relations) as the key functional area for deploying AI. This was followed by marketing and sales (70.6%), customer interactions (e.g. chatbots) at 66.7%, and security or fraud detection (62.8%). The same report also revealed that the most common AI initiatives were: According to a 2022 Business Insider report, most banks implemented AI technology in business domains like risk management (56%) and revenue generation (52%). The report also found that: Nearly 60% of financial-services sector respondents in McKinsey’s Global AI survey reported that their companies have embedded at least one AI capability. The most commonly used AI technologies include: A report by Temenos revealed that 58% of banks rely heavily on AI for fraud detection, and a further 32% use it to at least some extent. The report also found that AI is increasingly being used across a range of innovative use cases. However, banks are treading with caution as AI adoption faces increasing regulatory complexity and customer skepticism. Other key findings include: Research by Gartner reveals that global banking and investment services IT spending is estimated to hit $652.1 billion in 2023, an increase of 8.1% from 2022. With an increase of 13.5% in 2023, spending on software will see the largest growth. In addition, banking and investment services executives plan to spend the largest amount of new or additional funding in 2023 on cybersecurity, data and analytics, integration technologies, and cloud. Following a directive issued by Congress in the National AI Initiative Act of 2020, The National Institute of Standards (NIST) released a framework for organizations developing or using AI systems in January 2023. Through the framework, the federal government agency aims to cultivate trust in AI technologies and promote innovation while mitigating risk. Laurie Locascio, Director of NIST, emphasized the significance of this endeavor, calling it a crucial step toward cultivating public trust in AI technologies. “This work is critical in the AI space to ensure public trust of these rapidly developing and evolving technologies.” While acknowledging the transformative potential of AI across various sectors, Locascio noted the importance of a nuanced approach. “If we’re not careful, and sometimes even when we are, AI can exacerbate biases and inequalities that already exist in our society,” Locascio said. “The good news is that understanding and managing the risks of AI systems will help to enhance their trustworthiness. And this in turn, will cultivate public trust in AI to drive innovation while preserving civil liberties and rights.” The top four US banks that accounted for 50% of all US banking assets in 2022 also lead the pack in terms of tech adoption and spending. The US banking industry is dominated by four large banks: JPMorgan Chase, Bank of America, Wells Fargo, and Citigroup. These four banks are not only the leading banks on a domestic scale but are also among the largest banks in the world, with JPMorgan Chase being the largest bank in the world by market capitalization. In 2023, these industry leaders increased their tech spending to meet the growing demand for more customer-centric solutions and to compete with neobanks and fintech firms. North American banks published 80% of all bank AI research and made 60% of all bank AI-related investments in 2022 while filing 99% of all AI-related bank patents in 2021. JPMorgan Chase led the field in research, Capital One led in patents, and Wells Fargo led in investments. JPMorgan Chase is using AI and machine learning technology to provide next-generation banking solutions focusing on anti-fraud, customer experience, and policy compliance. According to CB Insights, JPM spent over $12 billion on AI and had 115 major AI projects in production in 2021. A key AI in banking example for this institution is Safetech Fraud, an anti-fraud solution for e-commerce merchants that uses AI to identify fraudulent behaviors like card testing. Another is Reonomy, a platform that uses machine learning to collate property data from public and private sources and provide in-depth property insights to commercial real estate clients. Capital One uses AI for everything from improving the mobile app experience for consumers to building internal developer tools for its own engineers. Capital One is the leading applicant of AI patents in the US, having submitted over 430 as of 2022. The bank founded the Capital One Center for Machine Learning to focus on areas such as graph machine learning, AI explainability, anomaly detection, and natural language processing. Notably, the bank uses machine learning to power applications such as Capital One’s Auto Navigator (lightning-fast auto loan approvals). In 2022, the bank piloted augmented reality features that allow users to scan a car they see and get information about its make, model, and financing options. It also built an internal ML tool for its DevOps engineers to help identify mobile app issues and respond to app failures in real-time. Citibank is leveraging AI and machine learning technologies to drive innovation in its banking operations. Citibank’s leading AI solutions include document digitization, customer service chatbots, an integrated mobile app featuring a conversational interface for customer inquiries, and fraud detection for efficient risk management. In 2018, the bank developed a solution called Citi Smart Match that leverages AI and machine learning technology to increase the efficiency of matching open invoices to payments received for its corporate clients. Wells Fargo is using AI technologies such as machine learning, deep learning, natural language processing, facial recognition, and chatbots to maintain its position as a market leader. These technologies help the bank improve its business processes, increase automation, enhance customer interactions, and predict customer needs. Wells Fargo has launched several AI-powered tools over the years including virtual assistant Fargo and the Customer Engagement Engine (CEE). CEE relies on modeling and adaptive machine learning to identify customer signals in real-time conversations and offer tailored responses. Since 2018, the bank has also provided an AI-powered predictive analytics tool through its mobile banking app. Bank of America leverages customer intelligence to personalize product offerings. Backed by AI, its integrated loyalty program has achieved a 99% retention rate and doubled the number of products held by each customer participating in the scheme. The bank also created myCTO, which uses automation, AI, and machine learning to monitor, identify, and address client issues before they become problems. In July 2023, Bank of America used AI, virtual reality, and the metaverse to train new hires. US Bancorp makes use of AI automation, machine learning, and voice AI to enhance fraud detection and make customer onboarding and transacting as seamless as possible. In June 2023, US Bancorp launched an AI-powered travel payments and management platform for emerging middle-market companies or firms generating less than $150 million in yearly revenue. Banks that focused on using AI benefited from market valuations that were 18% higher in 2019, and 27% higher in 2020. Across more than 25 use cases, AI technologies can help banks boost revenues through: According to the Stanford 2023 AI Index, the top outcomes achieved by embracing AI solutions include: By automating the processes that account for a large share of bank costs, AI can deliver major cost reductions. In fact, 51% of banks cite cost savings as the primary benefit of adopting AI. Additionally, in the US, mid-sized banks can expect to achieve a 2-3% cost-income ratio reduction, equivalent to $250 million to $750 million in incremental annual value by adopting AI. Banking executives found that investment in AI helped them reduce production costs by 13%. In the banking industry, competition is fierce, and switching providers has never been easier. A crucial part of staying ahead of the competition is re-imagining customer experience. Through the use of AI, banks are able to focus on customer experience and move towards holistic and hyper-personalized solutions. In fact, 46% of respondents in Nvidia’s 2023 State of AI in Financial Services survey stated that deploying AI improved customer experience. Organizations that are using AI to reinvent themselves outperform industry peers by 31% in terms of ‘experience’ metrics. AI can generate customer insights that can be used for more personalized communication, advice, offers, and services. Accenture’s payments survey found that 60% of consumers would value a single app that tracks payments from all payment providers. The rise of fintech has resulted in customers using a host of financial services offered by different providers. For example, a customer might use a provider for buy now, pay later (BNPL) transactions, another to make regular purchases, and another to trade cryptocurrencies. The downside is that 32% of customers often lose track of their financial products and services. More than 55% would use an app or service that offers a single aggregated view of all their financial products and services. A key benefit of AI is that it can power such platforms, allowing consumers to better manage their financial relationships. Nearly 50% of respondents in a Capgemini survey said their banking relationships were not emotionally connected or well-integrated into their lifestyles. Additionally, 52% said banking was not fun, while a majority said their banks didn’t offer the seamless experiences, personalization, and innovation they expected. AI could help turn this around by providing seamless, hyper-personalized solutions that keep customers engaged. In 2021, the average net promoter score (NPS) score for US banks was 34 on a scale of 100 – less than half that of the average fintech firm. With AI, banks can eliminate the silos isolating their products and channels, allowing them to offer more holistic solutions that combine credit, debit cards, mortgages, and other products, through physical and digital touchpoints. The use of AI in banking systems also provides a way to automate processes and significantly reduce error rates – all without increasing complexity or cost. Labor-intensive work like compliance reporting and new customer onboarding can become highly accurate, efficient, and cost-effective, ultimately resulting in productivity gains. AI can help automate the top 20% of back-office work that accounts for 85% of bank costs. When it comes to consumer lending alone, more than 20 decisions across the life cycle can be automated. Accenture states that additional productivity and efficiency gains of up to 50% can be seen in banks leveraging AI. A report by IBM further highlights that AI can lead to productivity gains in the following ways: Considering that less than 1% of all global money-laundering activity is detected, fraud detection is one of the most common use cases for AI in banking. Through the use of AI, banks are reaping benefits such as reduced losses, more efficient use of resources, and enhanced customer experience. 77% of risk leaders believe that new, complex, interconnected risks are emerging more rapidly than ever before. As operational risks for banks evolve, AI’s capabilities in real-time fraud detection and management are garnering interest from players of all sizes in the banking industry. Online payment fraud losses are expected to jump to $48 billion per year by 2023. As consumers look to banks and other financial services for more secure accounts, AI will continue to play a critical role in safeguarding their data and assets. The use of AI enables banks to manage huge volumes of data at record speeds to develop a better understanding of customers. But that’s not all, McKinsey discovered that harnessing big data can result in a productivity boost and cost savings of up to 25%. 71% of banks are now designing their operating model based on data, rather than on executive experience or intuition. AI gives banks the power to make data-driven decisions, which ultimately leads to better decision-making. These same prediction capabilities also help banks: When bank professionals were asked about the biggest challenges in achieving their AI goals in 2023, insufficient data sizes for model training and accuracy made the top 3 at 26%. Using AI, banks can generate synthetic data that can be used to augment existing data sets in terms of scope and diversity. This will help improve the performance and accuracy of AI models, giving banks the ability to harness the power of AI. AI helps banks compete and thrive in an increasingly fragmented industry. Its ability to increase competitiveness comes as banks face challenges on multiple fronts. As per the Economist Intelligence Unit, 77% of bankers believe that the ability to leverage AI will be the difference between the success or failure of banks. In capital markets, many banks trade at a 50% discount to book, and 25% of banks worldwide earn returns on equity that fail to cover their cost of equity. Traditional banks also face diverse competitive threats from fintech firms, neobanks, and other non-bank challengers. By incorporating AI into their operations, banks can compete with fintech firms and offer innovative solutions that encourage loyalty. At the start of the pandemic, global use of online and mobile banking channels increased by 20 to 50%. As consumers increase their use of digital banking services, they tend to expect more, especially when considering the innovative solutions driven by fintech players. Through the use of AI, banks can create new models and value propositions that boost their competitiveness. According to Accenture, the share of revenue of traditional banking products such as auto lending, consumer finance, and mortgages that are sold through non-banking channels will increase by 3 to 5% by 2025. This is a significant departure from the years when banks only competed with other banks through long-established channels. As non-traditional financial services businesses gain momentum, they’ll continue to put pressure on the banking industry’s margins. Many banks have struggled to move from experimentation around selected use cases to scaling AI technologies across the organization. Some of the key challenges of AI in banking include: Generally, the top three challenges associated with implementing AI-related projects in business include: Meanwhile, 50% of business leaders believe the top barrier to scaling existing AI initiatives is managing AI-related risks. This is followed by the need for more data or inputs to train a model (44%), and actually implementing AI technologies (42%). In 2022 alone, 10% of all federal AI bills in the US were passed into law. This is up from 2% in 2021. The growing adoption of AI has prompted intergovernmental, national, and regional organizations to craft strategies around AI governance. According to Accenture, some of the key challenges associated with generative AI include: The need to reduce AI costs remains a key challenge for banks in 2023. In a bid to lower costs, banks and other financial services companies are shifting their investments in data centers from capex (on-premises) to opex (the cloud). Another key challenge for banks is that sensitive data cannot be migrated to the cloud and certain workloads are cheaper to run on-premises. In fact, 44% of respondents in an Nvidia survey reported using hybrid infrastructure for their AI workloads and projects. Therefore, it isn’t a simple matter of choosing between on-premises and cloud solutions, it’s about optimizing both while keeping costs low. According to McKinsey estimates, banks currently don’t realize the value of more than 80% of the data they collect. Banks possess vast and varied amounts of customer data – geospatial, financial, social media, lifestyle, behavioral, and health. But most banks have been unsuccessful in using data and core technologies like cloud and AI to drive innovations. In the same report by Capgemini, 95% of bank executives said legacy systems and outdated core banking modules stifled efforts to optimize data and customer-centric growth strategies. Additionally: Bankers in an Impact Economist survey identified privacy and security concerns as the most prominent barrier to adopting and incorporating AI technologies. This is the case particularly for smaller banks whose assets are below $10 billion. Larger banks, however, are more likely to struggle with regulatory compliance, complexity or uncertainty, and limitations of technology infrastructure. As of 2022, only 15% of customers preferred to be assisted by a chatbot and only 12% said they would prefer to be served by a chatbot in the next three years. The declining figure echoes the general negative sentiment surrounding chatbots for customer service. Research by Genpact suggests that businesses have been quick to implement chatbots and AI, without considering customer experience. According to a 2019 report by Genpact, more than two-thirds (67%) of all consumers are concerned about AI discriminating against them in its decision-making processes. Additionally, there are only minor differences among age groups, ranging from 68% for Gen Z to 69% and higher for baby boomers and older generations. AI bias is a major concern and calls for urgent action from banks that deploy AI. However, only 34% of banks established a comprehensive governance and internal control framework to manage AI bias. A majority took smaller steps, such as using diverse teams to eliminate particular biases, discussing the potential of AI bias with employees who use the data, and modifying algorithms to eliminate particular biases. Nvidia surveyed over 500 global financial services professionals and found that 36% of respondents cited recruiting and retaining data scientists as the top barrier to achieving their AI goals. That’s an increase of 80% from 2022 and the first time in the survey’s three-year history that recruiting and retaining data scientists has emerged as the number one challenge. Only 10% of bank directors have professional experience in technology. The tech leadership gap in banking is also among the key challenges banks face when attempting to incorporate AI into their value chains. The global AI in banking industry is projected to hit $185.77 billion in 2028 at a CAGR of 42.9%. By 2030, the business value of AI in banking will exceed $300 billion. Growth will be driven by: According to IHS Markit, North America is projected to be the largest market for AI in banking between 2018 and 2023 with the industry set to increase from $14.7 billion in 2018 to nearly $79 billion by 2030. Asia Pacific is the second largest region using AI in banking and is estimated to become the leading region in 2024, surpassing $50.6 billion in business value. By 2030, the region is projected to hit $98.6 billion with China, Japan, South Korea, Hong Kong, and Singapore driving the global demand for AI in the banking sector. Accenture research shows 90% of all working hours in the banking industry could be impacted by large language models (LLMs). The research also found that 54% of the industry’s work time has a higher potential for automation by AI. By 2028, the industry is projected to see 30% employee productivity gains in front and back office operations. By 2030, around 1.3 million bank workers in the US and 500,000 bank workers in the UK could face job losses or reassignments due to the widespread adoption of AI. Worldwide, tens of millions of banking and financial services jobs could potentially be impacted by the introduction of AI technology in the coming decade. Jobs at risk include tellers, customer service reps, loan interviewers and clerks, financial managers, compliance officers, and loan officers. As per a 2023 survey by Nvidia, 72% of respondents in financial services reported that they’re building a framework for AI governance and risk management. While most of the respondents cited only being in the planning and piloting phases, this is a positive sign that more institutions are actively building frameworks for AI governance, risk management, and systems to test their AI quality. In 2022, 69% of customers surveyed by Salesforce said they were comfortable with AI. This is up from 60% of customers in 2020. More financial services customers are embracing the use of AI to improve their customer experience. A Genpact study found that 54% of customers now feel comfortable with banks using AI to access personal data to improve their customer experience. This is up from 30% in 2017. Consumer-facing AI applications rely on consumer data to personalize services and improve the customer experience. Despite many well-known businesses suffering high-profile data breaches, consumers have become more open to sharing their data. While customer willingness to share data continues to rise, reservations remain. In fact, 46% of customers still have concerns. Additionally, more than 52% think that the government should be doing more to protect their data. According to a Deloitte survey, 86% of financial services AI adopters say that AI will be very or critically important to their business’s success in the next two years. AI-first banks will be optimized for operational efficiency through extreme automation of manual tasks. Gains in operational performance will also flow from the broad application of AI technologies, such as machine learning and facial recognition, to analyze large and complex customer data in real time. Banks that prioritize AI will have the speed and agility associated with digital-native companies. AI-first banks will innovate rapidly, launching new features in days or weeks instead of months. Additionally, they will collaborate with partners to continuously deliver customer-focused solutions. AI is a transformative force in banking, driving financial gains, operational efficiencies, and customer satisfaction. With its ability to analyze vast amounts of data and automate complex processes, AI is setting new standards in the banking industry, positioning institutions at the forefront of the digital revolution.AI in Banking Statistics Highlights

How is AI Used in Banking?

Type of AI Banking Use Cases Machine Learning Computer Vision Deep Learning Natural Language Processing Natural Language Generation/Generative AI Robotic Process Automation Who Is Using AI in Banking?

JPMorgan Chase

Bank Name JP Morgan Chase Location New York, US Value of Assets $3.3 trillion Types of AI Used Capital One

Bank Name Capital One Location Virginia, US Value of Assets $391.81 billion Types of AI Used CitiBank

Bank Name Citibank Location New York, US Value of Assets $1.1 trillion Types of AI Used Wells Fargo

Bank Name Wells Fargo Location California, US Value of Assets $1.7 trillion Types of AI Used Bank of America

Bank Name Bank of America Location North Carolina, US Value of Assets $2.4 trillion Types of AI Used US Bancorp

Bank Name US Bancorp Location Minnesota,US Value of Assets $594 bilion Types of AI Used Benefits of AI in Banking

Cost Savings

Improved Customer Experience

Productivity Gains

Fraud Detection

Better Data Quality and Management

Increased Competitiveness

Challenges of AI in Banking

The Future of AI in Banking

Final Thoughts: The New Age of Banking

FAQs

How is AI used in banking?

What are the disadvantages of AI in banking?

Why is AI transforming the banking industry?

Sources