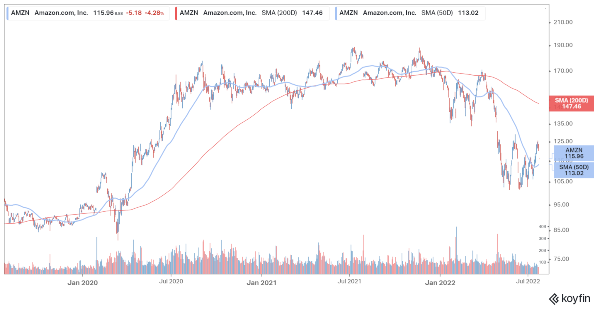

Amazon (NYSE: AMZN) stock is trading sharply lower in early US price action today after Walmart warned that inflation is eating into its earnings. Markets are concerned that rising inflation would also dent Amazon’s earnings.

Amazon is the third worst performing FAANG stock of 2022, ahead of Netflix and Meta Platforms, both of which are down over 50% for the year and are among the bottom performing S&P 500 stocks.

In its update, Walmart stated, “Rising food and fuel prices are influencing customer spending. While we’ve successfully reduced inventory in hardline categories, Walmart U.S. is needing more discounts for apparel. We expect to face more challenges with general merchandise in the second half.”

Notably, even during the previous earnings release, US retail companies had warned of slowing sales of discretionary products. Amazon also reported a slowdown in its sales during the first quarter of 2022. It also said that inflation has been taking a toll on its profitability. The company also said that it is overstaffed and has started to lower its burgeoning workforce.

Amazon would release its earnings later this week. Analysts expect its revenues to rise by 5.4% YoY to $119 billion in the quarter. If analysts’ estimates are correct then this would be the lowest growth rate for the company since it went public. Amazon’s adjusted EPS is expected to plunge 85% YoY to only 12 cents in the quarter.

Amazon posted strong revenue growth between 2020 and 2021 as the lockdowns lifted its revenues. However, over the last few quarters, it has been reporting a sharp slowdown in growth. The same story has been playing across all stay-at-home winners including fellow FAANG constituent Netflix, which has lost 1.2 million subscribers in the first half of 2022.

Amazon to Raise Prime Prices in Europe

The second quarter earnings season has been marred by warnings over slowdown. General Motors, which released its earnings today, also missed earnings estimates. While the company maintained its 2022 guidance, the management said that it is prepared for a recession.

Meanwhile, Amazon has announced that it would increase the price of Prime subscription in Europe. The prices for UK customers would rise from £79 per year to £95 from September 15, while in France it would rise from €49 to €69.90.

Earlier this year, Amazon raised the monthly Prime subscription from $12.99 to $14.99 and the annual subscription from $119 to $139 for its US customers. Like other companies, Amazon is also battling rising inflation and has been trying to pass the higher costs to consumers. US inflation rose by 9.1% in June, the highest level since 1981.

The Fed raised rates by 75 basis points in June to curtail inflation. The Fed is meeting again this week, which would be a crucial event for the week along with tech earnings and the Q2 GDP report.

Meanwhile, Amazon has been trying to make Prime an even more compelling proposition for users. Earlier this month, it announced a partnership with GrubHub and would offer Prime users in the US one-year free membership of Grubhub which usually costs $9.99 per month.

The company completed the acquisition of MGM earlier this year which has added to its library. Prime is a key moving part of Amazon’s success and helps increase customer stickiness on the platform by offering free and quick deliveries.

Most Analysts Advice Buying AMZN Stock

Amazon has also been trying to increase its target market and recently announced the acquisition of telehealth company One Medical for $3.9 billion.

Many Wall Street analysts have lowered Amazon’s target price progressively over the last year. However, most remain bullish on Amazon and rate it as a buy given its exposure to secular long-term growth industries like e-commerce, streaming, cloud, and digital advertising.

The company’s cloud operations are hugely profitable and it is the market leader in the space. Last month, Redburn initiated coverage on Amazon stock with a buy rating. The brokerage believes that AWS (Amazon Web Services) is alone worth $3 trillion, or roughly 3 times its current market cap. JPMorgan also reiterated the stock as its best idea for the second half of the year.

Related posts

Would the Healthcare Industry be ‘Amazoned’ by Amazon’s One Medical Acquisition?

Markets Brace for Volatility Amid Flurry of Earnings, Fed Meeting

How to Invest in Stocks Online for Beginners

Battle Infinity - New Metaverse Game

- Listed on PancakeSwap and LBank - battleinfinity.io

- Fantasy Sports Themed Games

- Play to Earn Utility - IBAT Rewards Token

- Powered By Unreal Engine

- Solid Proof Audited, CoinSniper Verified