Cathie Wood of ARK Invest, who is known to back up her favorite names, added more Block (NYSE: SQ) shares last week after it crashed following a short-sell report by Hindenburg Research. In its response, Block has denied the charges leveled by Hindenburg.

Wood was among the early backers of Tesla and Block, which was formerly known as Square. Block forms part of three ARK ETFs namely the ARK Fintech ETF, ARK Next Generation Internet ETF, as well as the flagship ARK Innovation ETF.

Wood invested another $21 million in Block shares last week after they crashed. She also added more Coinbase shares as the stock fell after it received a Wells notice. However, she sold some Tesla shares.

Wood has otherwise been buying Tesla shares over the last few months to capitalize on the crash. In hindsight, the decision paid off well as with a YTD gain of above 50%, the Elon Musk-run company is among the top S&P 500 gainers.

Coming back to Block, after shaving off billions of Indian billionaire Gautam Adani’s net worth, the dreaded short-seller found Block as its next target. Block stock lost 16% in two days after the Hindenburg report.

Hindenburg Accused Block of Fraud

In its report on Block, Hindenburg said, “Our 2-year investigation has concluded that Block has systematically taken advantage of the demographics it claims to be helping.”

According to Hindenburg, “The “magic” behind Block’s business has not been disruptive innovation, but rather the company’s willingness to facilitate fraud against consumers and the government, avoid regulation, dress up predatory loans and fees as revolutionary technology, and mislead investors with inflated metrics.”

Meanwhile, in its response, Block said that its analysis of Hindenburg Research shows that “it’s designed to deceive and confuse investors.”

“We intend to work with the SEC and explore legal action against Hindenburg Research for the factually inaccurate and misleading report they shared about our Cash App business today,” said Block as it dismissed the allegations.

Wood also came out in Block’s support and called the report “Widely misleading.”

Hindenburg seems to believe that investors and analysts with deep expertise in fintech will not read its reports but that speculators and traders will support its short positions by selling without reading or understanding them. Wildly misleading, as @mfriedrichARK exposes here. https://t.co/5iueTRSMZ6

— Cathie Wood (@CathieDWood) March 25, 2023

Hindenburg Reports Led to Crash in Several Stocks

Hindenburg has built its reputation and targeted many companies with its short seller report. It accused WINS Finance of hiding material facts from US investors. Four months after its report, Nasdaq delisted the company.

Hindenburg also accused Nikola and Lordstown Motors of fraud after which there were top-level exits at both companies and Lordstown accepted at least some of the allegations.

Last year, Nikola’s founder Trevor Milton was convicted of fraud for overhyping the company’s capabilities, which Hindenburg had accused him of.

Hindenburg also accused Clover Health of defrauding investors. While the company denied the allegations, its stock price has plummeted below $1 and is a penny stock now.

Adani Group shares have also plummeted after Hindenburg’s report and the company’s chairman has fallen out of the list of top 10 billionaires after losing billions of dollars in net worth.

Cathie Wood Likes to Back Up her High Conviction Names

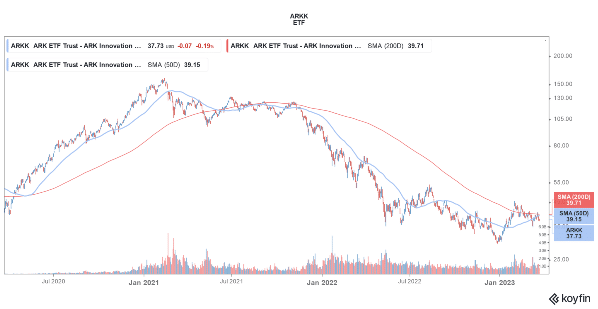

Wood has a reputation for backing up her high-conviction names including Block. She kept on buying the dip in her favorite stocks last year, only to see them falling to newer lows. ARKK lost over two-thirds of its value in 2022, which is over twice that of the Nasdaq Composite.

However, the ETF is up almost 24% so far in 2023 and is outperforming the markets by a wide margin. Growth stocks, which bore the brunt of the Fed’s rate hikes in 2022 have outperformed this year even as industrials and bank stocks have looked weak amid the bank crisis.

It meanwhile remains to be seen whether buying the dip in Block does the same wonder for Wood as her recent Tesla purchases.

Related stock news and analysis

- How to Invest in ETFs – With Low Fees in 2023

- 10 Best Crypto ETFs to Invest in 2023

- Key Earnings & Indicators to Watch Next Week amid the Bank Crisis

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops