Roblox (NYSE: RBLX) stock soared almost 20% yesterday after the company released its September update. Wall Street analysts meanwhile remain apprehensive about the once-hot pandemic winner.

In its business update, Roblox said that its DAUs (daily active users) rose 23% to 57.8 million in September while the hours engaged rose 16% over the period to 4.0 billion. The company estimates that its bookings in the quarter were between $212 million and $219 million. This would imply a YoY growth between 11-15%.

Roblox said that its revenue in the quarter is estimated to be between $171 million and $180 million. At the bottom end of the guidance, it would imply YoY degrowth of 2%. The top end of the guidance implies a YoY growth of 3%.

Looking at Roblox’s business update, the company expects to post revenues at $510.5 million in the third quarter at the midpoint. The guidance is well short of the $693 million that analysts were expecting. Notably, Roblox spooked markets with its second-quarter earnings as the gaming company’s growth fell well short of estimates.

Roblox Stock Soared after September Business Update

While releasing the September business update, Roblox increased its paying user life estimates from 25 months to 28 months. Like most other US companies with global operations, Roblox is also reeling under the impact of the stronger US dollar.

Roblox said, “We estimate that the impact of foreign currency fluctuations led to a reduction of approximately 6% in the year-over-year growth rate for September bookings. On a constant currency basis, we estimate bookings growth would have been 17% – 21% year-over-year and ABPDAU (Average Booking Per Daily Active User) would have been down 2-5% year-over-year.”

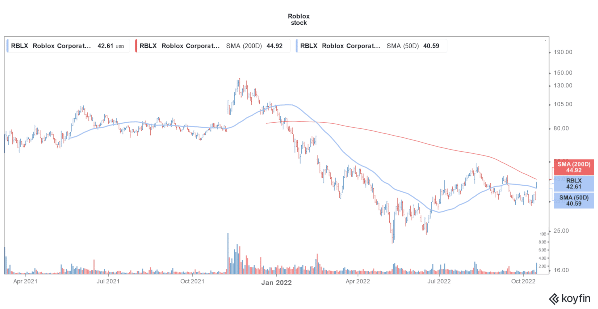

The rise in Roblox stock is a welcome break for investors as the stock has crashed this year amid the sell-off in growth names. The company went public last year through a direct listing after having ditched plans for a traditional IPO.

Euphoria toward gaming pushed Roblox’s market cap to around $90 billion. Even after the 20% spike yesterday, the company’s market cap is only around $25 billion now.

RBLX Is a Play on Metaverse

Roblox is a play on metaverse also. Nike and Walmart have partnered with the company to sell their products on metaverse. Meta Platforms’ CEO Mark Zuckerburg is bullish on metaverse in the long term.

However, Meta Platforms’ metaverse business is currently losing billions of dollars every quarter. It lost more than $10 billion in 2021 and has lost around $6 billion in the first six months of 2022. Companies like Nvidia also see the metaverse as a key growth driver. We have a list of companies that are a play on metaverse.

Meanwhile, not all analysts believe that metaverse business supports Roblox’s valuations. MoffettNathanson analyst Clay Griffin initiated coverage on RBLX stock with an underperform rating and a $19 target price.

Wall Street Analysts Are Divided on Roblox Stock

Griffin said, “In a market looking for less evangelism and more ‘meat on the bone,’ there’s plenty of room for the market to lose confidence. A huge range of outcomes could be possible for Roblox, we concede. But at this price, to earn a good return, what do you have to believe? Simply too much, in our view.”

Barclays also initiated coverage with underperform rating on Roblox. Wall Street analysts are quite divided on RBLX and only 12 of 25 analysts polled by CNN rate Roblox as a buy.

Most analysts are apprehensive about Roblox due to its valuations. While the valuations of growth stocks have come off their highs, they are still high for some brokerages.

US stock markets have been quite volatile in October. While stocks began October with a bang, they soon fell to new 2022 lows. US stocks whipsawed last week after September inflation data was released and swung 5% in intraday trade.

US markets have started this week on a positive note but all eyes would be on the upcoming earnings as well as economic releases.

Related stock news and analysis

- Most Undervalued Stocks to Buy – How to Buy Undervalued Stocks

- How to Buy Meta Stock in 2022

- Zuckerburg Missed a Social Media Trend and It Cost Billions to Meta Investors

Tamadoge - The Play to Earn Dogecoin

- '10x - 50x Potential' - CNBC Report

- Deflationary, Low Supply - 2 Billion

- Listed on Bybit, OKX, Bitmart, LBank, MEXC, Uniswap

- Move to Earn, Metaverse Integration on Roadmap

- NFT Doge Pets - Potential for Mass Adoption