Snap released its earnings for the first quarter of 2023 yesterday and reported its first-ever quarterly revenue decline. The company is pivoting towards AI to beat the slowdown in ad spending.

Snap reported revenues of $989 million in the first quarter of 2023 – a YoY fall of 7% – and below the $1.01 billion that analysts were expecting.

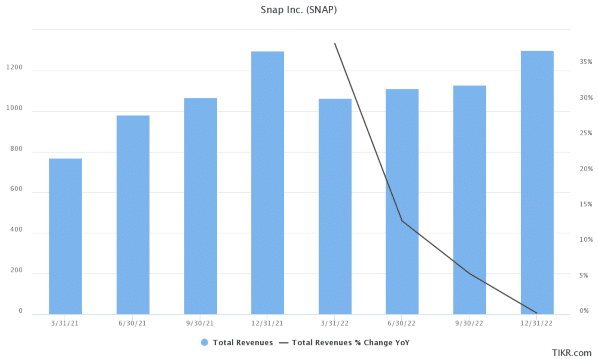

The company’s revenue growth has gradually fallen and in Q4 2022 its revenues were similar to the corresponding quarter in 2021.

Q1 2023 marks the first time when Snap’s revenues fell YoY. The company’s sales were growing at a brisk pace and rose by over 40% each between 2017 to 2020. In 2021, its revenues rose over 64% – but sales growth plummeted to a mere 12% last year.

Its sales continue to plummet in 2023 and after the revenue decline in the first quarter, Snap said that internal forecasts suggest a 6% YoY fall in second quarter revenues.

Snap CEO Evan Spiegel said, “We are working to accelerate our revenue growth and we are using this opportunity to make significant improvements to our advertising platform to help drive increased return on investment for our advertising partners”

Snap’s DAUs (daily active users) were 383 million in the quarter – slightly short of what markets were expecting. Its average revenue per user came in at $2.58 which again was below the $2.63 that analysts expected.

Snap stock is down sharply in US premarket price action today after reporting disappointing earnings and guidance.

Incidentally, Meta Platforms – which released its Q1 2023 earnings earlier this week – surged after reporting a YoY rise in revenues after three consecutive quarters of decline.

- Read our guide on buying Meta stock

Meta is the second-best performing S&P 500 stock this year and is outperforming FAANG peers by a wide margin.

Snap Stock Falls after Q1 2023 Revenue Miss

Companies like Meta Platforms and Alphabet are battling a severe slowdown in sales. Google search revenues have now fallen for two consecutive quarters along with YouTube.

One common thread between these companies is their pivot to AI. Meta Platforms’ CEO Mark Zuckerburg has said multiple times that AI is the company’s focus in the short term – while in the long-term metaverse would drive growth.

Alphabet has also come with its Bard chatbot to take on ChatGPT.

Snap is also following a similar trajectory and is pivoting to AI. The company announced an AI chatbot last week – however, the bot failed to impress which led to an increase in one-star ratings of the app.

Bard too had a disappointing debut which shaved off $100 billion from Alphabet’s market cap.

Could AI Pivot Help Companies Beat Slowdown Blues?

Tech companies across the board are witnessing a growth slowdown and are pivoting to AI to beat the slowdown.

Snap also launched AR Enterprise Services during the first quarter which helps retailers better connect with customers – allowing the latter to try merchandise from their homes or offices.

The company is also optimistic that AI would help it improve user experience – and by its extension its ad revenues.

- Read our guide on the best AI crypto projects

In the shareholder letter, Snap said, “We are excited about the opportunities we see for more innovation, especially as we look across our application at how AI can further enhance the

Snapchatter experience.”

That said, in the short term, a slowing economy and competition from TikTok look potent headwinds for Snap – as is the case with Facebook and YouTube as well.

Related stock news and analysis

- Best AI Stocks to Invest in 2023

- Dropbox Lays off 16% Employees Amid AI Pivot: Is Sam Altman’s Prophesy Coming True?

- Best Long-Term Crypto Investments for 2023

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops