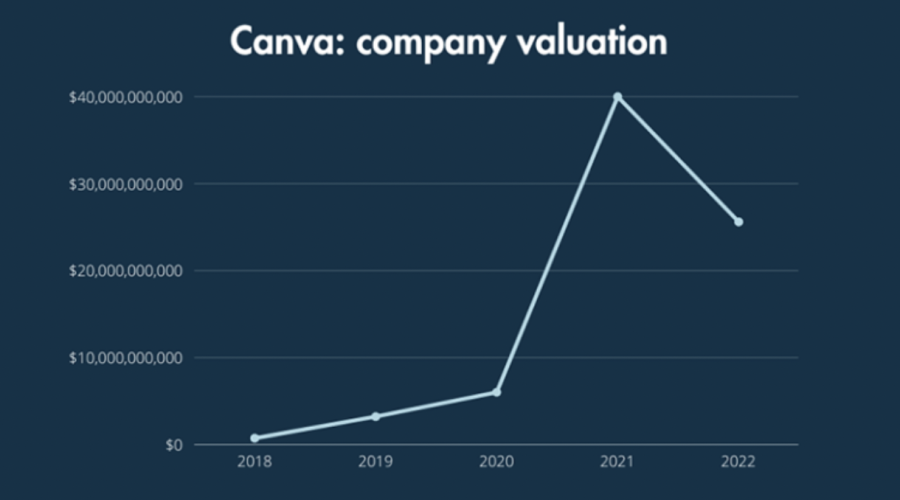

T. Rowe Price, one of the leading mutual fund companies known for its investments in late-stage startups, has made a significant adjustment to its valuation of Canva, the popular design platform. The company has marked down the value of its stake in Canva by a staggering 67.6%. This markdown comes after T. Rowe Price led a $40 billion funding round for Canva in 2021.

Significance of T. Rowe Price’s Valuation Adjustment

This follows a previous valuation adjustment, Blackbird Ventures, one of Australia’s prominent venture firms, once again revised the value of its stake in Canva. Last summer, the Sydney-based design platform had been valued at $40 billion by the VC during a $200 million funding round. However, Blackbird chose to readjust its own valuation, reducing it by 36% to $25.6 billion.

T. Rowe Price has marked down its stake in Canva by 67.6% https://t.co/yVSk0fvyJJ

— TechCrunch (@TechCrunch) June 3, 2023

The adjustment in Canva’s valuation by T. Rowe Price is a significant development, considering the company’s reputation and its past support for the design platform.

T. Rowe Price’s Blue Chip Growth Fund, which holds various classes of Canva shares, including Series A shares, has invested $99.1 million in the company. The fund now values those shares at $32.1 million on a cost-adjusted basis, reflecting the downward adjustment in Canva’s worth.

Canva’s Response to T. Rowe Price’s Markdown

In response to T. Rowe Price’s markdown, Canva’s spokesperson downplayed the impact in an email to Techcrunch, emphasizing the company’s strong financial position and profitability. The spokesperson stated:

We’re in a fortunate position to continue focusing on building an enduring company for the long term. Regardless of the macroeconomic environment, we’re well positioned to continue doubling down on key initiatives, including growing our team and expanding our product and AI innovation efforts.”

Canva highlights its rapid growth, surpassing 135 million monthly active users, and expressed confidence in exceeding its previous valuation despite market conditions. The spokesman added:

“It would be inaccurate to determine the valuation of Canva based on any one investor in isolation, and with our growth and pace of new product launches, we’re confident that no matter the market conditions, we’ll exceed our last valuation as the markets correct and our growth continues.”

Although T. Rowe Price’s investment in Canva represents a relatively small portion of the firm’s overall assets under management, the markdown is significant. T. Rowe Price’s Blue Chip Growth Fund had approximately $53 billion in assets under management at the end of the first quarter of this year, down from $63 billion the previous year.

This downward revision in Canva’s value indicates that a company once considered the fifth most valuable startup globally is now estimated to be worth around $13 billion instead of $40 billion.

When asked if Canva has adjusted its own independent 409A valuation to align with T. Rowe Price’s assessment, the spokesperson declined to comment on the matter. This suggests that Canva’s own evaluation may differ from T. Rowe Price’s opinion.

Downward Adjustments in Valuations Reflect the Bursting Tech Bubble

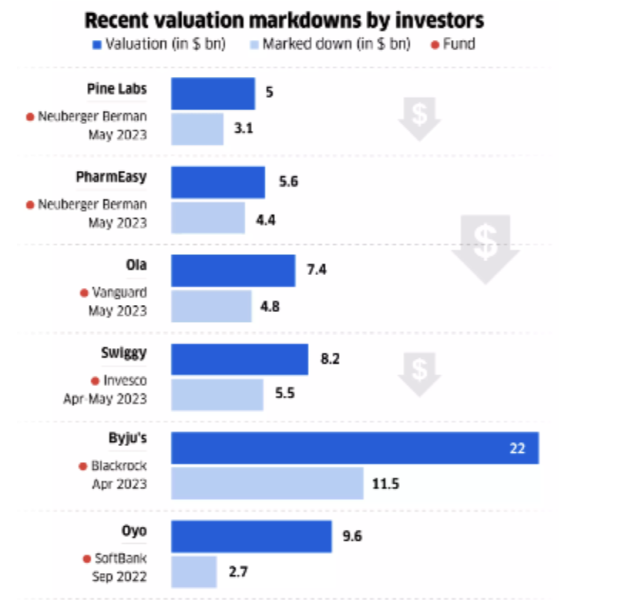

Canva’s valuation adjustment is not an isolated incident. Neuberger Berman, a prominent New York-based investment firm, has recently lowered the valuations of two major Indian portfolio companies in its portfolio, namely PharmEasy and Pine Labs.

Fintech giant Pine Labs experienced a significant 38% markdown in its valuation, now valued at $3.1 billion compared to its previous valuation of $5 billion in July 2021. Similarly, API Holdings, the parent company of PharmEasy, saw its valuation reduced to $4.4 billion from the $5.6 billion it achieved in October 2021.

The recent downward adjustments in valuations reflect the bursting of the tech bubble, indicating a more cautious approach from investors. They are now hesitant to pay high prices for companies that have yet to achieve profitability. This trend is likely to drive consolidation within the tech industry, with smaller companies being acquired by larger ones.

It remains to be seen what the long-term impact of the tech bubble bursting will be. However, it is evident that the industry is undergoing a transformative period. As valuations stabilize, companies will need to demonstrate sustainable growth, innovation, and market differentiation to regain investor confidence.

Related News:

- Old Internet Users Are Much More Likely to Do Online Brand Research Than Young Users

- Byju’s Set to List Aakash in 2024: Would the IPO Dodge Fate of Other Startups?

- Best Crypto to Invest in

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops