While fears of an EV (electric vehicle) price war are making investors apprehensive, China’s NIO has said that it won’t join the price war and instead work on improving its services.

Arguably, Tesla started the price war and has slashed prices across its models multiple times. The Elon Musk-run company has said that the price cuts would help it increase EV adoption.

However, it’s also a ploy to increase sales amid increasing EV competition as multiple new models hit the road.

The price cuts are set to take a toll on the company’s margins and analysts polled by TIKR expect Tesla’s pre-tax margins to fall to 12.4% in the first quarter – as compared to 16% in the previous quarter.

Meanwhile, NIO, whose gross margin plummeted to a mere 3.9% in Q4 2022 as compared to 17.2% in the corresponding quarter in 2021 has said that it won’t cut car prices.

Speaking with CNBC, NIO chairman William Li said, “For us, we will certainly not join the price war.”

Notably, earlier this year Charlie Munger lauded China’s BYD for actually raising car prices at a time when Tesla lowered EV prices in China.

Not all Chinese companies are on the same line though and Xpeng Motors lowered prices earlier this year.

The company has been battling falling sales for the last many months and its deliveries were below 10,000 in the last three months.

Xpeng Motors as well as other Chinese EV companies like NIO surged yesterday after XPEV announced a new platform that would help lower car prices.

NIO Would Not Join the EV Price War

In the interview, Li said that it believes that the price for its vehicles is commensurate with the product and service proposition.

Li added, “There are many new products coming to market, which of course means fiercer competition for us. But for users, they have a more abundant selection.”

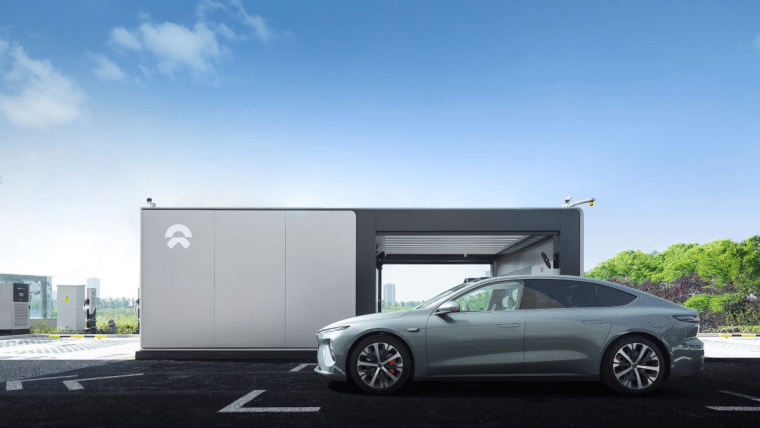

He said that NIO would instead add more battery swapping and charging stations to improve customer service.

Notably, NIO has built a premium brand image, and lowering prices might damage the brand.

While the company currently gets most of its revenues from China it has also started delivering vehicles in Europe – with a US market entry planned in due course.

Homegrown Chinese EV companies are giving a tough challenge to Tesla and Musk praised Chinese EV companies during the Q4 2022 earnings call.

- Read our guide on buying NIO stock

Meanwhile, there is some divergence now between the US and Chinese governments’ EV policies.

China’s EV Adoption Has Risen to 34%

Last year, US President Joe Biden signed the Inflation Reduction Act – which among others committed billions to increase the country’s EV adoption.

The US also modified the eligibility for EV tax credit which made models from Tesla, Toyota, and General Motors eligible for the lucrative $7,500 credit.

However, China ended its EV subsidies this year as the country’s electric car industry reached a critical mass – with one in every three cars sold in March either an EV or PHEV (plug-in hybrid vehicle).

Incidentally, BYD is now the largest seller of NEVs (new energy vehicles) globally even as Tesla leads the race in battery electric cars.

- Read our guide on buying Tesla stock

Markets would next look forward to Tesla’s Q1 2023 earnings tomorrow where the EV giant might provide color on how far it intends to go with its price cuts.

Related stock news and analysis

- Best Green Investment Funds to Watch in 2023

- 10 Most Eco-Friendly Crypto Coins 2023

- Apple Expands Financial Service Business & Launches Savings Account

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops