The US Consumer Financial Protection Bureau has issued a warning about the potential risks of storing money on mobile payment apps such as Venmo, Cash App, and Apple Cash.

While these apps are increasingly used as alternatives to traditional bank or credit union account, funds stored in them often lack federal insurance protection, which could put cash at risk if the app’s parent company experiences financial difficulties, the CFPB warned in a consumer advisory this month.

This risk is magnified by the fact that transaction volume on such apps was an estimated $893 billion last year, a figure expected to rise to $1.6 trillion by 2027.

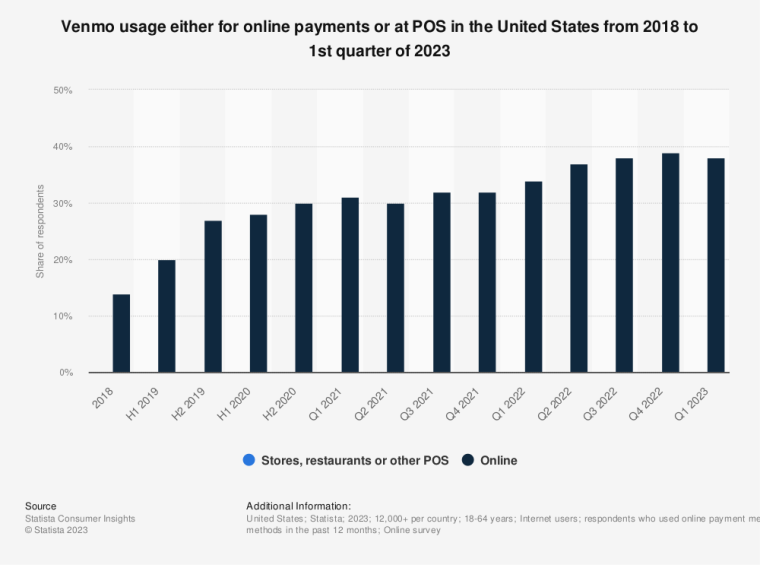

Venmo, which has emerged as one of the most popular mobile payment apps, has seen its user base continually grow over the past couple of years.

A survey by Statista shows that around 40% of respondents reported using Venmo in the first quarter of 2023, compared to less than 15% in 2018.

“Popular digital payment apps are increasingly used as substitutes for a traditional bank or credit union account but lack the same protections to ensure that funds are safe,” Rohit Chopra, the consumer bureau’s director, said in a statement.

The CFPB warned that while states do offer some protections for app users, rules can vary and some states may allow companies to invest customer funds in potentially risky securities.

YOUR MONEY STORED IN APPS LIKE VENMO AND PAYPAL MAY NOT BE SAFE

U.S. government is now cautioning bout the potential risk of losing money in these apps since they are not covered by federal deposit insurance.@FDICgov @TheNCUA @Venmo @PayPal @CashApp https://t.co/hoZzrzj1DS pic.twitter.com/TUCIurohqB

— Matt “Shadowbanned” Case (@MatthewRyanCase) June 5, 2023

In addition, while most payment apps are required to hold reserves similar to the amount of consumer funds they are holding in low-risk accounts, some payments are uninsured.

Payment Apps Are Used As Traditional Banks

Despite the potential risks, payment apps continue to gain popularity due to their free, near-instant transfer of money.

Typically, users link a traditional bank account or payment card to move funds into the app and withdraw payments they receive from other users.

After receiving payment, users receive funds in their app account, which will stay there until they move the money into their bank accounts.

However, some users leave money in the apps for future payments, seeing them as traditional banks.

The CFPB warned that such accounts may not carry Federal Deposit Insurance Corporation (FDIC) protection, though some apps do team up with FDIC-insured banks to offer accounts with “pass-through” FDIC insurance protection.

To activate the coverage, users may have to take extra steps or sign up for certain services.

Venmo balances, for example, are covered by deposit insurance at partner banks when customers use the app’s direct deposit or check-cashing options.

Apple Cash users must register their accounts with its partner bank, Green Dot, to obtain insurance coverage.

Users Need to Be Vigilant About Payment App’s Terms of Services

Meanwhile, some experts have warned that users need to thoroughly read user agreements and other terms of services of payment apps.

“Some user agreements are murky and not necessarily understandable for consumers,” Amy Zirkle, the CFPB’s senior program manager for payments and deposits markets, told The New York Times in an interview.

However, the Financial Technology Association, a lobbying group for firms such as PayPal (owner of Venmo) and Square (owner of Cash App), defended its members’ practices and said they prioritized consumer protection.

Still, the CFPB said it was coordinating with federal and state regulators to monitor the growing payments industry and take appropriate steps.

The CFPB also suggested that users may be better off using alternative payment networks such as Zelle, which moves funds between accounts at participating banks, rather than holding funds themselves.

Read More:

- Where to Buy Crypto with Credit Card – Best Sites

- The Best Payment Platforms: Stripe vs Paypal vs Square vs Braintree

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops