Venture capital firms invested almost three-quarters less in crypto startups in 2023 compared to the record highs of 2022, according to a recent report from The Block. If this pattern persists, it could be harmful for the latest wave of innovative crypto startups and the market overall. However, as macro conditions improve, analysts expect renewed interest from institutions in cryptocurrencies next year and a general recovery in VC funding trends by then.

Just over $10 billion in funds flowed into cryptocurrency and blockchain startups from VCs this year, representing a 68% year-over-year decline from 2022’s record figure of $33 billion. Investments concentrated toward the beginning of 2023 and peaked during the second quarter of the year to then progressively slow down.

This drop was widely expected due to much stricter access to capital during the ongoing crypto winter caused by major industry failures like FTX and lending platforms halting withdrawals. This led investors to withdraw their money and reduce their involvement in the sector, especially when overall economic conditions were also poor.

“This funding winter served as a healthy and necessary correction, enabling the industry to take stock and refocus on critical priorities” explained Polygon Ventures principal lead Abhishek Saxena to The Block.

Most Crypto VC Deals Targeted Early Stage Ventures

Venture deals in 2023 skewed toward early-stage companies, with pre-seed, seed, and Series A funding rounds garnering the highest share over their mid and late-stage counterparts. This indicates that while total dollar amounts retreated drastically, VCs still funneled money toward fresh entrepreneurial ventures that are expected to pave the way for the future of the blockchain industry.

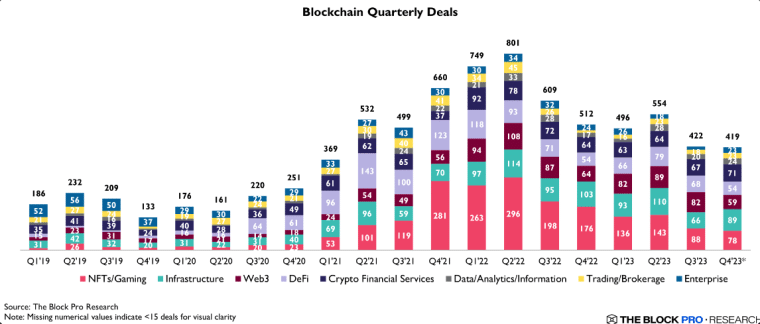

Total deal volume likewise dropped by 32% to 1,819 versus the prior year, though consistently exceeded monthly 2020 and 2021 numbers. Gaming/NFTs, infrastructure, and web3 applications retained dominance among deal categories. However, a wider range of blockchain verticals secured investments, displaying market diversity.

Despite deteriorating macro conditions decimating digital asset prices and funding in 2023, total investment significantly outpaced the $6.4 billion aggregate raised in both 2019 and 2020. The year thus represented a correction after a period of irrational exuberance rather than a sector-wide collapse.

Industry leaders describe the current development as akin to the internet’s early emergence – noisy hype diffusing into targeted creation of real-world utility. With technological progress occurring relatively unnoticed amid the market’s turmoil, VC conviction appears steeled to support crypto’s next iteration.

Mainstream Investors Positioning for 2024 Entry

With the crypto carnage of 2022 fading and inflation easing, expectations are mounting for renewed institutional participation next year as monetary policy normalizes. Some analysts believe that a rate cut could be performed by the U.S. Federal Reserve by mid-2024 that could result in a higher appetite for risk from investors.

Also read: FTX’s Amended Reorganization Plan Could Cost Creditors Millions

This backdrop could draw prominent investors and funds like BlackRock and ARK Invest toward increasing their digital asset exposure.

“A rate cut situation could make risk assets like bitcoin more attractive to institutional investors seeking higher returns in a lower interest rate environment,” analysts from Bitfinex noted.

Spot Bitcoin ETF Decision Potential Catalyst

Indeed, the seminal catalyst expected for early next year remains the long-awaited ruling on exchange-traded funds (ETFs) directly tracking Bitcoin’s price. Asset managers like Fidelity have joined the growing list vying for regulatory approval.

Analysts suggest that the approval of a spot bitcoin ETF could come through by January 2024 amid the latest filings addressing previous investor protection concerns. Such an instrument would grant simple and regulated exposure sparking immediate institutional and retail asset inflows.

With greater regulatory clarity unlocking participation barriers elsewhere also, exchanges anticipate heightened institutional activity within the maturing digital currency ecosystem through next year.

The combination of macro normalization, transparent guidance, and sophisticated risk management tools could make 2024 the year when Bitcoin and cryptocurrencies will fully captivate those who lean more toward traditional financial instruments.