Ford Motor Co.’s electric vehicle division is struggling as sales of its electric F-150 Lightning truck keep falling, leading the company to begin cutting jobs in its Lightning division. The Michigan Rouge Electric Vehicle Center, which makes the Lightning EV, will lose around 1,400 workers starting on April 1.

Reuters reported that Ford CEO Jim Farley said the company is using its flexible manufacturing to give customers more choices. At the same time, they’re making sure to keep a good balance between growing the company and making a profit.

While the Dearborn, Michigan-based company anticipates growth in global EV sales in 2024, it will be less robust than previously expected. This follows a Bloomberg report last month indicating Ford’s plan to halve its production targets for the F-150 EV this year.

Despite this, Ford is hiring almost 900 new people and moving 700 workers to increase production of other much more popular vehicles like the Bronco, Bronco Raptor, Ranger, and Ranger Raptor models. Despite the expansion in traditional vehicle manufacturing, Ford’s share prices experienced a slight decline, dropping 0.8% to $10.90 in early trading in New York on Friday, 19th January.

The F-150 Lightning Truck’s Position in the EV Market

When examining the F-150 Lightning Truck’s position in the U.S. EV market, especially in comparison to other leading EV models, the sales figures provide an interesting perspective.

According to Kelley Blue Book’s Q4 2023 report, the F-150 Lightning sold 11,905 units in the quarter, totaling 24,165 for the year. This marks a significant 54.7% increase over the previous year.

However, when compared to the leading EV models from other brands, the F-150 Lightning’s success is put into perspective. For example, Tesla’s Model Y sold 394,497 units, and the Model 3 sold 220,910 units in 2023, showcasing Tesla’s dominance in the market. It’s also important to note that Ford is losing money on each and every EV it sells. Ford said that it lost an estimated $36,000 on each of the 36,000 EVs it sold to dealers in Q3 (about $1.3 billion).

Despite these comparisons, it’s worth noting that the F-150 Lightning secured the seventh position in terms of the most sold EV models in the U.S. in 2023. This highlights its notable presence in the market.

Looking beyond sales numbers, Ford’s overall strategy seems to be responsive to broader market trends. The company’s decision to adjust production targets for the F-150 Lightning indicates a cautious approach, driven by the global slowdown in EV demand.

Is the American EV Industry Already Doomed?

Analysts are split over the future of American EVs.

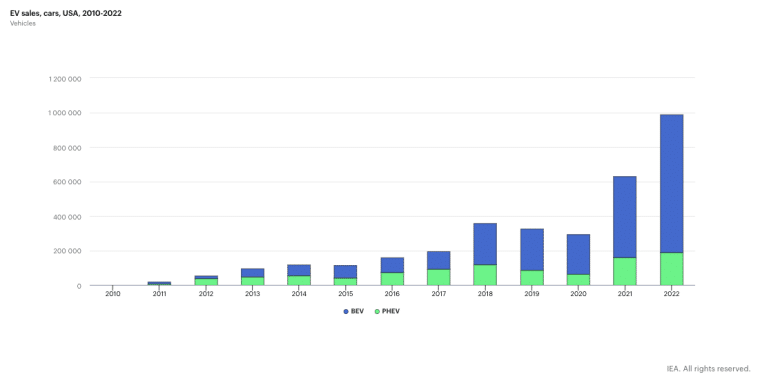

The EV market in the US has seen remarkable growth over the past decade. Reports from the International Energy Agency (IEA) show that EV sales increased by a massive 1,733% from 2012 to 2022, jumping from 54 thousand to 990 thousand sold. This significant rise indicates a strong shift towards preferring EVs over traditional fuel vehicles in the U.S.

The total number of EVs also grew impressively by 3,713% in this period, going from 75 thousand to 2.86 million.

However, the future growth pattern is set to be less dramatic but still significant. Projections by the IEA indicate that although sales are set to increase, the growth rate will slow down. Analyzing the Compound Annual Growth Rate (CAGR) provides a clearer picture of this trend.

From 2021 to 2022, U.S. EV sales experienced a year-over-year growth of approximately 57%. In 2025, the U.S. is expected to sell 3.34 million EVs, which means that the projected annual growth rate from 2022 to 2025 shows a slight decrease to approximately 50% per year. This is still a substantial rate but indicates a slowdown compared to the previous year’s growth. From 2025 to 2030, the annual growth rate is expected to decrease more significantly to around 18% per year.

Furthermore, Chinese EV companies, namely BYD, are starting to take over the global market. BYD recently passed Tesla as as the largest electric car company, selling thousands more battery electric vehicles than its US rival and it is showing no signs of slowing down

While these factors indicate a deceleration, they reflect a market that is steadily growing from a much larger base compared to the early 2020s. By 2030, the IEA forecasts EV sales to reach 7.76 million, a substantial increase from the projected 3.34 million in 2025.

Navigating the Future: Challenges and Strategies

This gradual slowdown in growth is typical of a maturing market. It reflects a natural leveling off as more people who want EVs have already bought them, and others may be waiting for advancements or price changes. Additionally, challenges like supply chain disruptions and component shortages can affect how many car manufacturers like Ford can produce.

For Ford, these trends mean a balancing act between meeting the current demand and preparing for the future. The company is adjusting its production to align with these market changes and is focusing on innovations and customer preferences to stay ahead.

With EV stock numbers expected to reach nearly 40 million by 2030, the U.S. is heading toward a more electric-driven automotive scene. Automakers will need to shift their focus from just selling cars to improving the overall driving and owning experience to keep customers engaged in the long term.