Nuclear fusion, a once far-off futuristic seeming power source that has captivated the imaginations of scientists for decades, appears to finally be edging closer to commercial viability as investors are eye the sector with renewed interest in recent months. This is due in no small part to the enticing prospect of capturing a lion’s share of the $10 trillion energy market, coupled with recent advancements in fusion technology.

Let’s dive into how nuclear fusion is materializing as a high-stakes bet for venture capitalists, attracted by the possibility of significant returns on their investments.

Progress in the Field: A Beacon of Hope

Over the last few years, nuclear fusion technology has undergone huge advancements. A wide range of milestones have been realized that seem to signal that nuclear fusion is ready to move beyond the confines of research labs and edge toward commercial use.

One such milestone was the recent announcement by the Department of Energy’s National Ignition Facility of their successful fusion reaction, which resulted in an energy output that exceeded the input needed to ignite the fuel.

Other technological advancements are contributing to the progress as well, including breakthroughs in superconducting magnets and vast improvements in computing power and machine learning capabilities. These developments have amplified the efficiency and power of magnets essential for the operation of nuclear fusion plants. They have also expedited simulations of potential reactor conditions, slashing the time needed to complete them.

Investments in nuclear fusion accompany a range of risks, however, as with any investment in new, unproven technologies. Unlike most sectors, investing capital into fusion demands investors adjust their expectations for returns, considering the scientific complexity and infrastructural requirements of fusion projects.

The typical five- to seven-year venture fund timeline has been far from adequate for fusion investments, but the economic prospects the sector offers make the extended wait worthwhile. As fusion startups achieve significant milestones, anticipation that investment figures will continue to rise doesn’t seem too unrealistic. And the possibility that returns could come soon is only getting greater.

Design Dilemma: Tokamaks vs. Stellarators

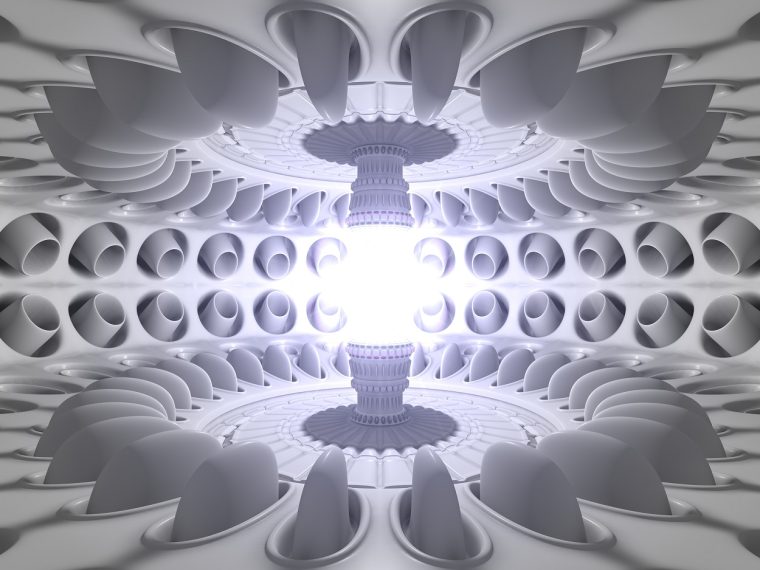

In nuclear fusion, the architecture of the power production design plays a pivotal role. Currently, tokamaks, which use magnetic confinement, are at the forefront of this industry. A tokamak is a device designed to confine plasma—an ionized gas containing the fuel for a fusion reaction—within a toroidal donut-shaped vessel.

The confinement occurs using powerful magnetic fields that keep the high-energy particles away from the structure’s walls. These structures have been the workhorse of fusion research for decades and are the design utilized by ITER, the world’s largest fusion experiment currently being built in France.

However, another design architecture known as stellarators has been showing significant promise more recently. Stellarators, similar to tokamaks, confine the plasma within a toroidal shape but do so with a complex and twisted set of magnetic coils. These coils are carefully designed to generate a magnetic field that naturally maintains the stability of the plasma, potentially offering operational advantages over tokamaks.

A key benefit of stellarators is that they can, theoretically, maintain a continuous fusion reaction, whereas tokamaks operate in pulses. The Wendelstein 7-X in Germany, the largest stellarator in the world, is currently validating this design approach.

As the nuclear fusion field continues to evolve, research into various other fusion approaches is expected to accelerate. A variety of methods—from Inertial Confinement Fusion, where fuel pellets are compressed by high-energy lasers, to Magnetized Target Fusion, a hybrid between magnetic and inertial confinement—are being explored alongside the dominant tokamak and emerging stellarator designs.

These different approaches each have their unique set of challenges and advantages. As such, the question of which design or method will first achieve commercial viability remains hotly contested.

Anticipation is growing that commercial nuclear fusion power plants will be operational and contributing to energy grids by the early 2030s. A combination of factors is driving this outlook: continuous advancements in the field, ongoing advancements in AI and materials science, increasing confidence in implementation prospects, increasing funding resulting from successes in the field, and alignment with international decarbonization goals set for 2050.

Excitement is growing that the industrialisation of Fusion Energy is now closer than ever – with many expecting net positive power will be obtained from fusion in the 2030s.

✅ @bayfusionuk will be hosting another Industry Event at the Whitworth Gallery (@WhitworthArt) on the…

— UK Atomic Energy Authority (@UKAEAofficial) June 16, 2023

In short, the sector is benefitting from a surge of private capital, significant scientific breakthroughs, and a supportive regulatory environment, accelerating progress in fusion technology. Additionally, new collaborations between academia and industry are playing a vital role in pushing the frontiers of nuclear fusion technology, nurturing the talent pool necessary for the industry’s growth and sustainability.

The Race to Commercialization: Challenge and Opportunity

Venture fund timelines and the pace of development in nuclear fusion technology are key considerations for investors. While the sector requires substantial capital and carries a degree of risk, the astronomical rewards on offer balance the scales. Consequently, nuclear fusion, once deemed the future of energy, is gradually inching toward reality.

As this sector evolves, it will undoubtedly be under the watchful eyes of investors, scientists, policymakers, and consumers, given its potential to redefine the energy landscape and contribute to a more sustainable, carbon-neutral future.

Fusion startups are increasingly showing signs of being on the cusp of capturing significant slices of the $10 trillion energy market, a prospect that could finally put to rest the elusive and ever-shifting goal posts of the ’30 years away’ timeline for nuclear fusion.

With the budding industry quickly changing, the focus is no longer on large government programs but on smaller, venture-backed initiatives. These projects are exploring novel architectures that could yield significant progress or fail quickly, making them attractive for their manageable risk and expenditure.

In short, the balance between academia and industry in propelling fusion technology forward has shifted significantly. Startups in the fusion sector are now leading the charge, with academia playing a supporting role, offering validation and advice. Today, venture capitalists, scientists, and innovators seem more optimistic than ever that nuclear fusion could change the energy market far sooner than expected.

Related:

- Nuclear Fusion Startups Receiving $46 Million in Funding From US Department of Energy

- Microsoft Just Bought Nuclear Fusion Power From Upcoming Plant

- Startup Engineering Fusion Reactors the Size of Shoeboxes Avalanche Energy Brings in $40 Million and Breaks Major Milestone

Wall Street Memes (WSM) - Newest Meme Coin

- Community of 1 Million Followers

- Experienced NFT Project Founders

- Listed On OKX

- Staking Rewards