Nikola Corporation, the once-promising US-based electric truck manufacturer founded by Trevor Milton, received a warning yesterday from the Nasdaq stock exchange that its shares may be delisted within the next 30 days if it fails to comply with the institution’s listing requirements.

According to the SEC filing and the rules set forth by Nasdaq, listed securities must trade at a price above $1. Failing to meet this requirement within a 30-day period usually prompts the exchange to send a warning. If the price is not raised via mechanisms such as a reverse stock split within the next 30 days, the stock will typically be delisted.

In the case of Nikola (NKLA), the price of the stock dropped below $1 on 12 April, meaning that it has been a month and a half at least since the security breached this provision. Meanwhile, the price has not been able to recover lately and experienced a sharp 20% drop yesterday as news concerning this delisting warning came out.

The drop may have also been precipitated by another SEC filing where the company registered millions of common shares that will be sold to third parties. According to one of the prospectuses, up to 23,890,000 warrants corresponding to one common share for every instrument along with 53,390,000 common shares would be sold to third parties.

Nikola Has Cash Reserves to Stay Afloat for Just a Few More Months

In the latest quarterly report covering the first three months of 2023, Nikola reported that it had 694,091,215 common shares outstanding as of 4 May.

The company is in a dire situation from a financial standpoint as it has not yet been able to generate significant revenues out of the sale of its electric-powered trucks. In 2022, truck sales stood at $45.93 million while the company brought in total revenues of $50.83 million.

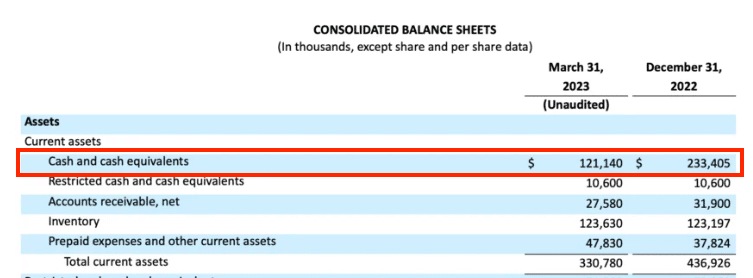

Meanwhile, during the first quarter of 2023, the company managed to bring in some cash by selling shares and convertible notes. The proceeds from these sales total approximately $120 million for Nikola.

However, the company’s cash burn remains quite high and even accelerated during these first three months as it used $179.96 million in operating activities – a $48 million year-on-year increase.

As a result, Nikola’s cash reserves stood at $121.14 million resulting in a nearly 50% reduction from the previous year’s balance. If Nikola is unable to raise enough cash to sustain its operations during this second quarter of the year it may be forced to file for bankruptcy soon.

Stockholders Will Soon Vote on a Proposal to Raise Number of Authorized Shares

During the first quarter, the firm generated revenues of $11.12 million but profit margins on its trucks are negative. In this regard, the cost of revenue for truck sales stood at nearly $43 million while vehicle sales brought in just $10 million. Meanwhile, the firm’s operating expenditures stood at $118.14 million.

The Board of Directors of Nikola has proposed to increase the number of authorized shares that the company can issue from 800,000,000 to 1.6 billion. This proposal will be discussed during the upcoming annual meeting of stockholders, which is scheduled to take place on 7 June.

Also read: Quick Guide to Invest in Tesla Stock in 2023

“If capital is not available to the Company when, and in the amounts needed, the Company could be required to delay, scale back, or abandon some or all of its development programs and operations, which could materially harm the Company’s business, financial condition and results of operations”, a risk disclosure on the firm’s latest quarterly report reads.

The disclosure further reveals: “The result of the Company’s ASC 205-40 analysis, due to uncertainties discussed above, is that there is substantial doubt about the Company’s ability to continue as a going concern through the next twelve months from the date of issuance of these consolidated financial statements”.

Other Related Articles: