Donald Trump is getting ready to enter the Oval Office in a few months and one of the most important decisions he will face may be the fate of the Chairman of the Federal Reserve – Jerome Powell.

During his first term, Trump was a vocal critic of the central banker and reportedly explored the possibility of removing him from his position.

Now that he is taking over the country’s reins once again, he could take decisive action to shuffle things at a point when the United States is finally emerging from a period marked by high inflation and interest rates.

Ironically, it was Trump who appointed Powell in 2018 as the Chair of the institution’s Board of Governors. However, his allegiances quickly shifted apparently as he started to criticize the central banker’s inaction and even categorized the board as a group of “boneheads” who lacked guts, sense, and vision.

Later on in 2020, Trump addressed the matter with reporters and said that he had the right to remove him. “He has, so far, made a lot of bad decisions, in my opinion,” Trump emphasized at a press conference.

At one point, he referred to Powell as a “bigger enemy” to American prosperity than the leader of China – Xi Jinping.

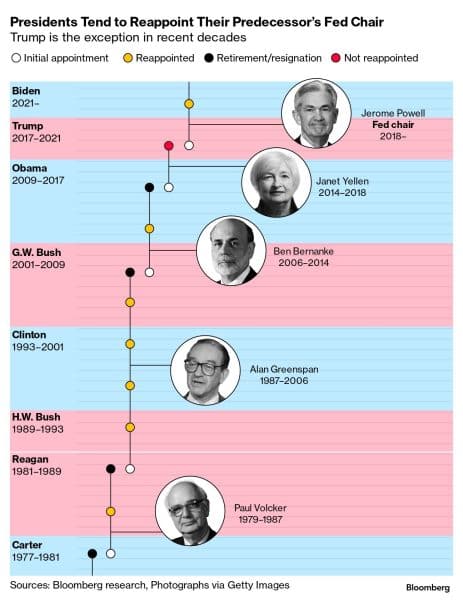

Meanwhile, in 2022, President Joe Biden opted to reappoint Powell – a decision that is now forcing Trump to come into the White House with a Federal Reserve Chair he apparently antagonizes.

Powell Bluntly Discards the Possibility of Resigning if Trump Asks

Powell has cleared the air about the possibility of resigning from his post if Trump asks. In a press conference, the head of the Fed answer was clear: “No.”

He further stressed that the law does not allow Trump to remove him from office as this can only be done under certain special circumstances – none of which are currently taking place. He clarified that policy disagreements are not considered cause to remove a Federal Reserve Chair.

Powell’s blunt and direct answer sounds like a direct challenge to Trump’s presidential authority over the central bank. However, it highlights the tension that typically marks the relationship between central bankers and the federal government.

Also read: The 2024 Crypto Bull Market Hinges on Fed Interest Rates

In a recent speech at the Economic Club of Chicago, Trump undermined the complexity of Powell’s job and mocked it to an extent. “You show up to the office once a month and you say, ‘Let’s flip a coin,’ and everybody talks about you like you’re a god,” he said referring to the Federal Open Market Committee (FOMC) meetings, where interest rate decisions are made.

No Legal Precedent of a Fed Chair Removal by a U.S. President Exists

Under the law, the decisions made by the Federal Reserve are not influenced or directed by the President or by any member of his cabinet. Hence, the institution is considered independent.

This mandate helps maintain a much-needed objectivity when it comes to monetary policy matters as the federal government could opt to print money indiscriminately to cover budget holes and create the appearance of economic growth.

Despite this independence, presidents have historically sought to influence the Fed’s decision-making to further their economic and political agendas.

The most relevant precedent when it comes to rifts between a Fed Chairman and the current President goes back to 1933 when President Franklin D. Roosevelt tried to remove the head of the Federal Trade Commission (FTC).

Also read: How The Fed Helped Transfer $1.1 Trillion to Big Banks While Americans Struggle to Survive

His actions were ultimately challenged and overturned by a court of law. Similarly, to the Fed, appointed officials at the FTC cannot be removed for their policy views or for political reasons.

However, the Supreme Court has recently leaned toward giving the executive branch more power (especially when the executive is Trump) than what the law contemplates. If Trump opts to clash with Powell, there is a chance that the country’s top court may rule in favor of the former.

Additionally, the president has more direct control over how the Federal Reserve’s leadership is composed. While the president cannot easily remove a sitting chair, they do have the power to nominate new members to the central bank’s board of governors to influence the balance of power.

Critics have argued that the President’s inability to remove the head of the Fed – a critical institution that can either foster or hamper the country’s economic success – creates challenges for the current administration to advance its plans.

The fact that these officials are not elected by the American people is often cited as enough cause to allow the President – an elected official – to at least expand the number of scenarios under which an appointed individual can be removed from office.

The Fed May Not Cut Rates Until Trump Play His First Cards

The outcome of this clash between Trump and Powell could have significant implications for the market and the economy.

Even a slight chance Trump may succeed in removing Powell could cause a severe drop in stock market valuations as investors hate unexpected leadership changes – especially in such a powerful and influential institution.

Also read: Analysts Explain What the 50 BP Rate Cut Means for Crypto

Moreover, the economy is still in a fragile state and inflation has just been contained after many months of struggle. As a result, Powell has once again gained that market’s favor and the most recent interest rate cut was also favorable to the American public.

Conversely, if Powell is able to maintain his position, it could provide a crucial check on the president-elect’s economic agenda. Trump has repeatedly expressed his desire to lower interest rates – a view that is not aligned with the Fed’s mandate to maintain price stability and full employment.

Lindsay James, an investment strategist at Quilter Investors, cautioned that “interest rates will stay higher for longer as the Fed will need to tread very carefully until it is better able to assess the true impact of Trump’s plans.”

Wrapping Up

Despite the tensions, Trump’s senior advisers have indicated that the president-elect will likely allow Powell to serve out the remainder of his term, which expires in 2026. This suggests that the president-elect is reluctant to engage in a high-profile battle over the Fed chair’s position, at least in the near term.

However, Trump’s unpredictable nature and his demonstrated willingness to challenge institutional norms mean that he could change his stance on this particular matter overnight.

The president-elect could always change his mind and decide to take more aggressive action against Powell – a move that would set the stage for a constitutional showdown with far-reaching consequences.

Ultimately, the fate of Jerome Powell and the independence of the Federal Reserve may be stress-tested by the Trump administration.